Has Liquidity Dried Up in Private Equity?

- Private-equity investors may face a cash crunch stemming from the market sell-off in the first three quarters of 2022.

- Our analysis shows that capital calls and distributions in 2023 could drop below their historical average, diminishing investors' ability to fund upcoming contributions with distributions from prior vintages.

- By connecting private-asset liquidity to public-market dynamics, investors may be better prepared to manage funding status.

Three hypothetical scenarios for private equity

Given the uncertainties in how inflation and the economy will play out in the coming months, we consider three hypothetical macroeconomic scenarios.

- Positive supply shock: We assume that supply-chain bottlenecks, which had contributed to the past year's high inflation, lessen. As a result, inflation is dampened moderately. In addition, the Federal Reserve slows its hikes in interest rates, and consumer sentiment climbs. Under this scenario, equity markets are assumed to regain some ground in the near term.

- Soft landing: The Fed lowers inflation without causing a severe recession, although economic growth slows in the near term. Long-term growth stays intact. Equity returns decline below the baseline in the near term.

- Stagnant long-run growth: Trend growth slows, moving the economy to a lower-growth path that persists for many years. Under this scenario, the equity market will retreat further.

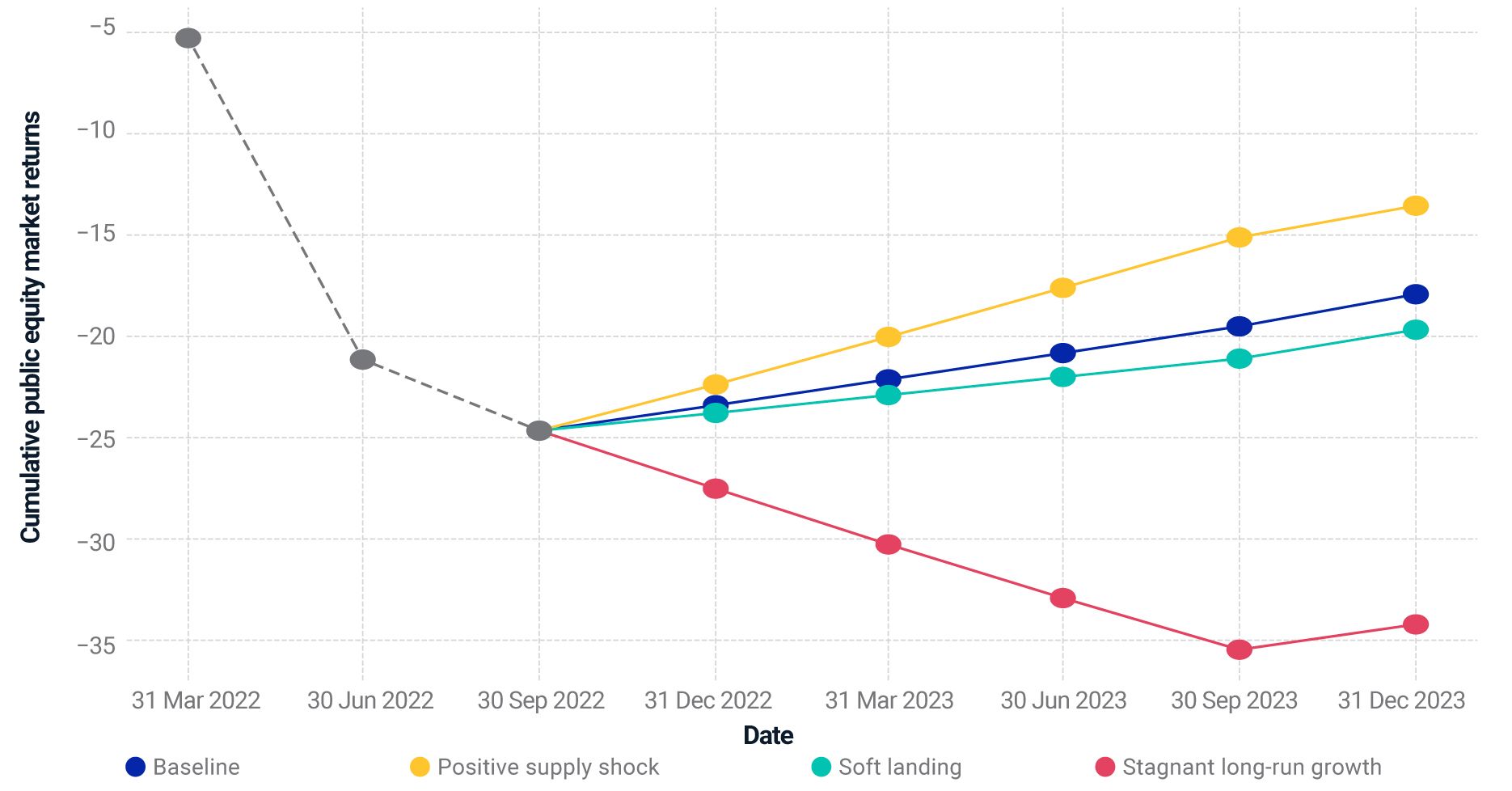

Public-equity returns assumed under the scenarios

Public-equity-market returns under all scenarios are generated using the MSCI Macro-Finance Model. Each scenario is associated with a different macroeconomic shock and represents how the economy might evolve from the current high-inflation environment.

Implications for buyout cash flows

Contributions to and distributions from private-equity buyout funds have shown positive sensitivity to lagged returns in the public-equity market historically.2 Consistent with this, through the second quarter of 2022 both capital calls and distributions from private-equity funds slowed,3 as the public market sharply sold off. Although equities have moved up modestly since then, the public-equity market is still down sharply for the year through Nov. 16. As a result, the slowdown in private-equity capital calls and distributions could continue into 2023.

