Four Scenarios for 2023: Navigating Uncertainty

- The year started off with investor optimism on the economic outlook, although economists' forecasts vary considerably.

- We outline four scenarios for navigating the economic-outlook uncertainty and assess their impact on investment portfolios.

- Under our "baseline" scenario, a diversified portfolio of equities, bonds and real estate could gain 3%, while it could lose 0.5% and 7%, under our "hard landing" and "stagflation" scenarios, respectively.

Uncertain macroeconomic outlook

The economic forecasts from organizations such as the International Monetary Fund (IMF), World Bank and Organization for Economic Cooperation and Development (OECD) outline sluggish growth in the U.S. and a shallow recession in the eurozone, along with elevated inflation (see exhibit below).1 At the World Economic Forum in Davos, the mood was more optimistic due to three potential tailwinds for the global economy: China's reopening and the anticipation of a "revenge spending" boom, falling energy prices providing relief in Europe and the Inflation Reduction Act's boost to the U.S. economy.2 Caution may still be in order, however, as central banks continue to fight inflation, and geopolitical tensions may still surprise, in 2023.

Forecasts vary significantly in major economies

Economic forecast for GDP growth and inflation from OECD, IMF and a median and range from a poll of economists.

Amid this high uncertainty, we outline four macroeconomic scenarios for 2023 and their corresponding impact on investment portfolios:

- Baseline: Interest rates remain high as inflation stays elevated in 2023. Economic growth in the U.S. is weak but slightly positive, while there is a mild recession in Europe. No additional global downside risks materialize. The U.S. dollar slightly depreciates.

- Hard landing: Monetary policy effectively curbs inflation, and the Federal Reserve maintains its credibility, at the cost of a U.S. recession in 2023. The Fed's pivot in response to the recession weakens the U.S. dollar significantly.

- Mild stagflation: Central-bank policy does not efficiently tame inflation, eroding central banks' credibility, and inflation becomes entrenched. High prices and interest rates weigh on growth for an extended period. The U.S. dollar strengthens, putting pressure on emerging-market economies.

- Strong rebound: Inflation is under control and falls more than economists' consensus expectation, while economic growth surprises on the upside. Current global headwinds get resolved and supply-chain issues ease.

Four paths for US growth and inflation

In addition to the uncertain macroeconomic outlook, we see a wide dispersion in equity valuations across regions (see exhibit below). For certain regions, such as emerging-market Asia, the combination of strong regional growth forecasts, with room for valuation expansion in markets such as Taiwan, could lead to outperformance relative to global markets. Growth stocks, on the other hand, still show higher valuations in historical perspective and could take a further hit, particularly in a high-rate environment, such as under our "mild stagflation" scenario.

Trailing price-to-earnings ratios by region

Based on trailing price-to-earnings ratios for the respective MSCI indexes, between January 2011 and December 2022.

These regional assumptions are taken into consideration in the scenarios outlined in the table below.

Our scenario assumptions

Scenario assumptions are informed by the MSCI Macro-Finance Model, analysis of historical data (e.g., price-to-earnings ratios) and subjective judgment. Breakeven inflation (BEI) is measured in basis points (bps). These are not forecasts, but hypothetical narratives of how the macroeconomic scenarios could affect multi-asset-class portfolios over the horizon of one year.

Potential implications for financial portfolios

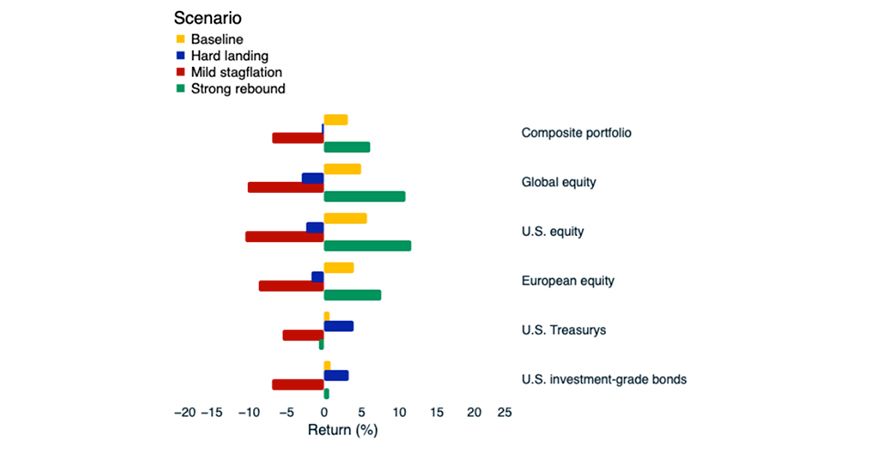

To assess the scenarios' impact on multi-asset-class portfolios, we used MSCI's predictive stress-testing framework and applied it to a hypothetical global diversified portfolio, consisting of global equities and U.S. bonds and real estate.3 For such a portfolio, the impact under our "baseline" scenario was a 3% gain. Under the more bearish "hard landing" and "mild stagflation" scenarios, the portfolio lost 0.5% and 7%, respectively. The exhibit below shows more detailed results.

Impact across asset classes under our scenarios in USD

Portfolio impact of the scenarios based on market data as of Jan. 31, 2023. Note that the stress-test results capture the effect of repricing of the assets, not the income component. Sovereign inflation-protected securities are represented by Markit iBoxx indexes. Equities and corporate and nominal sovereign bonds are represented by MSCI indexes. Private equity is represented by model portfolios. U.S. real estate is represented by the MSCI/PREA U.S. AFOE Quarterly Property Fund Index. The composite portfolio is 50% global equities (35% public and 15% private), 10% U.S. Treasurys, 10% U.S. Treasury inflation-protected securities, 10% U.S. investment-grade bonds, 10% U.S. high-yield bonds and 10% U.S. real estate. Source: S&P Global Market Intelligence, MSCI

Under our "baseline" scenario, we expect elevated interest rates and volatile markets, due to the ambiguity around economic growth, monetary policy, and the geopolitical situation. In our recent "Markets in Focus" blog post, we outlined that investors might prefer tilts to value, quality, high-dividend-yield and minimum-volatility stocks — which, historically, have been more resilient in such an environment. Despite recent optimism, investors may not want to let their guard down.

The authors thank Raman Subramanian, Anil Rao, Raina Oberoi, Monika Szikszai and Dora Pribeli for their contributions to this blog post.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1“Confronting the crisis.” OECD Economic Outlook, November 2022.

“Countering the cost-of-living crisis.” IMF World Economic Outlook, October 2022

Economic-indicator poll sourced from Refinitiv EIKON. Poll data as of December 2022.2Giles, Chris. “Things are looking up for the global economy.” , Jan. 20, 2023.3The results are generated by using model correlations to propagate shocks to the portfolios, using MSCI's BarraOne®. MSCI clients can access BarraOne® and RiskMetrics® RiskManager® files for these scenarios on the client-support site.

“Countering the cost-of-living crisis.” IMF World Economic Outlook, October 2022

Economic-indicator poll sourced from Refinitiv EIKON. Poll data as of December 2022.2Giles, Chris. “Things are looking up for the global economy.” , Jan. 20, 2023.3The results are generated by using model correlations to propagate shocks to the portfolios, using MSCI's BarraOne®. MSCI clients can access BarraOne® and RiskMetrics® RiskManager® files for these scenarios on the client-support site.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.