Foul Is Fair, Fair Is Fair: Is Private Equity Rich?

Key findings

- Using the Burgiss Manager Universe, combined with novel analytics, we estimated if funds are overvaluing, undervaluing or holding their assets at fair market value.

- For the 22 years ending December 2022, funds held assets at modestly conservative valuations. Large market moves, however, did result in private assets being temporarily over- or undervalued.

- As of Q4 2022, venture-capital funds were close to fairly valued in contrast to the recent past when venture capital was significantly overvalued. Buyout-fund valuations appeared to be in line with historical norms.

This blog post originally appeared on Burgiss.com. MSCI acquired The Burgiss Group, LLC in October 2023.

Whether private assets are overvalued is of great interest to limited partners for several reasons. For example, overvaluations — and undervaluations for that matter — will paint a misleading picture regarding allocations to such assets. This can be exacerbated if public markets fall rapidly, shrinking the size of the denominator and amplifying the apparent overallocation. Since private-capital investments require commitments to be made several years ahead of when capital is fully deployed, valuation biases can result in overcorrections to pacing patterns, causing allocation problems down the road.

We studied these issues in "The Truth Will Out: Is Private Equity Overvalued?" (henceforth referred to as "The Truth Will Out") and argued that venture-capital funds were significantly overvalued, whereas buyout funds were approximately fairly valued (or, at most, valued modestly above historical norms). In this blog post, we review developments since then and reveal what our model says is the current state of play.[1]