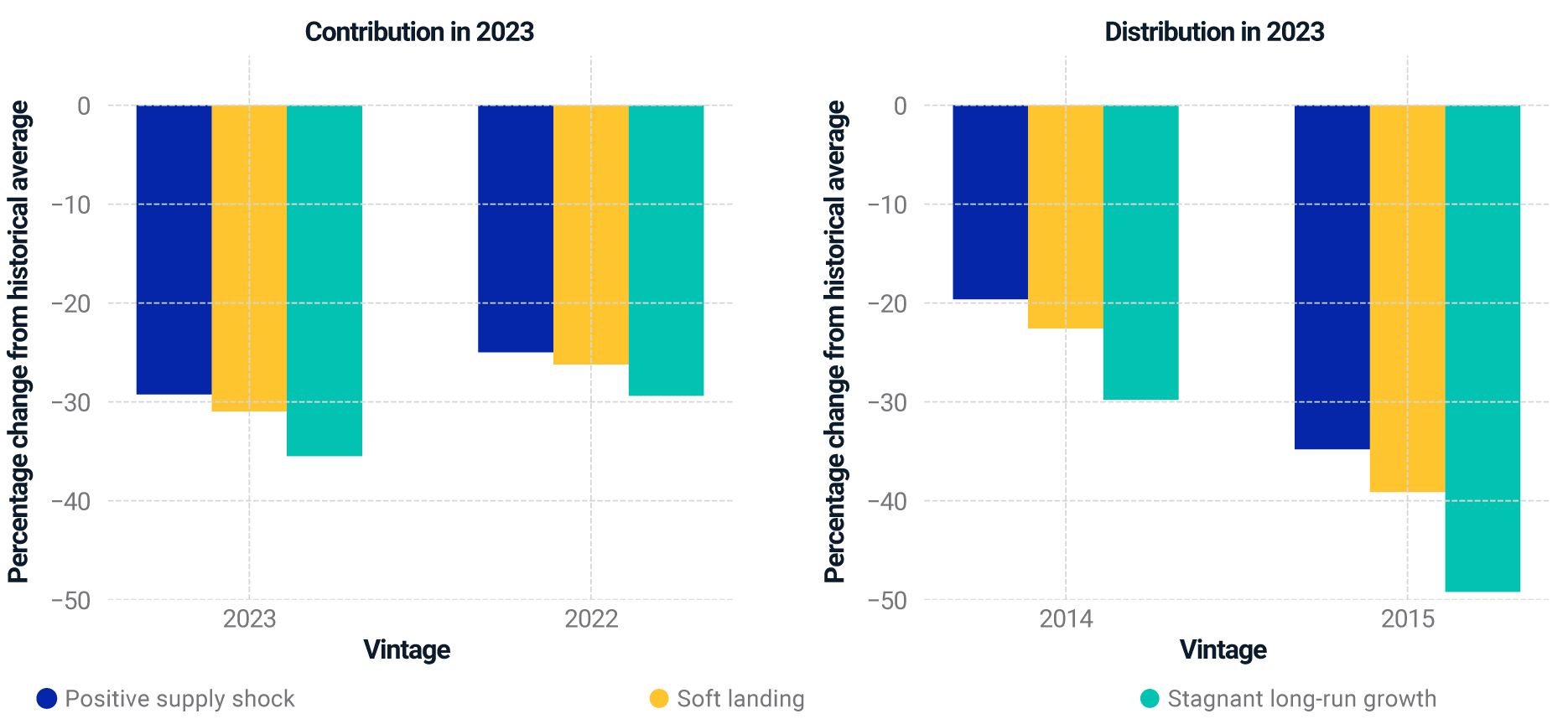

Under all three assumed macroeconomic scenarios, use of historical sensitivities suggests that contributions could be lower in 2023 than their historical levels from 2016 to 2020 (see the left panel of exhibit below).4 This holds both for funds launched in 2022 and for funds to be launched in 2023. As a result of the diminishing availability of viable buyout deals due to high borrowing costs, contributions drop by as much as 35% in the scenario of stagnant long-run growth.

Use of historical sensitivities also suggests that distributions on older vintages could be lower in 2023 than the historical average under all three scenarios (see the right panel of the exhibit below). Diminished valuations may cause managers of private funds to delay selling portfolio companies or force them to exit at lower prices, driving distribution reductions in 2023. Scenario distributions from vintage 2014 and 2015 drop by 20% to 50%.

