Climate-Transition Risk and Private Capital: An Introduction

Key findings

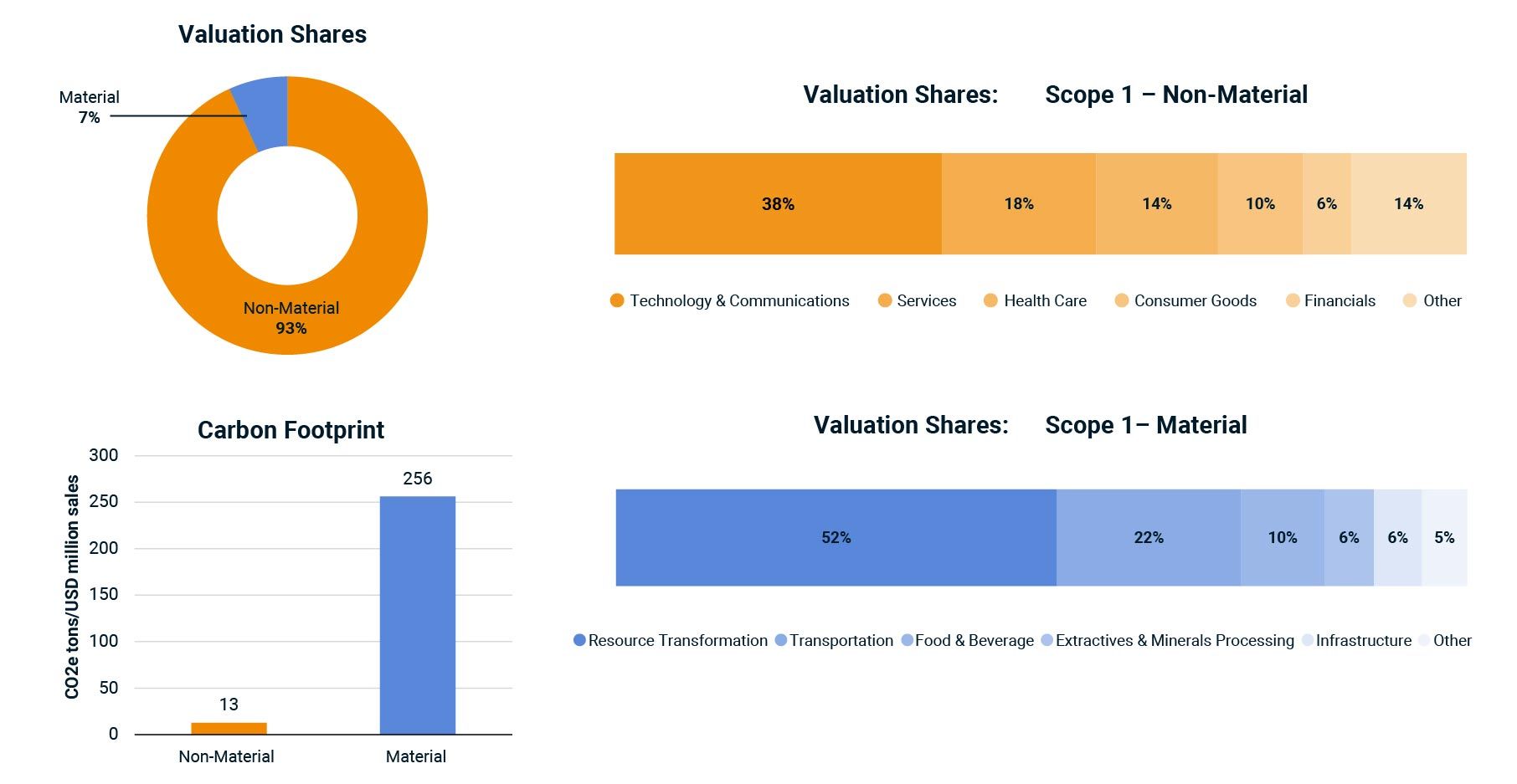

- Greenhouse-gas direct emissions (Scope 1) are estimated to be financially material to a relatively small fraction of buyout funds’ U.S. holdings — 7% by valuation and 10% by company count, according to our analysis.

- Private companies with financially material GHG emissions have a carbon intensity estimate of approximately 256 tonnes CO2/USD million sales, or about 20 times the level exhibited by the non-material segment.