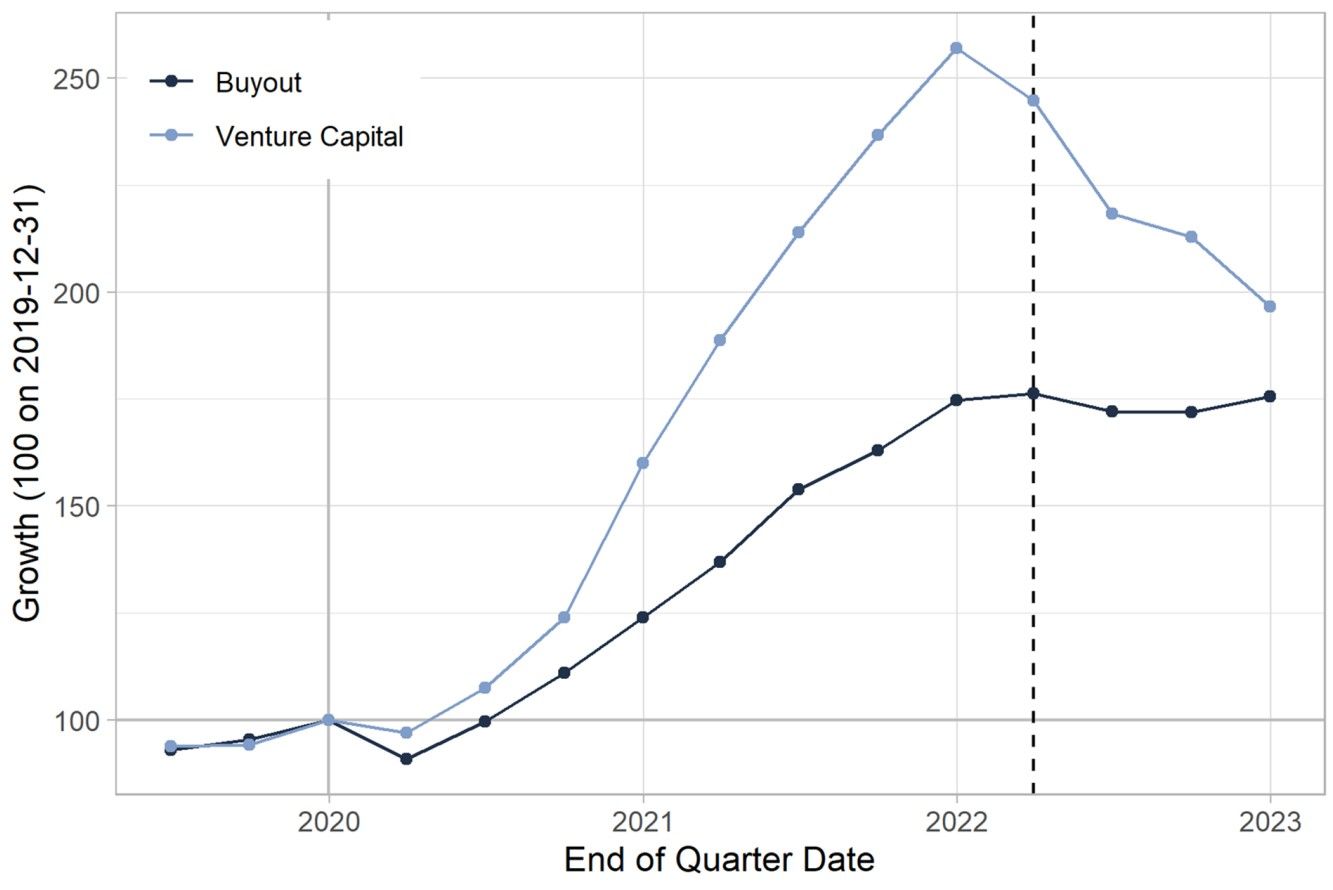

Venture-capital returns suffered in 2022

Based on the results from "The Truth Will Out," one would have expected buyout funds to move roughly sideways — perhaps rising or declining somewhat depending on the subsequent evolution of the equity markets — and venture-capital funds to decline until their valuations fell in line with their fair value; given their significant amount of overvaluation, one might have expected this to take several quarters to fully play out.

First, we summarize the actual evolution of private markets since "The Truth Will Out." Note that this previous research was based on Burgiss Manager Universe (BMU) data to Q1 2022, shown as a dashed line in the exhibit below:

- Buyout funds had some slight negative returns in Q2 and Q3, followed by a slight positive return in Q4.

- Venture capital suffered an unprecedented string of declines, with four consecutive quarters of negative returns; the decline in Q2 2022 (-10.95%) was almost as severe as in Q4 2008 (-11.89%).

Cumulative returns of US venture-capital and buyout funds

Data as of Dec. 31, 2022. The dotted line is at the end of Q1 2022, the latest data used in estimating our model in "The Truth Will Out."

Based on this data, we think that private equity returns have evolved in line with what "The Truth Will Out" suggested.