Scenarios' impact on contributions and distributions in 2023

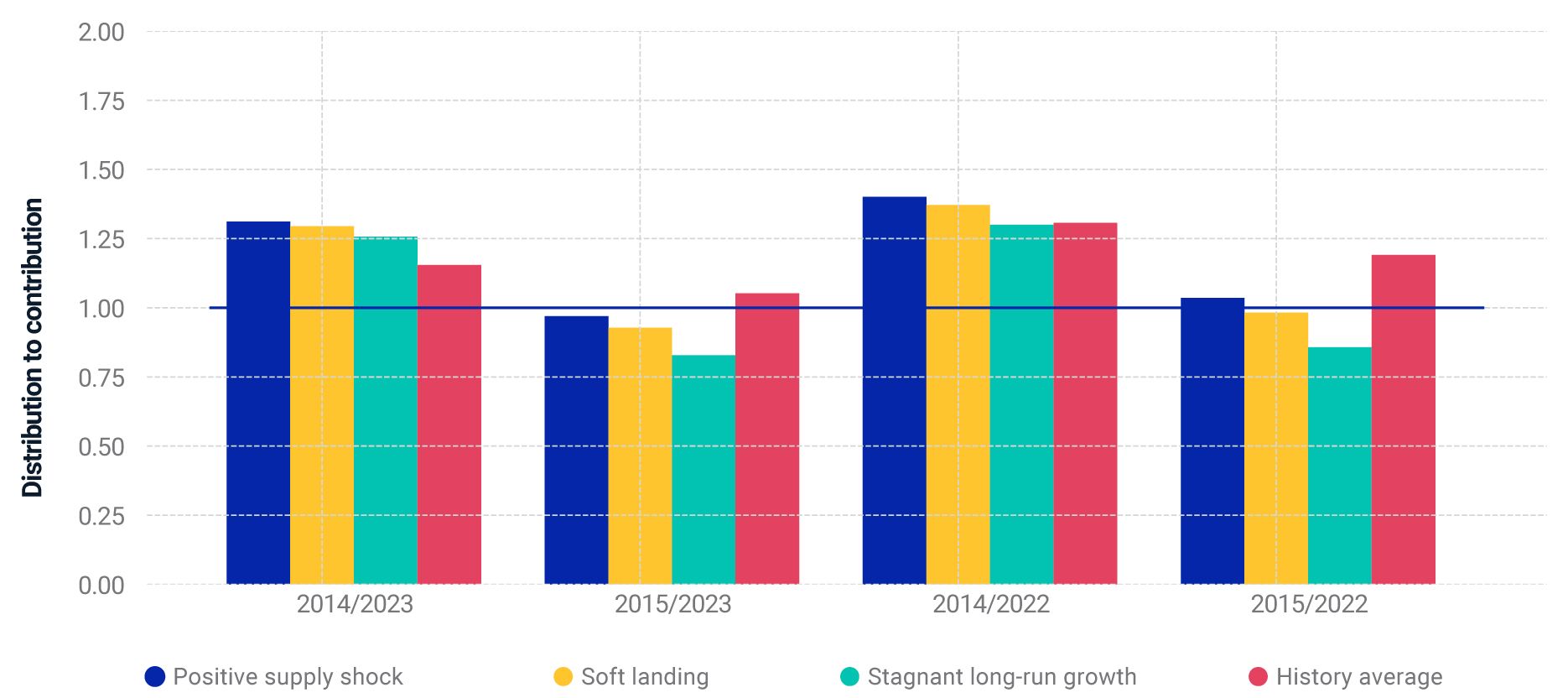

Changes to the outlook of private-equity cash flows could have several implications for investors. First, some investors may have to adjust how they fund capital calls. Historically, investors with a mature private-asset program have been able to fund capital calls of young vintages entirely with distributions from old vintages. If distributions slow down more than contributions, that will be much harder. Short of private-fund distributions, investors may need to raise liquidity by selling assets from the public book at unfavorable valuations.

Scenarios' impact on the distribution-to-contribution ratio

Second, confronting high funding costs, investors may need to lower their private-equity exposure either with a sale of their fund stake in the secondary market or by cutting back on new private-equity commitments.

Private-equity cash flows have slowed down in the wake of swooning equity markets. How much further cash flows and funding ratios may decline depends on how inflation and the economy will unfold. Investors may wish to assess their total plan liquidity management and private-equity commitments with these connections in mind.The authors would like to thank Luis O'Shea at Burgiss and Will Baker for their contributions to this post.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1In this event, limited partners (LPs) may be subject to penalties and legal liabilities. In addition, LPs could suffer reputation damage, preventing their participation in future private-asset investments.2Using Burgiss as our source for quarterly data on U.S. buyout funds’ cash flows from 1994 to 2021, we found that private-equity contributions and distributions both increase with public equity’s returns from previous quarters (up to four quarters). In addition, cash-flow sensitivities vary by fund age.3“Global Private Capital Performance Summary: 2022 Q2.” Burgiss. 2022.4These cash flows would differ substantially from those from Takahashi and Alexander (2002), which vary only by fund vintage and are not by public-equity-market performance. Takahashi, Dean, and Alexander, Seth. 2002. “Illiquid Alternative Asset Fund Modeling.” Journal of Portfolio Management 28 (2): 90-100.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.