Assessing Company Alignment with UN SDGs

- Anecdotal, noncomparable and often subjective reporting on impact measurements is a challenge for institutional investors seeking to evaluate corporate alignment with the UN Sustainable Development Goals (SDGs).

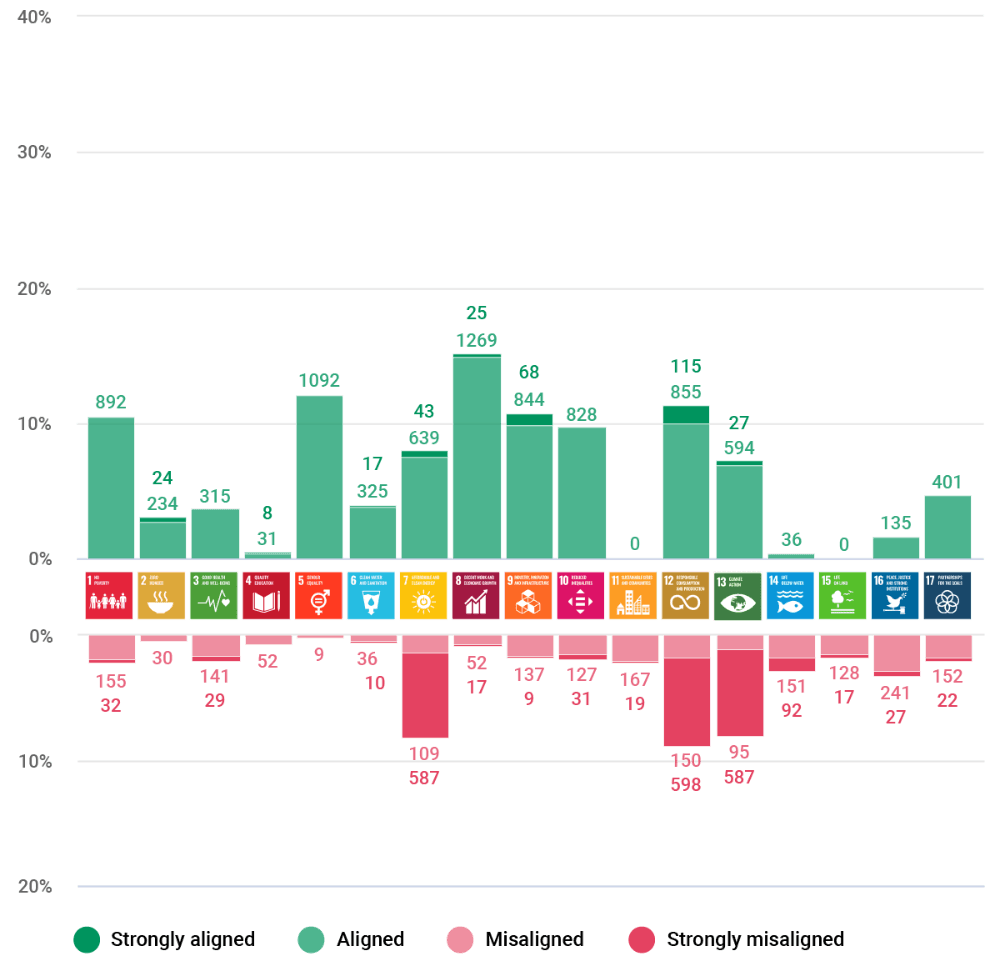

- Goals 7 (clean energy), 12 (sustainable consumption and production) and 13 (climate action) had the highest percentage of companies (8%-9%) misaligned with the goals, driven mostly by continued reliance on fossil fuels.

- U.S. companies were behind on Goal 8 (decent work and economic growth): Only 8% of U.S. firms aligned with this SDG compared to 15% for Australia and New Zealand, 17% for Europe and 19% for Asia.

Have Companies Made Progress Toward Meeting SDGs?

The chart displays distribution of companies' assessment by SDG for a set of 8,550 companies, as of Aug. 11, 2020.

Source: MSCI ESG Research LLC.

