Constructing Low Volatility Strategies

Blog post

January 25, 2016

Low volatility is one of the few factors that have historically performed well in turbulent markets. Moreover, over long periods of time, this defensive strategy has produced a premium over the market, contravening one of the most basic theories in finance — that one should not be rewarded with greater returns for taking less than market risk. Since the global financial crisis hit in 2008, low volatility has garnered increased attention from institutional investors.

A low volatility strategy can be constructed in two key ways, using purely ranking-based (heuristic) approaches or optimization-based methods. While purely ranking-based approaches are simpler to understand, we find that optimization-based methods offer greater flexibility in constructing low volatility strategies. In addition, some purely ranking-based approaches provide unintended exposures to factors other than low volatility, which can affect the risk/return profile significantly. Optimization strategies can have shortcomings of their own; however, constraints can be used to fine-tune the construction methodology.

A well-designed approach can benefit from the advantages and flexibility of optimization-based methodology, while incorporating constraints that address the shortcomings of an unconstrained optimization such as high turnover and large active and unwanted sector and country bets.

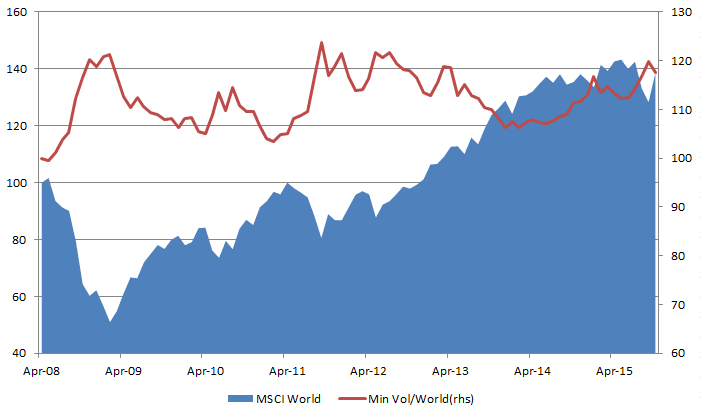

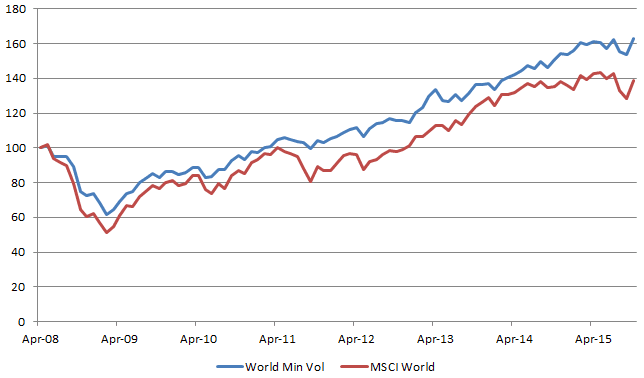

Using the MSCI World Minimum Volatility Index as an example, we reviewed the behavior of the index during various market regimes since its launch in 2008. The index reduced overall volatility by 30%, holding up better than the market during downturns (Exhibit 1). Over the same time period, the index outperformed the market by 20 percentage points as the market itself gained 40% (Exhibit 2).

Exhibit 1: Defensive Behavior of MSCI World Minimum Volatility Index

Exhibit 2: MSCI World Minimum Volatility Index Performance since Launch

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.