Built for what’s next.

Private markets are evolving fast. What’s needed now isn’t just data – but a modern toolkit that connects, clarifies and leverages independent insight to drive more informed investment decisions.

MSCI is redefining what’s possible with integrated intelligence for private markets, bringing together research-quality data, industry-leading analytics and purpose-built infrastructure designed to help you measure, manage and invest with confidence.

Target opportunities aligned to your risk-return profile using look-through data, scenario modeling and robust benchmarking across asset classes for optimized positioning.

Identify strategy drift, track direct and indirect investments and evaluate manager performance against industry benchmarks.

Analyze the drivers of returns at both fund and asset levels, leveraging leading indexes for consistent, comparable performance insights.

View greenhouse gas (GHG) emissions, manage aggregate exposures and build climate-aligned strategies for a more complete view of risk and opportunity.

Enhance due diligence with AI-driven data analysis, anomaly detection and real-time insights for deeper transparency into investments and managers.

Seamlessly connect public and private market data for benchmarking, risk assessment and portfolio construction.

Integrated Intelligence for informed decision-making

Access the essential elements and integrated infrastructure that empower you to make more informed, confident investment decisions in private markets.

Independence and objectivity

Gain objective insights from an independent partner aligned with your needs and serving stakeholders across the private market ecosystem.

Industry-leading data

Leverage research-quality, cross-validated data spanning $17.3T in private investments, with AI-powered analytics and domain expertise, to drive transparency, comparability and actionable insights.1

Clarity across your portfolio

Connect public and private market data and analytics to enable holistic benchmarking, risk assessment and portfolio construction so you can capture opportunities and manage risk across your portfolio.

A foundation of scale and scope

28,000+

Funds2

$17T+

In private investments

589,000

Underlying investments

$57T

In public and private real estate transactions

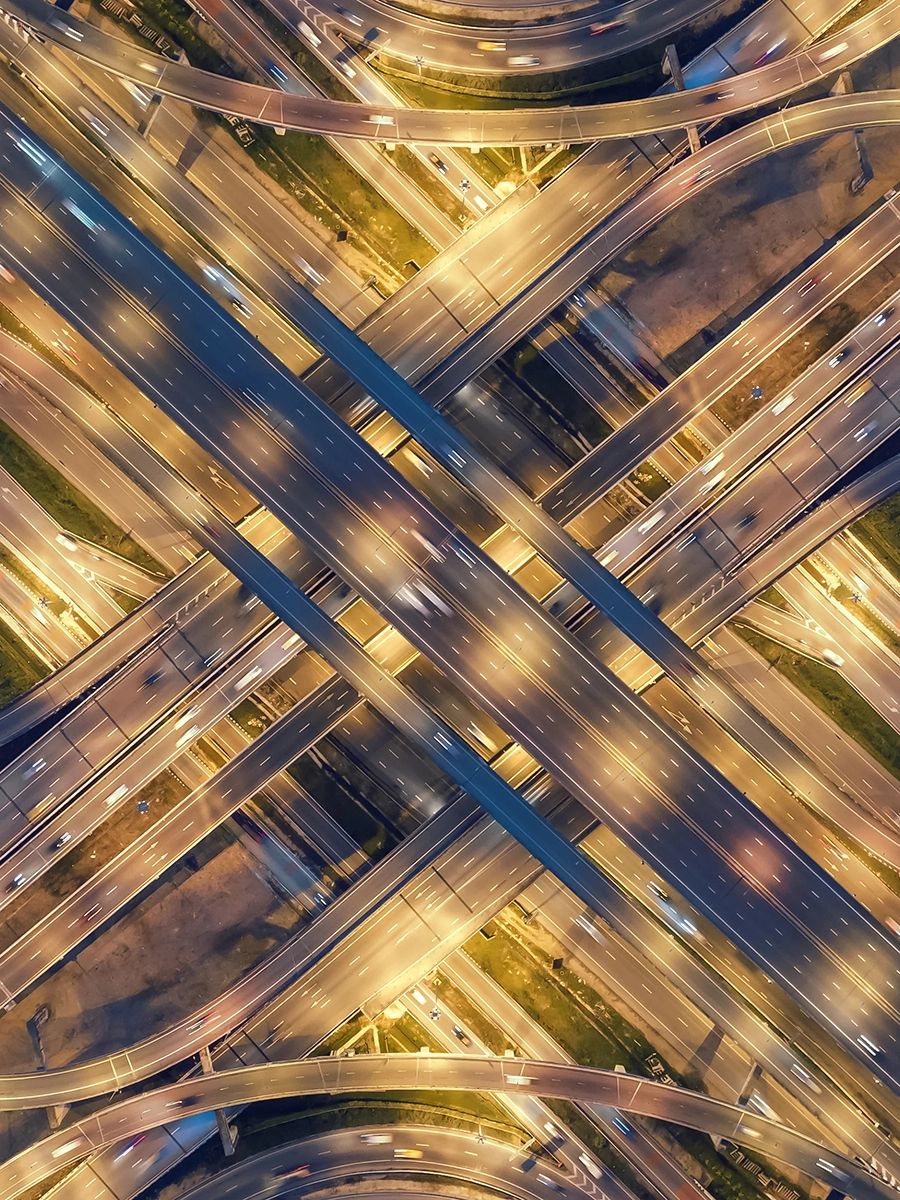

Innovative solutions built for the road aheadData, indexes and specialist solutions designed to support your unique portfolio needs

Private i®

Find your edge with the platform designed to bring clarity to your private market portfolio.

Total Plan Manager

Make confident investment decisions with a unified view of public and private assets.

Private Asset Indexes

Set your standard with indexes designed to capture the distinct risk, liquidity and return characteristics of private markets.

Private Credit

Support your private credit strategy—and total portfolio construction—with independent risk assessments, benchmarking and analytics.

Portfolio Management

Designed to organize and unify private asset information into a centralized hub.

Private Capital Transparency

Gain insights with transparent, look-through data. Leverage research, analytics and forecasting to optimize your investments.

GP Solutions

The data and analytics needed to benchmark performance, streamline reporting, and engage investors with confidence.

Real Estate Solutions

Game-changing data, analytics and research on global commercial real estate and infrastructure to help inform your investment decisions.

Family Offices

Institutional-grade portfolio intelligence for family offices. Gain clarity across public and private assets with integrated analytics, benchmarks and reporting.

Private Capital Intel

Benchmark, report and allocate using one of the largest, research-quality private capital datasets.

Case studies and resources

Global Private Capital Performance Summary

Up-to-date insight into private assets performance and trends, all based on since-inception quarterly returns and cash flow data.

The 2025 General Partner Survey

See how GPs are responding to tighter deal flow and rising LP demands for transparency in our latest private markets survey.

Is your private asset strategy built for what’s next?

Discover MSCI research

Private Markets for Wealth: Insights from 11,000+ Funds

Explore our new guide — featuring proprietary data from over 11,000 funds — designed to support wealth managers seeking to increase their allocation to private assets.

Charting private assets

Stay ahead of private markets with the latest trends in performance and capital dynamics.

Troubling Signals for Private-Equity Exits

Private market exits remain elusive. What should LPs expect next? Learn what’s behind the delays and explore ways to navigate the rest of 2025.

Benchmarking Private Asset Performance

Understand private asset performance with MSCI’s benchmarks and indexes. Measure portfolios, justify allocations, report confidently in the private markets.

1 All data as of January 2026, unless otherwise noted.

2 All data as of January 2026, unless otherwise noted.