Biodiversity - hero banner

Nature and Biodiversity

Identify and measure portfolio impacts and risks

Social Sharing

Biodiversity - intro copy

Why biodiversity matters

Biological diversity is rapidly declining — and becoming a material risk to investors. That means they need advanced tools to measure impact and manage risk.

The variety of the Earth’s living species is declining at an alarming rate due to human activity, from habitat destruction to the emission of greenhouse gases resulting in climate change. Biodiversity loss poses an existential threat to ecosystems, the global economy and, in turn, to investors.

At MSCI, we have spent decades developing metrics and data for global investors to measure risks and opportunities related to climate change and environmental, social and governance (ESG) factors. We have applied that experience to our Nature and Biodiversity Solutions—an accessible framework comprised of biodiversity data and screens complemented with practical guidance for investors.

Biodiversity - CTAs under video

Biodiversity - A material risk

A material risk to businesses

Economic risk from biodiversity loss could emerge at the asset, company or portfolio level. Biodiversity and climate change are inextricably linked. Biodiversity loss reduces nature's ability to absorb greenhouse gases — forests, wetlands and oceans annually absorb 5.6 gigatons of carbon. Climate change, in turn, takes a bigger toll on nature.

Companies are coming under more scrutiny: Regulators are intensifying their focus on the destruction of ecosystems and the Taskforce on Nature-related Financial Disclosures (TNFD) has launched a standard framework to report related risks and opportunities. Investors are expected to be encouraged or mandated to integrate nature and biodiversity considerations into their investment decisions.

Biodiversity - Dependencies graphic

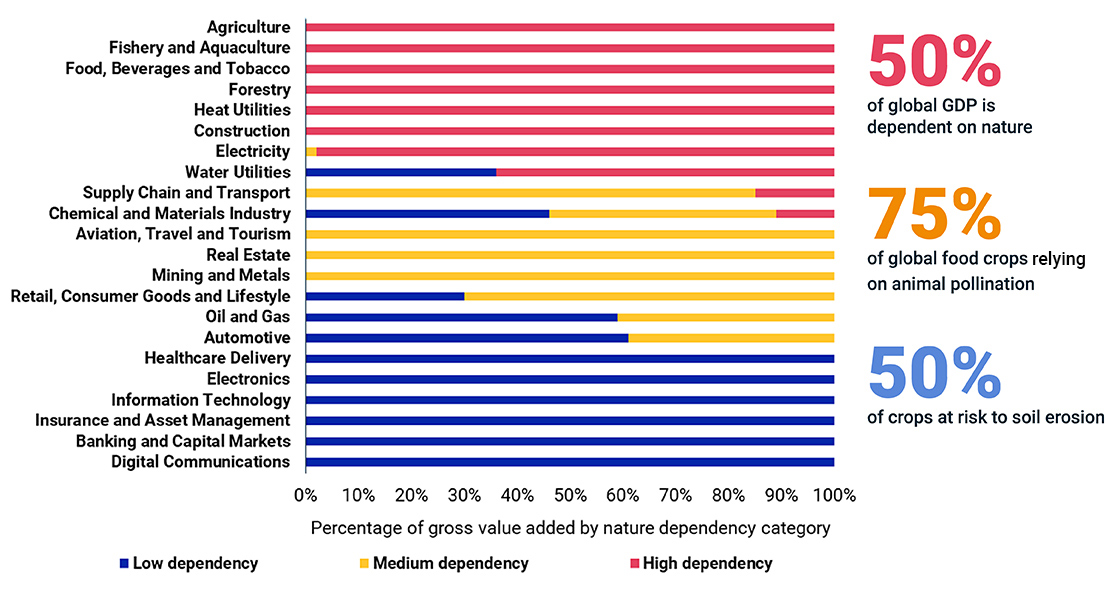

Dependencies of industries on natural capital

Sources: MSCI ESG Research, World Economic Forum and PwC. 2020. “Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy.”, Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES). 2020. "The Global Assessment Report on Biodiversity and Ecosystem Services."

Biodiversity - A growing momentum to act

A growing momentum to act

With our ecological foundations deteriorating, we can no longer ignore how companies are impacting, and being impacted by, nature and biodiversity. As biodiversity loss intensifies, more regulators, investors and companies are taking action.

-

Regulatory momentum

The European Union is taking steps to mandate that products sold in the EU be deforestation-free and has mapped out a comprehensive plan to protect nature that includes biodiversity-related disclosure requirements for companies and investors.

