MSCI Carbon Project RatingsIt’s time to raise the bar on carbon credit integrity.

Carbon project ratings built for capital markets

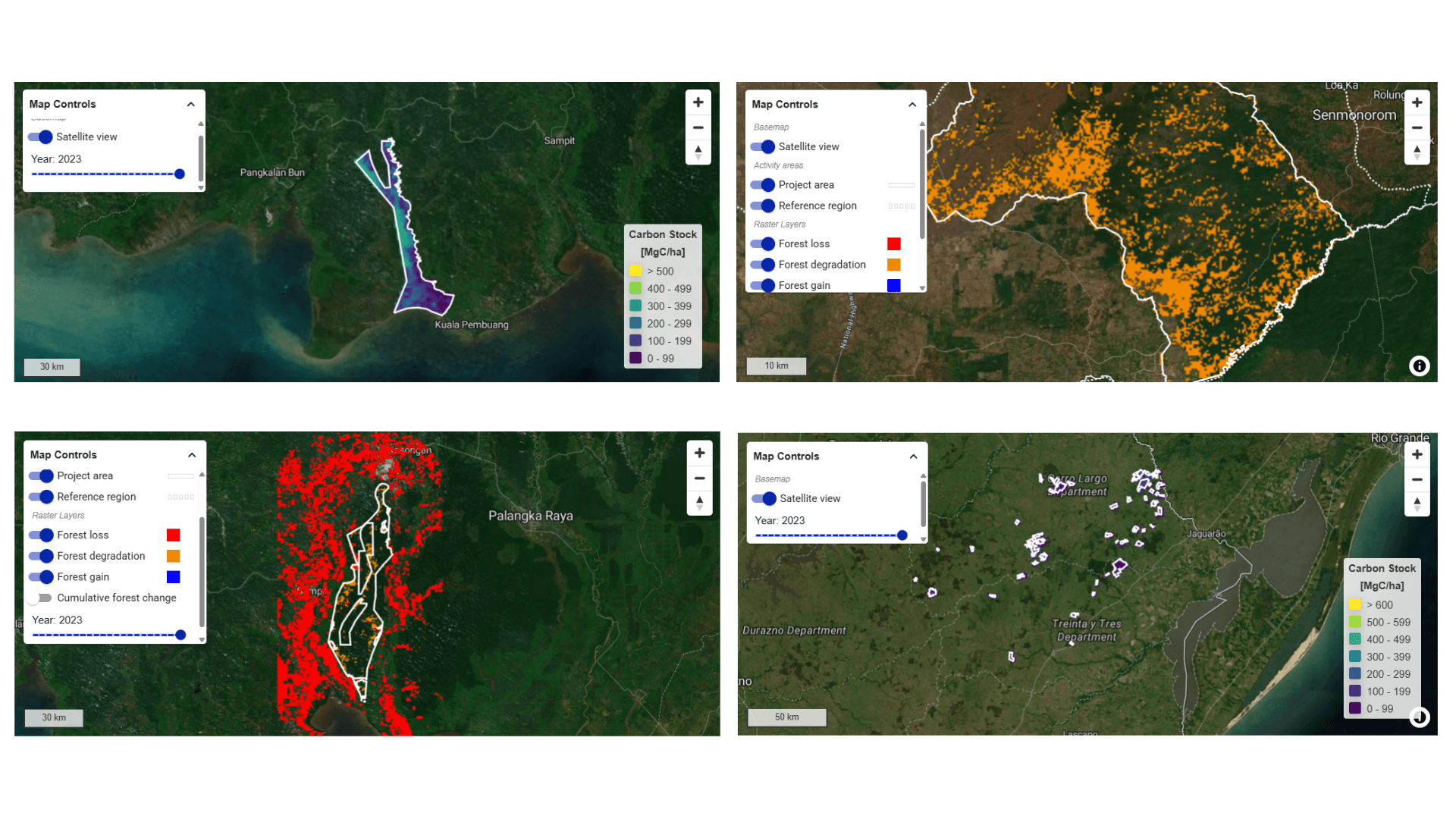

Assess the integrity of more than 4,000 global carbon credit projects with investor-grade ratings with our independent assessments grounded in rigor, granularity and geospatial project analytics.1

Better understand risk with an independent assessment of carbon credit quality and an intuitive rating. Perform due diligence, supported by in-depth, transparent methodology and over 20 years’ experience in carbon-market analysis.²

Evaluate the investment and reputational risks associated with carbon projects based on a holistic assessment of six key criteria, informed by investor-grade data and backed by geospatial intelligence.

Evaluate the potential value of carbon projects, with laser focus on integrity and in-depth individual evaluations using a rules-based, project-specific framework. Weight ratings to match your strategic priorities.

Enhance credibility and find your strategic edge by comparing your projects with those of peers. Benchmark a project’s integrity to the market and within project types to assess strengths and align with market standards.

Leverage our leadership in climate data and assessments

Our Carbon Project Ratings represent in-depth and consistent assessments of individual projects using rules-based, project-type specific frameworks. Our ratings feature transparent scoring of six key criteria.

Each carbon project receives an intuitive composite rating from AAA to CCC. Our ratings combine the detailed carbon credit integrity assessment system developed since 2021 by Trove Research with MSCI’s decades of experience in producing investor-grade sustainability research and ratings.

Why leading institutions use our Carbon Project Ratings

Companies, investors, traders and developers around the world use MSCI’s Carbon Project Ratings to assess risk and drive impact.

View carbon credit integrity across 4,000+ projects.3 Assess integrity holistically on six key criteria — additionality, quantification, permanence, co-benefits, reputational risk and delivery risk.

Covers both registered and re-registration projects, across all major project types, including jurisdictional REDD+ and engineered carbon removal solutions.

Interested in our Carbon Project Ratings?

MSCI Carbon Project Ratings

Raise the bar on carbon project integrity. Elevate your carbon strategy with a new generation of ratings that leverage over two decades of experience in analyzing carbon markets and rating the financial risks and impacts of sustainability.

Get a glimpse of our data

See how we are raising the bar on carbon project ratings and enhancing clarity in the carbon credit market. To learn more about the analysis and findings behind the ratings, get in touch.

Research and resources

Understanding Carbon Markets – An MSCI Guide

A handbook to help capital-markets participants navigate this critical corner of climate finance.

State of Integrity 2025

A look at the integrity of nearly 5,000 registered and pipeline projects in the global carbon market based on MSCI’s Carbon Project Ratings.

Explore our methodology

Our Carbon Project Ratings Methodology describes in detail the framework and criteria we use to define carbon project integrity.

The First Core Carbon Principles – Qualifying Projects

What the first methodologies approved under the Core Carbon Principles could mean for the broader carbon credit market.

Outlook and Assessment of Real Nature-based Removals

Answers to investors’ questions about the growing market for Afforestation, Reforestation, and Revegetation (ARR) carbon credits.

Corporate Emissions Performance and the Use of Carbon Credits

Companies that used a material amount of carbon credits were, on average, more likely than non-users to have taking climate action within their businesses.

Related to Carbon Project Ratings

Investment insights

Leverage our in-depth data and advanced analytical tools for clarity on global carbon markets.

1 As of Sept. 15, 2024.

2 Following MSCI’s acquisition of Trove Research in 2023.

3 As of Sept. 18, 2024.

4 As of Sept. 18, 2024.