Can Crowding Scores Quantify US Stocks’ Fragility?

Key findings

- The U.S. equity market has become more concentrated than any other time in the past three decades, driven largely by the performance of mega-cap tech stocks, leading to rising investor concerns about crowding.

- The MSCI Security Crowding Model shows that the mega caps have divergent crowding scores, as of April 24, 2024, with Apple Inc., for example, scoring at a level of relatively “uncrowded.”

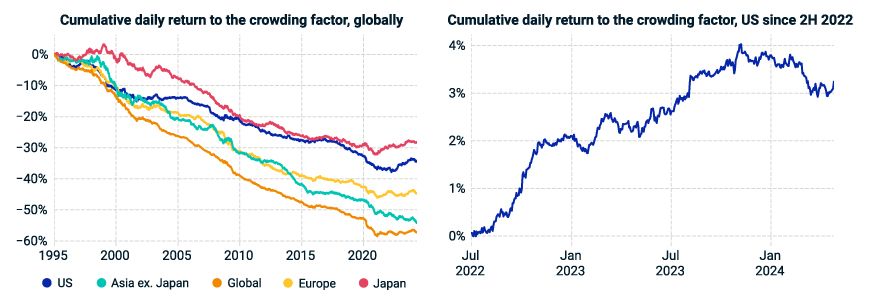

- The stock-crowding factor in the MSCI Global Equity Factor Trading Model shows crowded stocks underperformed uncrowded stocks globally, since 1995. However, the U.S. market recently fought this trend, as it touched record highs.

With the U.S. stock market touching a record high on March 28, 2024,[1] some investors have become concerned about the downside risk for U.S. equities, given a backdrop of renewed interest-rate uncertainty, earnings-season surprises and speculation about the business influence of advances in generative AI. If sentiment turns negative unexpectedly, as was the case following Meta Platform Inc.'s recent earnings announcement, crowded stocks may be the most vulnerable to price correction. To help investors as they assess their portfolios in this dynamic environment, we use the MSCI Security Crowding Model to identify segments of the U.S. market that were the most and leastcrowded as of April 24, 2024.[2]

Historic level of market concentration in the US

The U.S. market has now become more concentrated than any other time in the past 30 years. The top-10 constituents of the MSCI USA Investable Market Index (IMI) accounted for 28% of the index, far beyond the peak of 20% seen in the 2000s tech bubble and the 2008 global financial crisis (GFC). The top-50 constituents accounted for nearly half of the entire market capitalization (exceeding the 47% seen in 2002). Meanwhile, the effective number of stocks,[3] a market-concentration metric that considers the size of every stock in the market, and not just the largest ones, fell to just 81 (vs. 2,375 index constituents), an all-time low since June 1994. The concentration was also clear at the sector level with the dominance of information technology and communication services reflecting the influence of the digital economy.

Measuring market concentration of US equities

* Telecommunication services prior to October 2018

High market concentration does not automatically make mega caps a 'crowded trade'

Recently, many investors are increasingly concerned about crowding, an investment risk that arises when too much capital is pursuing the same investment strategies. Our previous research demonstrated that crowding increases the downside risk of stocks and factor strategies. While crowded stocks often have strong price momentum, the MSCI Security Crowding Model also looks for other signs of crowding: demanding valuation, elevated shorting activity and high volatility and trading volume. Using the overall score from the MSCI Security Crowding Model to analyze the top-10 constituents of the MSCI USA IMI, we found — surprisingly — that not all mega caps were crowded. Meta Platforms, Broadcom Inc. and Nvidia Corp. were the most crowded among the top 10, while Microsoft Corp. was neutral and Apple Inc., at a two-year low, actually appeared as "out of favor." As market concentration soared since January 2023 the average crowding z-score has increased from -0.2 to a high of 0.7 in June 2023 and generally stayed above 0.4 through the end of our study period.

Different levels of crowding among mega caps

The integrated crowding score is a z-score and is shown with the five model components. A high (low) value indicates a stock is crowded (uncrowded). The 90th, 50th and 10th percentiles were 1.1, -0.2 and -1.4, respectively. Data as of April 24, 2024.

Which US market segments were crowded?

Among the large caps with market capitalization over USD 100 billion, many of the most crowded were found in the semiconductors and semiconductor equipment industry, including Micron Technology Inc., Broadcom, Lam Research Corp. and Nvidia. At the other extreme, Tesla Inc. was among the least crowded, along with AT&T Inc., Pfizer Inc. and Comcast Corp.. When we computed the index-weighted crowding score of each industry across the index, interactive media and services, along with semiconductors and semiconductor equipment were the most-crowded industries. Automobiles and water utilities were the least-crowded.

Top five most and least crowded industries

A high (low) value for the integrated crowding score indicates a stock is crowded (uncrowded). The 90th, 50th and 10th percentiles for the integrated score were 1.1, -0.2 and -1.4 respectively. Data as of April 24, 2024.

The effect of crowding on stock returns

The next logical question is: How does crowding affect stock performance? We can answer the performance question by using the latest MSCI Equity Factor Trading Models, which incorporate a crowding score that accounts for return-drivers like momentum and value (which might swamp the crowding effect). After all, crowded stocks have often been momentum stocks[4] and momentum has historically been a strong performance driver. This adjustment makes, for example, Nvidia and Eli Lilly look less crowded and Alphabet and Amazon much more so. Returns to this "crowding factor" have been broadly negative globally, since January 1995: around 1.5% per year, depending on market.[5] However, the U.S. return has been positive since 2H 2022, as the U.S. market touched a record high amid widespread investor enthusiasm for AI.

Crowded stocks generally underperformed uncrowded stocks, except in the US since mid-2022

Are US crowds simply different from others?

When the Federal Reserve started to hike rates aggressively in 2022, many market participants predicted a recession in the U.S. Instead, U.S. equity markets reached a record high, and a few mega-cap technology stocks dominated the market. Since July 2022, crowded stocks in the U.S. have even bucked the historical trend and outperformed uncrowded ones. However, crowded stocks may suffer if sentiment deteriorates, and in this blog post, we have discussed some tools that can help investors prudently monitor their portfolios for potentially vulnerable exposures.

Subscribe todayto have insights delivered to your inbox.

1 Based on the end-of-day index level of the MSCI USA Investable Market Index (IMI).2 The analyses in this blog post were based on data as of April 24, 2024, unless stated otherwise.3 The effective number of stocks in the MSCI USA IMI is calculated as 1 / sum(wi2) where wi is the weight of the i-th constituent of the index. Strongin and Petsch offer a risk-based alternative: The effective number is the number of equal-weighted stocks with the same stock-specific risk (“Beating Benchmarks — A Stockpicker's Reality: Part 2,” Goldman Sachs, Nov. 30, 1999.).4 The average cross-sectional correlation between the crowding score and the exposure to the momentum factor in the MSCI USA Equity Factor Model is 0.46 between December 1996 and March 2024.5 The annualized return is based on the return of a daily-rebalanced long-short portfolio with an exposure of one to the stock-crowding factor.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.