MSCI SRI INDEXES image

MSCI SRI INDEXES

MSCI SRI Indexes

The MSCI Socially Responsible Investing (SRI) Indexes are designed to represent the performance of companies with high Environmental, Social and Governance (ESG) ratings. The indexes employ a ‘best-in-class’ selection approach to target the top 25% companies in each sector according to their MSCI ESG Ratings. SRI indexes can be used by institutional investors seeking to align ethical values and manage potential financial risks.

MSCI SRI INDEXES Part 2

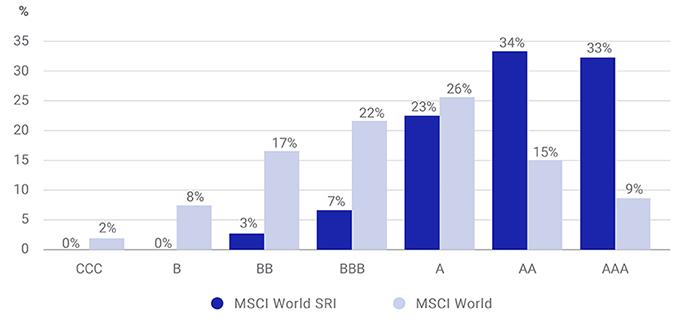

ESG Ratings breakdown(% of total universe)

The indexes are also designed to exclude, or underweight companies involved in controversial activities1 such as controversial weapons (zero tolerance) and civilian firearms, nuclear weapons and tobacco (minimum tolerance).

MSCI SRI Indexes Key Features:

The MSCI SRI Indexes are designed for investors seeking a diversified index that integrates ESG considerations while also considering investment constraints:

- The indexes target companies with high ESG Ratings

- Excludes companies whose products have negative social or environmental impacts

- Excludes companies involved in controversies

- Targets a 25% representation of each sector’s market cap

- Securities are weighted by their free float market cap

- The MSCI SRI Indexes leverage research and data provided by MSCI ESG Research. These indexes leverage the MSCI ESG Ratings, MSCI ESG Controversies, MSCI Business Involvement Screening Research

- Designed to Maintain regional and sectorial diversification and a similar profile to the parent market cap index

- Aims to Exclude companies whose products have negative social or environmental impacts

- Designed to minimize the index’s carbon intensity by removing companies involved in Thermal Coal mining and power generation

- Exclude companies involved in controversies

MSCI SRI Indexes Use Cases

The MSCI SRI Indexes can be used:

- To facilitate the integration of ESG considerations into the investment process while managing the impact on the risk-return profile of the portfolio s

- For back testing of various investment strategies and product creation

- As the basis for structured products and other index-linked investment vehicles, such as ETFs and passive funds

- As performance benchmarks and for risk and performance attribution

- As an investment universe of companies with robust ESG characteristics

- For internal and external reporting purposes

Additional Research

Additional Research

MSCI ESG Controversies Executive Summary Methodology

Business Involvement Screening Research Methodology Overview

Blog – Looking inside ESG indexes

Research Report -TCFD-based reporting: A practical guide for institutional investors

Research Report - Climate change and climate risk: An index perspective

Research report – Understanding MSCI ESG Indexes

1 Controversial weapons, Civilian firearms, Nuclear weapons, Tobacco, Alcohol, Adult Entertainment, Conventional Weapons, Gambling, Genetically Modified Organisms, Nuclear Power, Thermal Coal. Please refer to Appendix 1 of MSCI SRI Indexes Methodology for details on these criteria.

2 MSCI ESG Research data and ratings are provided by MSCI ESG Research LLC. MSCI ESG Indexes utilize information from, but are not provided by, MSCI ESG Research LLC. MSCI Equity Indexes are products of MSCI Inc. and are administered by MSCI UK Limited.

3 Carbon Intensity is the measure used in the construction of the MSCI Global Low Carbon Indexes