Thematic Indexes

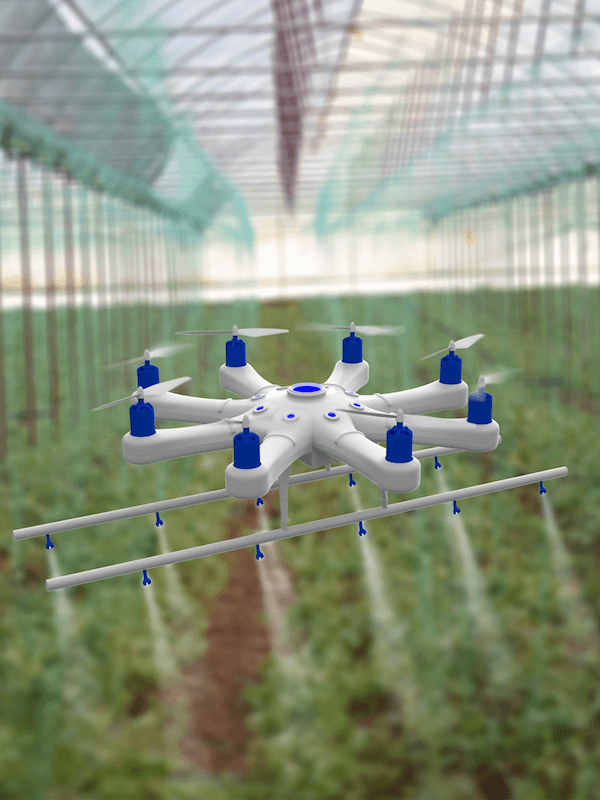

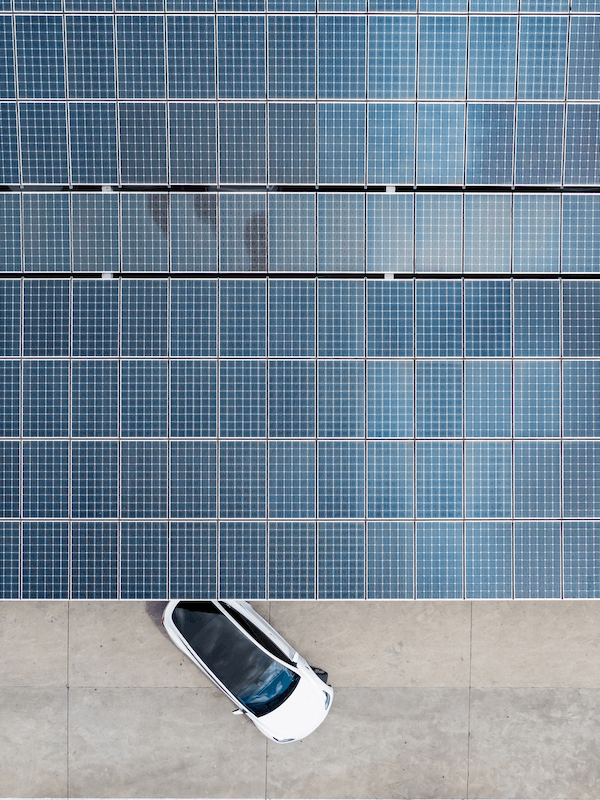

Thematic investing is a future-focused investment approach that relies on research to explore long-term macroeconomic, geopolitical and technological trends. Clients use our integrated data, analytical tools, indexes and insights for a clearer view of long-term, structural shifts arising from climate change, disruptive technologies and changing consumer behavior.

Target benefitsGet clarity on thematic investing

Identify growth opportunities

Identify long-term trends that can potentially transform global economies, drive innovation and redefine business models.

Adopt rules-based methodology

Transparent, flexible, scalable and customizable index construction that allows for combinations of multiple themes or sub-themes.

Explore a world of big ideas

Over 30 themes across environment and resources; transformative technologies; health and healthcare; and society and lifestyle.

Featured indexes

Circular Economy Indexes

A new approach to portfolios as we minimize waste and circulate resources to regenerate nature.

Decrement Indexes

Designed to represent the performance of a strategy in which a synthetic dividend is periodically withdrawn from the parent index.

Economic Regime Allocator Indexes

Aiming to represent the performance of a strategy that automatically allocates to market subsets when macroeconomic change is detected

Digital Asset Solutions

Designed to help institutional investors identify and measure trends across this evolving ecosystem.

Explore Thematic IndexesView performance details, fact sheets and more

These Additional Terms of Use govern your access or use of the index data and related information and materials on the MSCI web site ("Index Data"). Initial and subsequent access and use of the MSCI web site and Index Data is subject to these Additional Terms of Use.

The Index Data is for informational, non-commercial purposes only, and the user of the information contained in the Index Data assumes the entire risk of any use made of the Index Data. You understand and agree that the Index Data is provided "as is" and MSCI does not warrant the accuracy, completeness, non-infringement, originality, timeliness or any other characteristic of the Index Data.

The Index Data is not an offer or recommendation to buy or sell or a solicitation of an offer to buy or sell any security or instrument or to participate in any particular trading strategy. Further, none of the Index Data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Reproduction, redistribution or any other form of copying or transmission of the Index Data without MSCI's prior written consent is strictly prohibited. Without limiting the generality of the foregoing, the Index Data and other MSCI intellectual property you access via the MSCI web site may not, without MSCI's prior written permission, be used as a basis for any financial instruments or products (including, without limitation, passively managed funds and index-linked derivative securities) or other products or services, or used to verify or correct data in any other compilation of data or index, or used to create any other data or index (custom or otherwise), or used to create any derivative works, or used for any other commercial purposes.

For further details,

How we can help you

ETF providers

ETFs are now available on nearly all our megatrend indexes as demand for licensing increases globally.

Asset owners

Understand and manage targeted exposure to long-term structural trends and benchmark performance.

Banks

Choose from extensive range of thematic indexes to support structured product build around megatrends.

Active managers

Respond to demands of asset owners and understand portfolio exposure to key long-term change.

Thematic index resources

Unleash power of future-focused investing

Learn about our three-dimensional approach to thematic investing and identifying globally impactful megatrends.

Who are our theme experts?

Read about ARK Invest, investment manager focused on disruptive innovation and Royalty Pharma, buyer of biopharmaceutical royalties.

How MSCI builds Thematic Indexes

A step-by-step guide to our future-focused investment approach.

Want to learn more about thematic investing?Get in touch.

Related to Thematic Indexes

MSCI Thematic Rotation Indexes

A dynamic approach to invest in megatrends based on current market sentiment.

Explore themes and sub-themes

From robotics and cybersecurity to genomic and millennials, we target companies potentially impacted by emerging trends.