Real Assets Market DataThe go-to global source on real estate market data.

Where insight meets opportunity

Gain a clear view of real estate investments with validated, transparent market data. MSCI Real Assets Market Data enables asset owners, managers and service providers to assess risk, benchmark performance and refine strategy with confidence. Leverage index, fund and asset-level data from original sources to navigate opaque private markets with data-driven insights.

Make confident decisions with more robust insights that integrate macro trends and granular property-level details.

Access solutions for every stage of the investment lifecycle, from identifying opportunities to managing and exiting assets.

Our data — sourced directly from funds, industry partners, public filings and private deals — is validated for accuracy and enriched with proprietary research.

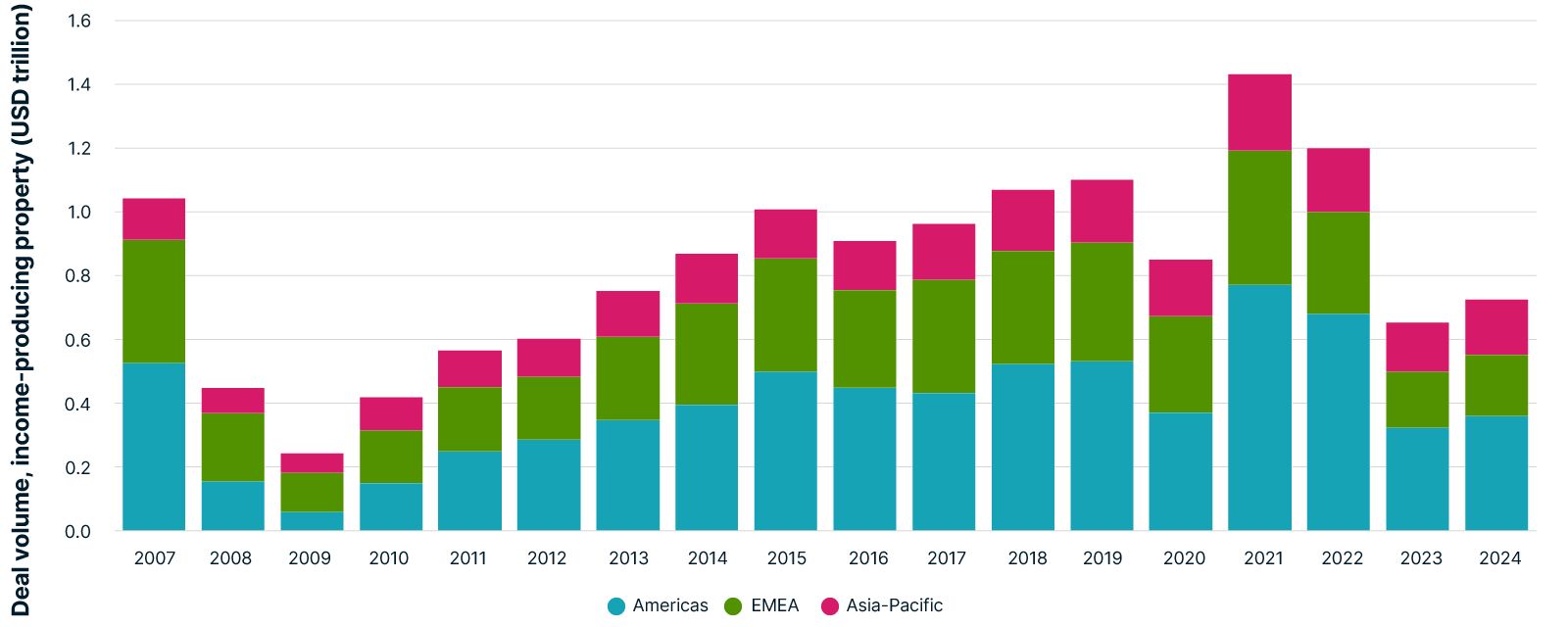

Global commercial real estate transactions:Regional trends and market shifts

Our transaction data provides insight into global property market pricing dynamics, including cumulative transaction volume by region. (See MSCI Real Assets’ quarterly Global Capital Trends for more).

As of December 2024.

Featured products

Gain insights into global commercial real estate transactions, track market trends, and analyze buyers, sellers, and lenders to inform strategic decisions.

Source opportunities

Search an industry-leading database covering over USD 50 trillion in deals across sales, financings and construction, and compare valuations.¹

Analyze investment holdings

Identify buyers, sellers, lenders and true owners to understand borrower profiles and find assets potentially coming to market.

Connect with key players

Expand your network with contact information linked to over 120,000 investor profiles searchable by name, role, company or location.

Get market and asset insights

Track trends and market moves by creating custom charts in-platform and accessing applied research reports and market commentary.

Looking for a demo of MSCI Real Assets Market Data?

Real Asset Indexes and fact sheets

MSCI’s Real Asset Indexes help investors build better portfolios by reporting the operating performance of property investments in more than 30 countries.

1 All data as of April 2025 unless otherwise noted.

2 As of June 2024.