How Accurate Are ‘Zombie’ Valuations?

Key findings

- On average, zombie assets were liquidated at prices in line with general partners’ valuations.

- Funds that outperformed in their first 10 years tended to continue outperforming with zombie assets, realizing higher returns than peer funds after age 10.

- For risk management, limited partners should be conscious of the substantial probability of write-downs, even though this is not the expectation.

This blog post originally appeared on Burgiss.com. MSCI acquired The Burgiss Group, LLC in October 2023.

Although a 10-year term is a common feature of private-capital-fund limited partner (LP) agreements, funds usually take significantly longer than that to fully liquidate; these zombie assets can continuously shuffle along through multiple extensions.[1] For LPs considering selling zombie assets onto the secondary market, the big question is: Are general partners (GPs) clinging to these overstated zombie valuations, and thereby postponing eventual write-downs, or should LPs ultimately expect this capital to be distributed in full? In this blog post, we present evidence that zombie assets are, on average, appropriately valued.

GPs' zombie valuations are close to the mark

We call a fund a zombie if, at age 10, its reported net asset value (NAV) is at least 10% of the original commitment amount. There are a couple of reasons why some LPs may think that GPs are systematically overvaluing zombie assets: GPs may be overly optimistic or they may be strategically trying to extract more fees for the same work.[2] Once a fund's NAV drops to 1% of the commitment, we consider it to be quasi-liquidated, at which point we can evaluate whether GPs had intentionally overvalued their zombie assets.

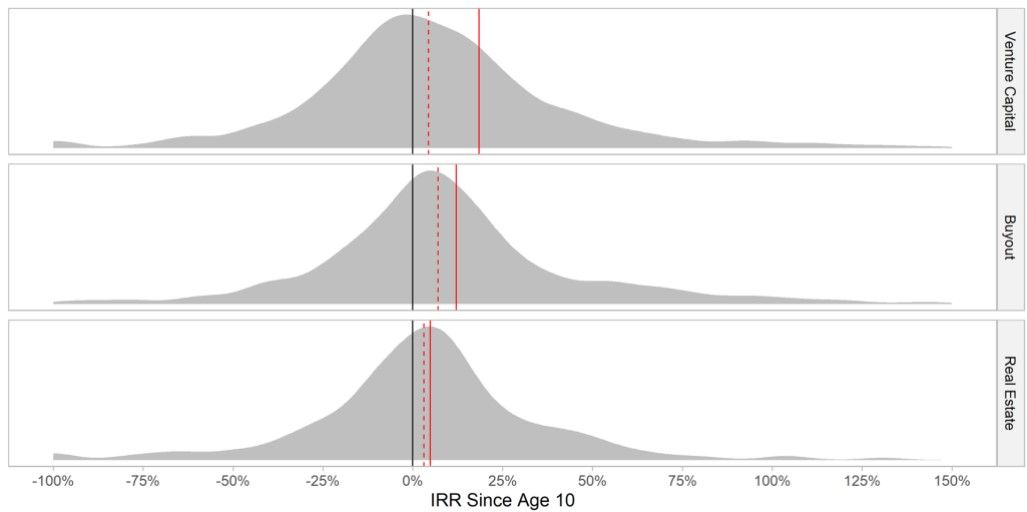

One way to test these valuations is to look at the internal rates of return (IRRs) for funds in their zombie phases, as illustrated in the following exhibit.[3] An IRR of zero means the valuation at age 10 was exactly right, a positive IRR suggests that the assets were written up and a negative IRR suggests the assets were written down. We find that IRRs were above zero in all three asset classes (venture capital, buyout and real estate); however, median IRRs were closer to zero.[4] This data demonstrates that GPs have been relatively accurate when valuing zombie assets.

Probability density of IRRs from age 10 until 1% quasi-liquidation

Data as of October 2022. Solid red lines denote pooled IRR, and dotted red lines denote medians.