This blog post originally appeared on Burgiss.com. MSCI acquired The Burgiss Group, LLC in October 2023.

Private-capital investors are currently facing two types of climate risks: physical and transition. Physical risks result from extreme climate events, such as floods, wildfires, heatwaves and hurricanes, that cause financial losses. Transition risks arise from moving toward a carbon-constrained economy, driven by changes in climate policies, cheaper low-carbon technologies, and a shift in consumer and investor sentiment toward green solutions.[1]

Measuring climate-transition risks as well as conducting climate stress tests are increasingly gaining momentum, as worries mount over the risk of stranded assets and the uncertainty around their long-term valuations. For instance, the Bank of England has indicated that if government policies were to change globally in accord with the Paris Agreement, two-thirds of the known global fossil-fuel reserves would not be burned, which would lead to changes in the value of fossil fuel investments.[2]

This blog post serves as an introductory piece for a research series that will estimate climate-transition risks of private companies and examine how their profitability could be impacted by various carbon-pricing schemes. The first step is to map the financial materiality of GHG emissions to private companies in order to estimate their carbon exposures. This post covers U.S. portfolio companies, held by buyout funds.

Emissions are not created equal

Calculating climate-transition risks requires an understanding of the financial materiality of GHG emissions in private companies and the consequent exposures to climate regulatory risks. Financial materiality can be understood as the relevance of a specific ESG factor to a company's financial performance, business model and enterprise value. For example, GHG emissions can be relevant and financially material to carbon-intensive companies due to the growing regulatory restrictions and the associated compliance costs.

Using the Sustainability Accounting Standards Board (SASB) Standards, the Burgiss data universe of private companies is divided into "material" and "non-material" segments based on the financial materiality of their direct GHG emissions (Scope 1).[3] These two samples are expected to be fundamentally different in terms of their carbon footprints, climate regulatory exposures, and climate-transition risks. Burgiss has mapped over 120,000 private portfolio companies and properties from the Burgiss Manager Universe (BMU) to the SASB Standards, allowing limited partners (LPs) to detect opportunities and risks in their portfolios.

The exhibit shows that GHG emissions are estimated to be financially material to only 7% of the buyout funds' aggregate U.S. holdings valuation, or to 10% of the underlying U.S. private portfolio companies, by count. The "material" subset is relatively small but has a Scope 1 carbon-intensity estimate of about 256 tonnes CO2/USD sales, or over 20 times the non-material subset's average, demonstrating a significant exposure to climate policy.[4] Identifying the material subset (10% of company count) will allow LPs to effectively monitor and engage with general partners (GPs) on this concentrated part of their portfolios and the associated carbon footprint and climate-regulatory risks.

SASB GHG emission materiality: climate vulnerabilities within buyout funds

Data as of Q2 2022. This analysis is based on an aggregated underlying holdings valuation of approximately USD 1.2 trillion in U.S. portfolio companies that are held by buyout funds. Carbon footprint analysis is based on approximately 98.6% of the net asset value (NAV). Carbon intensity estimates were calculated only for companies within the private capital universe. Therefore, properties, natural resource investments, and infrastructure assets generally do not have available estimates yet. The sectoral percentages are based on holdings valuation shares. The sector classification is based on SASB's Sustainable Industry Classification System (SICS). Source: Burgiss, MSCI ESG Research

Looking ahead

While private markets are inherently opaque with minimal climate disclosure, LPs' growing engagements with GPs and portfolio companies could prove valuable in expanding climate transparency. Prioritizing climate-disclosure engagements with companies that face financially material climate transition and regulatory risks may be valuable in risk management and mitigation.

The next posts in this series will examine climate-transition risks across private companies and estimate the impact of various carbon-price scenarios on profitability, using upstream and downstream approaches.

Subscribe todayto have insights delivered to your inbox.

1 “Climate-related risk drivers and their transmission channels.” Bank for International Settlements, April 2021.2 "Climate change: what are the risks to financial stability?” Bank of England, January 2019.3 Scope 1 emissions are direct greenhouse-gas emissions from sources controlled or owned by an entity. (Greenhouse Gas (GHG) Protocol.)4 Source: Burgiss, MSCI ESG Research

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.