Real Estate Climate RiskMeasure climate risk across your real estate portfolio.

Access solutions through a single analytics platform

With nearly 40% of global carbon emissions produced by our human-built environment,1 real estate participants have faced increasing societal and regulatory pressure to reduce their environmental impact.

At MSCI, we enable asset managers, investors, banks, valuers, brokers and developers to analyze and quantify both physical and transition climate-related risk in real estate holdings in a single platform to align with regulatory frameworks and achieve sustainability goals.

Assess and quantify both physical and transition climate risks of real estate across portfolios and loan books, markets and property types.

Align with regulatory frameworks and report to teams and investors with standardized risk metrics and automatically generated reports based on a robust methodology.

Determine the carbon emissions reduction needed to achieve your net-zero targets based on your current emissions level.

Run broad climate risk assessments of potential purchases during the due diligence process to identify potential risks.

Quickly narrow your in-depth assessment to the assets in your portfolio with the highest potential for climate risk.

Featured productsSupporting every step of your climate journey

Real Estate Climate Risk fact sheet

Learn more about how we can help you integrate climate risk analysis across your investment process.

Sustainability due diligence for banks

Learn how global banks say they deal with data challenges when conducting due diligence on private companies.

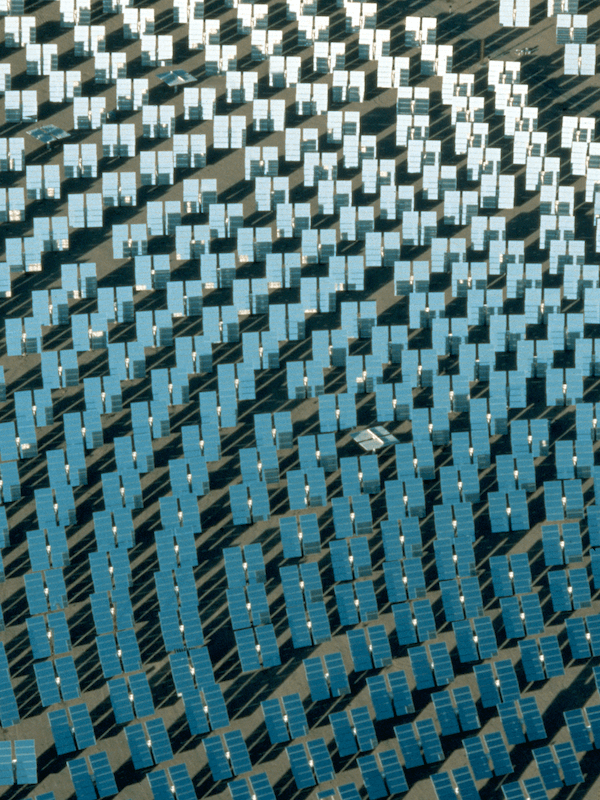

Renewables in private markets: Climate wins and financial gains

See our analysis of climate impact and returns in renewable investments.

Interested in real estate solutions? Connect with us.

GeoSpatial Asset Intelligence nature and physical risk data

Identify risk where it matters.

Carbon Footprinting for Private Equity and Debt

Harness climate data to make better investment decisions.

Interested in real estate solutions? Get the latest insights.

Keep up to date with our global research, industry events and latest products.

1 Source: World Green Building Council and the UN Environment Programme.