Where Companies Are Most Aligned and Misaligned

Of the 17 SDGs the global community aims to achieve, climate mitigation (Goal 13), clean energy solutions (Goal 7) and sustainable consumption and production (Goal 12) are among the most commonly cited by companies.3 Yet these three goals saw the highest degree of misalignment (more than 8% out of 8,550 issuers were assessed as misaligned or strongly misaligned) compared to other SDGs.

The slow progress toward addressing these three SDGs was most apparent for the energy and utilities sectors.4 The energy sector continued to develop low-carbon solutions and advance the use of alternative energy, but only three energy companies — the biofuels companies VERBIO Vereinigte BioEnergie AG, Renewable Energy Group and REX American Resources Corp. — earned more than half their revenue from clean energy. However, 91% of the energy sector continues to rely on fossil fuels as a core source of revenue, suggesting strong present-day misalignment on all three SDGs (Goals 7, 12 and 13).

The alignment gap looked less drastic for the utilities sector. Just over 18% of the 425 utilities companies we assessed promoted the transition to clean and affordable energy through greening their fuel mix, with 7% exclusively involved in renewable power generation. In addition, 40% continued to primarily rely on fossil fuels for power generation (though this included natural gas, considered a "transition" fuel by some).

Goal 8, which targets economic advancement, employment and decent work conditions, saw the highest degree of support and alignment: 15% of the 8,550 companies we assessed in the beginning of August 2020 supported inclusive employment, advancement of professional growth or offered economic-empowerment solutions. Due primarily to their involvement in controversies related to adherence to labor standards, only 8% of U.S. firms aligned with this SDG compared to 15% for Australia and New Zealand, 17% for Europe and 19% for Asia. Companies domiciled in Europe also tended to be more aligned with the goals tied to gender equality and women's empowerment (Goal 5) and reducing inequality (Goal 10) compared to companies in other regions.

Majority in the Middle

Though MSCI ESG Research does not assess a company's overall alignment with the SDGs, we can draw some overall conclusions based on the extent each company is aligned or misaligned with the 17 goals:

- Across all SDGs, we found that nearly four in 10 (37.8%) of the 8,550 companies we assessed had a greater number of alignments than misalignments. However, a larger share of developed-market companies (60.9%) were aligned with more SDGs. This finding may suggest that companies in highly industrialized nations face greater pressure to mitigate their effect on the environment and society, and report on those efforts, compared to their counterparts in developing economies.

- The majority (55%) had neutral or mixed alignment across the goals, generally because their products or operations were not especially relevant to the advancement of specific individual goals (e.g., Goal 4 on access to quality education).

- At the extremes, 0.8% of companies were strongly misaligned with at least three SDGs, while 0.2% of companies were strongly aligned with at least three of them. The outliers — strongly aligned or strongly misaligned — exhibited roughly the same rates in both developed and emerging markets.

10 Years and counting

From institutional investors' perspective, effective evaluation of SDGs still has a long way to go. The path starts with having clear, transparent and consistent information. That way, investors can better assess the merits of claims put forth by portfolio companies, whether overstated or understated. With the target deadline for achieving the SDGs only a decade away, starting on the standardization of that assessment now is critical.

1 Transforming our World: the 2030 Agenda for Sustainable Development." United Nations Department of Economic and Social Affairs, Oct. 21, 2015.

2 "United Nations Secretary General's Roadmap for Financing the 2030 Agenda for Sustainable Development, 2019-2021." United Nations Secretary General, July 18, 2019.

"World Investment Report 2019." United Nations Conference on Trade and Development. 3 Scott, L., and McGill, A. 2019. "Creating a Strategy for a Better World." PwC.

Who Cares about the United Nations Sustainable Development Goals?" MSCI Blog, April 6, 2020. 4 Based on the Global Industry Classification Standard (GICS®), the global industry classification standard jointly developed by MSCI and Standard & Poor's.

"World Investment Report 2019." United Nations Conference on Trade and Development. 3 Scott, L., and McGill, A. 2019. "Creating a Strategy for a Better World." PwC.

Who Cares about the United Nations Sustainable Development Goals?" MSCI Blog, April 6, 2020. 4 Based on the Global Industry Classification Standard (GICS®), the global industry classification standard jointly developed by MSCI and Standard & Poor's.

Further Reading

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.