Private Capital IntelBenchmark performance with one of the largest private capital datasets.

Understand your portfolio

Benchmark performance against one of the largest pools of private capital data with extensive coverage of historical profiles, including inception date, sourced directly from limited partners (LPs).

Compare performance against one of the largest pools of private capital. Gain insight into asset class dynamics and dimensions across private capital strategies.

Conduct cross-asset research to inform asset allocation processes and frame investment strategies.

Analyze cash flow behavior and liquidity to refine pacing strategies and address the time-varying nature of private capital funds.

Measure pooled and quartile performance with various rates of return, multiples and public market equivalent analytics.

Compare funds by sector, geography, asset class, vintage and size to create a benchmark universe tailored to your specific investment goals.

Streamline reporting and disclosure processes with integrated data access and customizable reporting templates for a clear presentation of analytics.

Quality data

We can help you contextualize relative manager performance and understand the cash flow and valuation behavior of private asset investments.

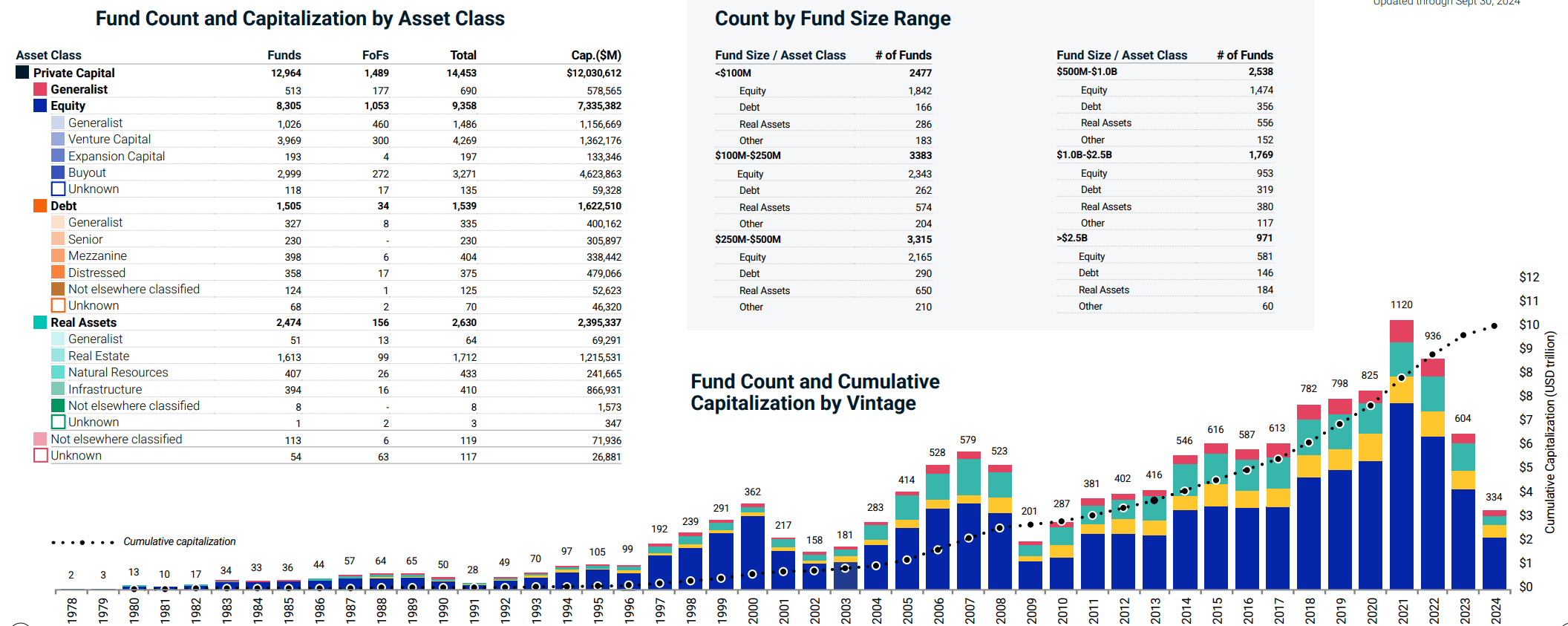

$11.5 trillion+

Committed capital

14,000+

Funds

263k+

Underlying holdings

100%

LP-sourced Data1

Ready to find your edge?Get started today.

Frequently paired products

Private Capital Indexes

Explore indexes designed to cut through the complexity of private assets.

Private Capital Transparency

Navigate private markets with confidence using a research-enriched dataset.

Private Capital Benchmarks Report

Up-to-date insight into private assets performance and trends, all based on since inception quarterly returns and cash flow data.

1 All stats as of August 21, 2024 unless otherwise noted

2 As of December 31, 2024