-

Investor action

Investors are forming coalitions for action, including the Partnership for Biodiversity Accounting Financials, the Finance for Biodiversity Pledge, Nature Action 100 and the Coalition for Private Investment in Conservation.

-

Emerging frameworks

Groups such as the TNFD, the Science Based Targets Network, and Exploring Natural Capital Opportunities, Risks and Exposure are developing new biodiversity risk accounting metrics and tools.

MSCI Nature and Biodiversity Solutions

MSCI Nature and Biodiversity Metrics

MSCI’s Nature and Biodiversity Metrics package and supporting guidance framework provides multifaceted Nature and Biodiversity Solutions:

Evaluate company and portfolio impact on nature and biodiversity

MSCI provides metrics that encompass activities in sensitive areas, the drivers of nature change, such as resource/water use, greenhouse gas emissions, and pollution, as well as indicators that help identify a company’s capacity to mitigate impact.

- Drill down to better understand a company’s involvement in activities that contribute to deforestation

- Analyze revenues generated from products that negatively impact nature, or nature-related controversies, such as the production/use of palm oil, soybeans, beef or timber

- Find out whether companies have established nature-related governance, strategy or targets

Assess impact of nature and biodiversity loss on companies and portfolios

- Identify physical risks, such as assets dependent on ecosystem services or revenues derived from regions with high water risk

- Explore and identify transition risks, including company revenues or assets exposed to regulatory, legal or reputational risks based on actual or alleged involvement in adverse impact activities

- Discover nature-related investment opportunities in companies with revenues from product with a positive impact

Framework image - Biodiversity

Introducing MSCI's Nature & Biodiversity Metrics Framework

A framework to help you manage nature and biodiversity risks and opportunities. Selecting the appropriate set of metrics is relevant to adequately assess risks and impacts since criteria can differ significantly in scope, objectives and applicability.

Biodiversity - seeing biodiversity

Powerful screening metrics to assess nature and biodiversity risks

As part of our Nature and Biodiversity Metrics, the biodiversity-sensitive areas and deforestation screens capitalize on MSCI’s broad coverage universe, vast data repositories and rigorous methodology. They are designed to enable you to address impacts on nature in your portfolios, identify companies with operations in ecologically sensitive areas, or assess exposure to potential direct and indirect involvement in deforestation.

Biodiversity - video

Seeing biodiversity risks more clearly

Learn how to integrate biodiversity into your investment decisions with our Biodiversity Screening Metrics.

Biodiversity - contact us

Biodiversity - featured content

Featured content

An Investor's Guide to Nature and Biodiversity Risks and Impacts

Investors thinking about biodiversity are asking questions such as, how do I know which holdings are most vulnerable to biodiversity loss? And, can I measure biodiversity risk exposure across my portfolio? We aim to help them start finding answers.

Biodiversity and Business: Are Companies Aware of Nature’s Risks?

The growing stakeholder awareness of biodiversity and nature loss as business risks places pressure on companies to report on and mitigate such threats. The launch of the TNFD framework could further elevate these expectations. Our analysis shows that current corporate disclosure practices vary.

Biodiversity Funds: Welcome to the Jungle

Nature-related risks and opportunities are becoming more important for investors and regulators, and with the emergence of reporting frameworks such as TNFD, biodiversity funds may soon receive greater attention. We assess the current landscape of pure play biodiversity-labeled and broader biodiversity-related funds.

Five things you should know about the TNFD framework

What are the five things you should know about the TNFD framework, find out here.

Biodiversity - Related content

Related content

Foundations of Climate Investing

Did companies’ climate transition risk profiles affect performance? The growing strength of Low Carbon Transition Scores provides support for this thesis (after controlling for GEMLT factors).

Read moreClimate Investing

Learn how climate investing can help investors and issuers use climate data and tools to support their investment decision making.

Learn moreSustainable Finance Solutions

Examine a toolkit to help clients prepare for new ESG regulations, integrate ESG factors across the investment process, and report on progress along the way.

Explore the toolsESG Investing

ESG Investing (Sustainable Investing) is growing exponentially as more investors and issuers utilize ESG and climate data and tools to support their investment decision making.

Learn moreClimate and Net-Zero Solutions

Our solutions aim to empower investors to analyze and report on their portfolios' exposures to transition and physical climate risk.

Read moreAssessing Company Alignment with UN SDGs

Inconsistent and incomplete data has implications for asset managers who may have to report on portfolio companies’ alignment with U.N Sustainable Development Goals.

Read the blog