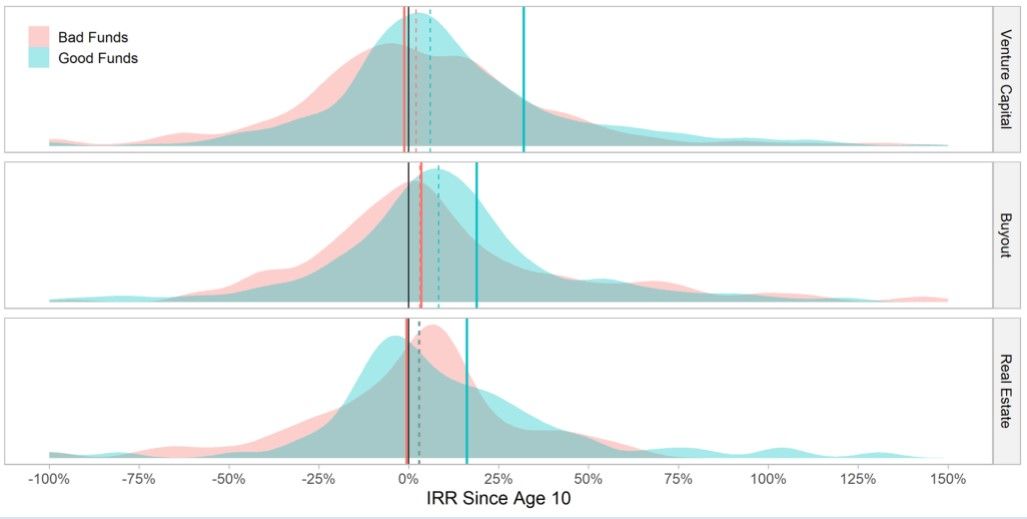

Although the average fund appears to be accurately valuing its holdings, LPs may worry that this is untrue for funds that underperformed during their first 10 years. Using fund private market equivalents (PMEs) from inception to age 10, we divide funds into "good funds" — funds that outperformed public equities[5] — and "bad funds" — those that did not.

The following exhibit suggests that even bad funds distributed their reported NAV in full but good real-estate and venture-capital funds significantly outperformed. While these findings are encouraging for LPs with zombie exposure, a word of caution: the risk of large write-downs was substantial, and this risk was greatest for bad funds, as evidenced by the meaningful mass of funds with negative IRRs since age 10. Approximately 30% of bad funds yielded zombie IRRs below -10%, compared to just 20% of good funds.

Distributions of IRRs from age 10 until 1% quasi-liquidation

Data as of October 2022. Funds with since inception PMEs greater than 1.0 at age 10 are classified as "good funds," while the rest are "bad funds." Solid vertical lines denote the pooled IRRs of good and bad funds, and dotted lines denote medians.

Little reason to fear zombie assets

Despite concerns that GPs might overstate valuations of zombie assets, we find little evidence that this was a systematic practice. Even underperforming funds appeared to be accurately valuing their zombie assets, on average. However, risk managers should keep in mind that there remains substantial potential for write-downs, especially among funds that have already underperformed.

The author thanks Brooke H. Jones and Henry Phan of Bryn Mawr College for valuable discussions on the topic.

Subscribe todayto have insights delivered to your inbox.

1 Using an overly simplified measure of fund life, from age 10, the average zombie buyout fund takes another six years to quasi-liquidate. The number is similar for real estate funds but rises to over eight years for zombie venture-capital funds. These numbers likely underestimate fund lifetimes because funds that have yet to quasi-liquidate have unknown final ages, so the ages we can measure are biased toward zero.2 For instance, GPs may be able to extract additional compensation if there is a post-investment-period management fee based on invested capital. Alternatively, a manager raising a new fund may try to inflate returns of previous funds at the margin.3 Including the venture-capital, buyout and real estate asset classes, the Burgiss Manager Universe contains 7,247 funds as of October 2022. For our analysis, 1,604 quasi-liquidated funds meet our zombie criteria. An additional 1,199 funds are currently in a zombie phase but have yet to quasi-liquidate, so we exclude them here. Only 435 funds were quasi-liquidated by age 10, while another 800 reached age 10 with a residual value of less than 10% of the fund size. The remaining funds are under age 10 and still active.4 This is a predictable and common result in private capital, where returns have a long right tail.5 As determined by a Kaplan-Schoar PME of greater than 1.0.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.