Corporate Emissions Performance and the Use of Carbon Credits

Research Paper

September 24, 2024

Preview

The use of carbon credits has been the subject of some criticism, including the assertion that companies that spend money on carbon credits commit fewer resources to reducing their own emissions.

To investigate whether carbon-credit users have reduced emissions faster or slower than non-users, we analyzed constituents of the MSCI ACWI Investable Markets Index (IMI) from 2017 to 2022.

Our analysis found that those companies that used a "material" amount of carbon credits were, on average, more likely than non-users to have:

- Disclosed their emissions

- Reduced their Scope 1 and 2 emissions

- Reduced the intensity of their Scope 1 and 2 emissions

- Set a climate target, and for that target to be of high credibility

- Earned a higher proportion of their revenues from low-carbon activities

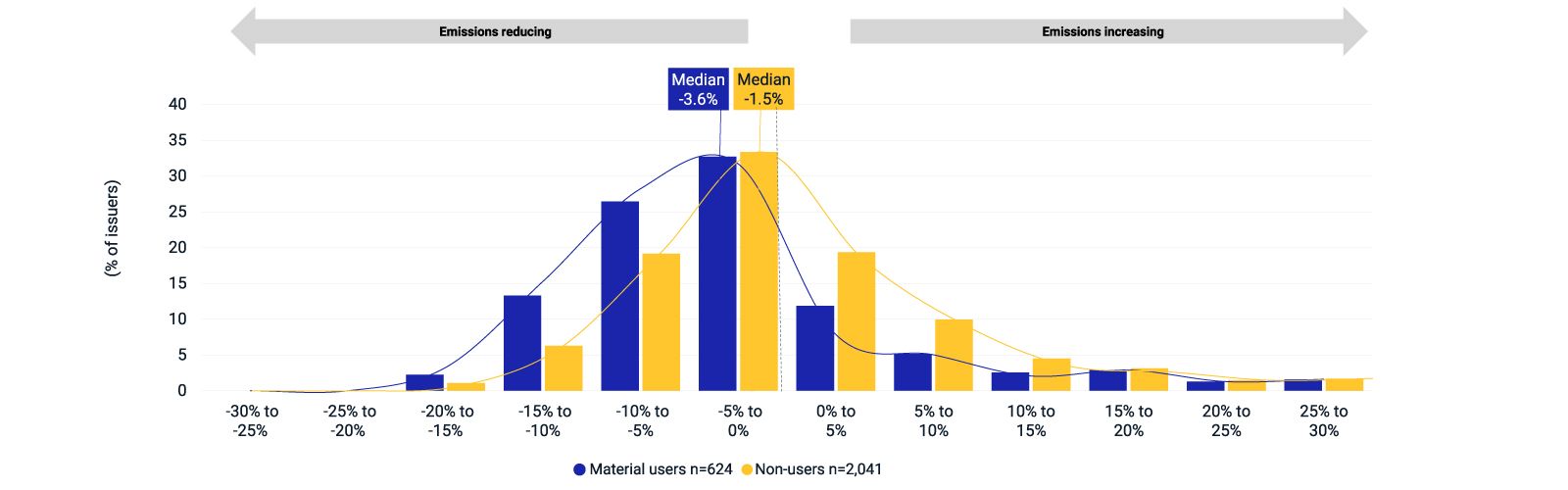

Distribution of annualized change in company-reported gross Scope 1+2 emissions for material carbon-credit users and non-users, 2017-2022

Data as of July 1, 2024. Only includes firms within the MSCI ACWI IMI that reported their Scope 1 and 2 emissions for every year between 2017 and 2022. Source: MSCI Carbon Markets, MSCI ESG Research

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

Using Carbon Credits to Meet Corporate Climate Targets

We analyze the impact of allowing firms to use carbon credits to help meet their science-based emissions targets, modeling how many carbon credits would be needed to close the gap to meet corporate emissions targets today and in 2030, and how many additional firms might sign up to science-based targets if such use of carbon credits were permitted.

Corporate Emission Performance and the Use of Carbon Credits (Trove Research, June 2023)

Our analysis of the emissions performance of over 4,000 global companies and the link with the use of carbon credits found that companies that use material quantities of carbon credits are, on average, decarbonizing at twice the rate of companies that do not use them at all.

VCMI Claims Code of Practice – Important Progress but the Difficult Stuff Still Lies Ahead

The Voluntary Carbon Market Integrity Initiative's Claims Code of Practice clarifies some aspects of how corporations can make high-integrity claims regarding their voluntary use of carbon credits, but more-controversial issues remain.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.