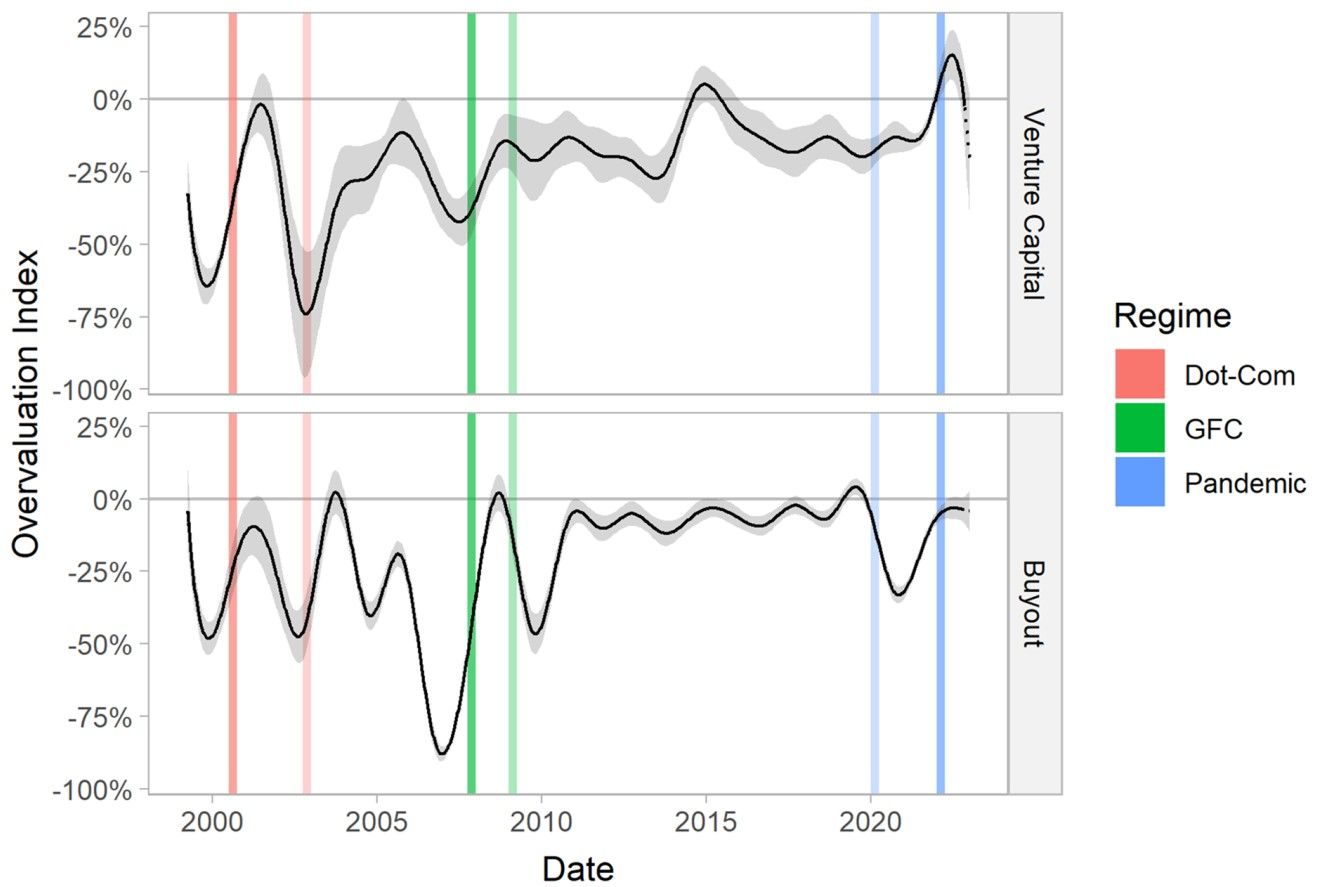

Assessing the current state of play in valuations

Turning to the present, are valuations now fair?[2] First, we look to the public markets and assume that private-market returns are mostly a lagged — and smoothed — version of public returns, perhaps with a beta greater than one. Buyout funds were essentially flat throughout 2022, which seems at odds with the declines in public markets. Venture-capital funds suffered steep negative returns in all four quarters of 2022, which at first blush might seem to mirror the public markets; note, however, that numerous studies (both academic as well as our own study[3]) suggest that the beta of venture capital to the public markets is significantly greater than one. Taking this into account would suggest that further steep declines should be expected. But all of this is based on similarities between the public and private markets. The methodology of "The Truth Will Out," in contrast, is entirely independent of the behavior of public markets as it uses only private capital data — namely, data from the BMU. As we will see, private data paints a somewhat different picture, and it is to this analysis we turn next.

The methodology of "The Truth Will Out" can be summarized as follows. The BMU records much more than just the pooled behavior of a large number of funds; rather, it captures the behavior of every individual fund. Furthermore, there are significant differences in behavior among the individual funds: some distribute no capital in a given quarter, while others distribute a significant fraction of their net asset value. We exploit this cross-sectional variation by noting that, for example, if valuations are too high, then funds that distribute large amounts of capital will tend to have lower returns than those that do not (since the former set of funds will be forced to recognize the true value of their assets — cash flows are objective, but valuations may not be). Further details can be found in the original article.

Overvaluation for US venture-capital and buyout funds

Data as of Dec. 31, 2022. The black line indicates whether fund assets are over- or undervalued relative to their fair market values. The colored bars correspond to various regimes; the darker color indicates the quarters when the U.S. public-equity markets achieved their maximum values, and the lighter color indicates the quarters when they achieved their minimum values.

The exhibit shows the results of estimating an index based on this methodology.[4] As we remarked in "The Truth Will Out," there are a number of interesting details about the past behavior of this index, including that private-equity funds generally tend to hold assets at a slightly conservative valuation (i.e., the index usually takes on negative values; we refer to the degree of such undervaluation as historical norms). Fitting the methodology to the current BMU suggests that buyout funds continued to be valued slightly conservatively, and hence in line with historical norms. But the degree of overvaluation of venture capital has declined markedly, to the point it has also become aligned with historical norms. In our view, this perspective — based purely on private data — paints a somewhat more positive picture than what the public markets might otherwise suggest.

Venture-capital and buyout funds appeared fairly valued at yearend 2022

By exploiting the cross-sectional variation in fund behavior within the BMU — and only such data (i.e., not using any public data) — we can estimate whether private equity is over- or undervalued. This approach, combined with the latest data from the BMU, suggests that as of Q4 2022, both buyout and venture-capital funds were approximately fairly valued. For venture-capital funds, this is a marked change from several quarters ago when they appeared to be significantly overvalued.

Subscribe todayto have insights delivered to your inbox.

1 As of the BMU updated through Q4 2022.2 As of the BMU updated through Q4 2022.3 Luis O'Shea and Vishv Jeet, “Estimating Public Market Exposure of Private Capital Using Bayesian Inference,” Working paper 3, The Burgiss Group LLC, 2017.4 The analyses in this blot post were carried out using BMU data through Q4 2022 on over 1,500 buyout funds and 2,400 venture-capital funds. These funds generated around 700 individual distribution cash flows per quarter during our sample period, thus providing our methodology with the required cross-sectional dispersion in distribution amounts.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.