Total Plan Manager A unified view of multi-asset class portfolios.

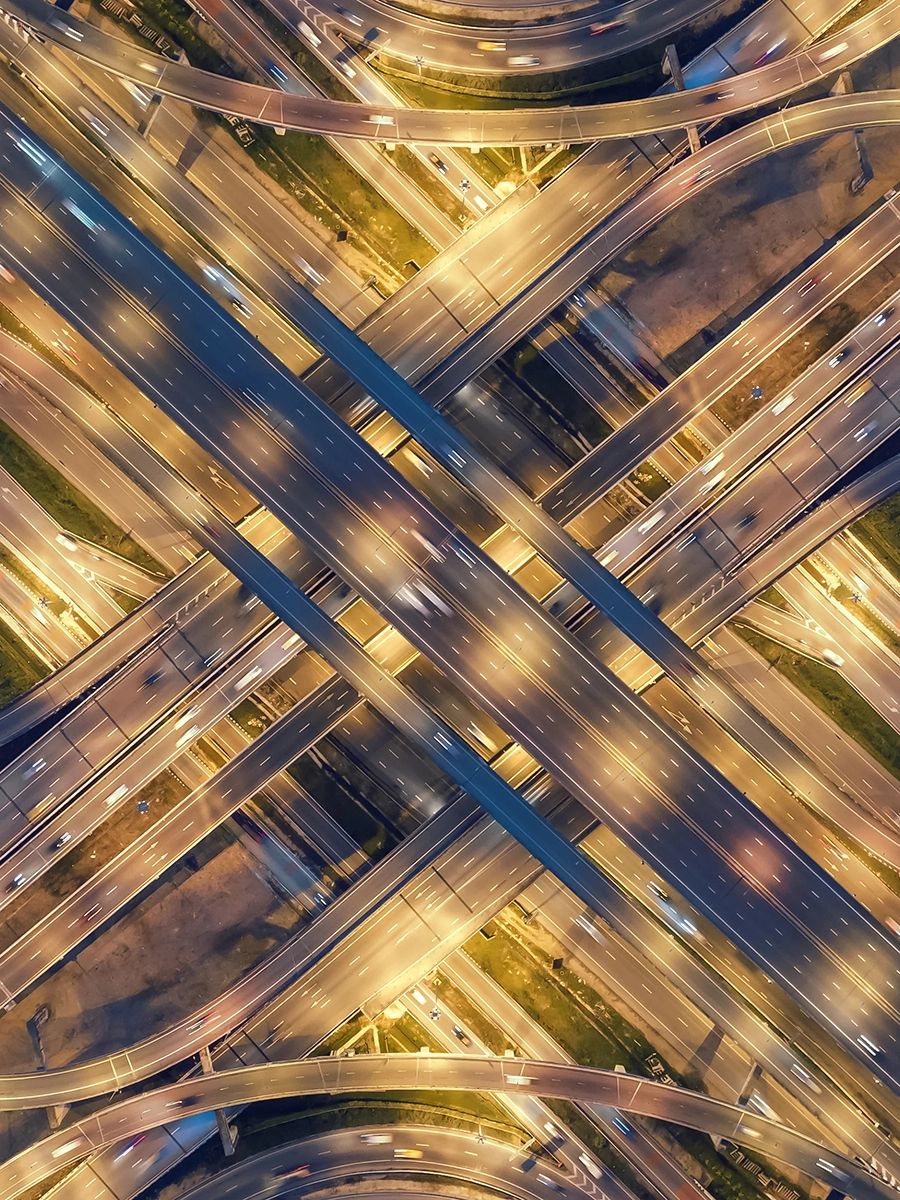

Clarity and control across your total portfolio

We help CIOs make sense of their unstructured and opaque data, enabling them to make clearer investment decisions and optimize board and stakeholder reporting. Total Plan Manager bridges public and private markets, creating a common language for modern allocators to harmonize disparate datasets.

Unify fragmented data from investor letters, SMAs and private equity funds into a single platform—providing transparency and clarity across the investment lifecycle.

Conduct in-depth exposure, risk, liquidity and attribution analysis with harmonized data to align your portfolio's risk and return objectives.

Shift focus from maintaining data to monitoring investments with manager style drift analytics.

Support your portfolio’s resilience by bringing investment data across asset classes into a single, factor-based risk view.

Analyze your portfolio

Enhance your investment decision processes with tools for performance tracking, exposure management, liquidity analysis and future scenario modeling.

Report on your portfolio's performance with our modern, real-time performance engine, and own your portfolio performance data.

Analyze your portfolio’s universe of investments, including hedge funds, SMAs, long-only funds, venture capital funds and private equity funds.

Capture complex liquidity terms, compute liquidation schedules and easily assess portfolio rebalancing opportunities.

Simulate future transactions, forecast cash flows, project exposures and plan allocations and redemptions with existing managers.

Quantify and benchmark your total and active risks on a holdings basis — isolating the factors that drive portfolio volatility across public and private assets.

An allocator's single source of truth

Analytics and reporting for multi-asset class investors — presented in a flexible, intuitive interface and powered by rich datasets.

Compute performance from recorded market values and transactions, at all levels of the portfolio. Choose from a large library of native benchmarks and easily blend your own.

Featured products

MSCI Factor Risk in Total Plan Manager

Gain portfolio risk clarity with holdings-based insights powered by MSCI’s Barra factor models. Analyze public and private assets in a single framework, quantify and benchmark risk and stress test your portfolio.

Report Builder

Transform your reporting process with Report Builder, available within Total Plan Manager. Customize and automatically generate reports, and deliver tear sheets, portfolio reviews and investor updates with ease.

Private Capital Transparency

Gain insights with transparent, look-through data. Leverage research, analytics and forecasting to optimize your investments.

Research and resources

Want more clarity?Get started today.

Private Capital Benchmarks Report

Up-to-date insight into private assets performance and trends, all based on since inception quarterly returns and cash flow data.