Is MBS Refinance Risk Increasing?

Blog post

October 12, 2018

With the Federal Reserve raising interest rates and the majority of agency mortgage-backed securities (MBS) under the refinance threshold,1 how much do investors need to worry about refinance risk? Our model indicates that future refinance regimes would be similar to recent 2016 experiences, and this view is consistent with current behavior of MBS empirical durations. However, investors may want to remain vigilant, as the recent trend toward looser mortgage credit standards by agencies and regulators could increase the prepayment intensity of future refinance waves.

Generally, market expectation changes with regard to future refinance regimes would impact MBS valuations and duration risk. The exhibit below shows significant duration variations for pass-through securities under different potential refinance intensity assumptions, derived from the MSCI Agency Prepayment Model.2 More leveraged products, for example, interest rate-only (IO) and collateralized mortgage obligations (CMOs), which rely heavily on models for hedge ratios and risk measurement, may have much higher sensitivities to these assumptions.

Duration and OAS responses to future mortgage credit assumptions

Unnamed: 0 | Duration | Duration.1 | Duration.2 | OAS | OAS.1 | OAS.2 |

|---|---|---|---|---|---|---|

Unnamed: 0 Coupon | Duration Tight Credit Env. | Duration.1 Base | Duration.2 Loose Credit Env. | OAS Tight Credit Env. | OAS.1 Base | OAS.2 Loose Credit Env. |

Unnamed: 0 3.5 | Duration 6.3 | Duration.1 5.9 | Duration.2 5.5 | OAS 33 | OAS.1 28 | OAS.2 23 |

Unnamed: 0 4 | Duration 5.2 | Duration.1 4.8 | Duration.2 4.0 | OAS 41 | OAS.1 34 | OAS.2 22 |

Unnamed: 0 4.5 | Duration 4.4 | Duration.1 3.8 | Duration.2 2.5 | OAS 53 | OAS.1 44 | OAS.2 15 |

Source: MSCI Agency Prepayment Model

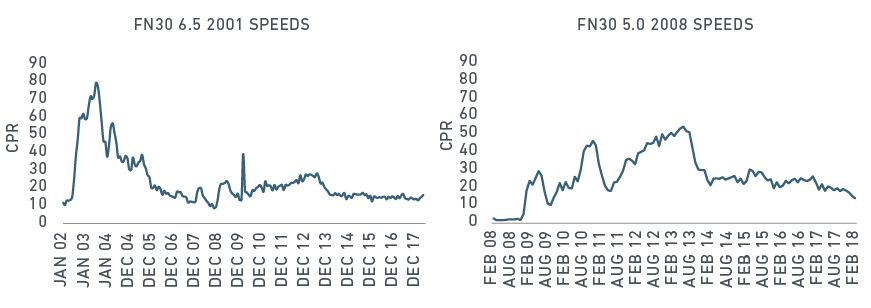

RECENT REFINANCE WAVES HAVE BEEN MORE SUBDUED THAN 2003

The agency mortgage universe has experienced multiple types of refinance regimes, as we see when we compare the 2003 refinance wave with more recent ones. The FNCL 2001 6.5s (Fannie 30-year 2001 origination 6.5s coupon mortgage loan cohorts) reached a conditional prepayment rate (CPR) of 80 during the 2003 wave, while those of FNCL 2008 5s, the most credit-worthy cohort after the global financial crisis, never reached higher than the lower 50s during its refinance waves.

Tales of two refinance waves

Source: Fannie Mae, MSCI

The high refinance speeds in 2003 have been generally attributed to financial technology advancements, such as refinancing with the help of the internet, as well as a simplified mortgage origination process, including relaxed mortgage credit at that time. Though the former is still with us, the mortgage origination process has grown more complex and mortgage credit has tightened since the financial crisis, which may have contributed to milder refinance waves.

SIGNS OF A REFINANCE REGIME CHANGE?

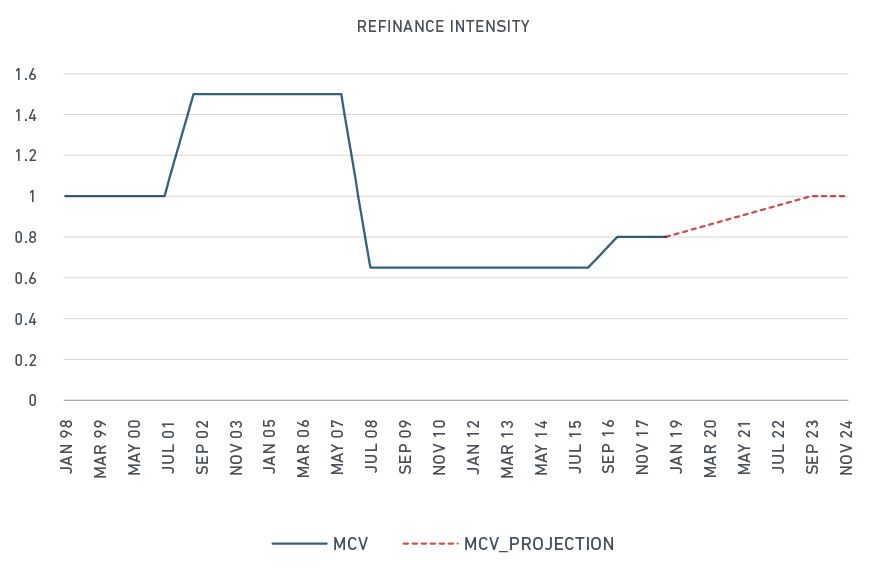

To get another view of the multiple refinance regimes, we looked back over the last 10 years using our model, which employs a "macro credit variable" indicator to measure the combined effect of multiple factors on refinance intensity. Using the 1998 refinance wave as a benchmark, our model shows that after the surge in 2003 and subsequent pullback in 2009-2010, we've seen refinance intensity recover to about 80% of level. Looking forward, the model projects a further recovery back to benchmark by 2023.

Refinance intensity appears headed back to level

Macro credit variable (MCV) measures the overall refinance intensity.

The increase above appears steady. However, the agencies and regulators have recently accelerated their push to relax mortgage credit requirements, which could have an impact on the speed of the next refinance wave. The recent changes include:

- Fannie Mae's HomeReady® program and Freddie Mac's Home Possible® program, effective since June 23 and Aug. 29, 2018, respectively, reduced the mortgage down payment requirement to 3%, together with reduced income requirements.

- The Federal Housing Finance Agency (FHFA) and the government-sponsored enterprises (GSEs) it regulates have been evaluating credit score models as alternatives to FICO® to encourage lending to underserved borrower segments.3

- A new standard required by the Consumer Financial Protection Bureau as of April 16, 2018, may increase borrowers' FICO Scores as much as 30 points.4

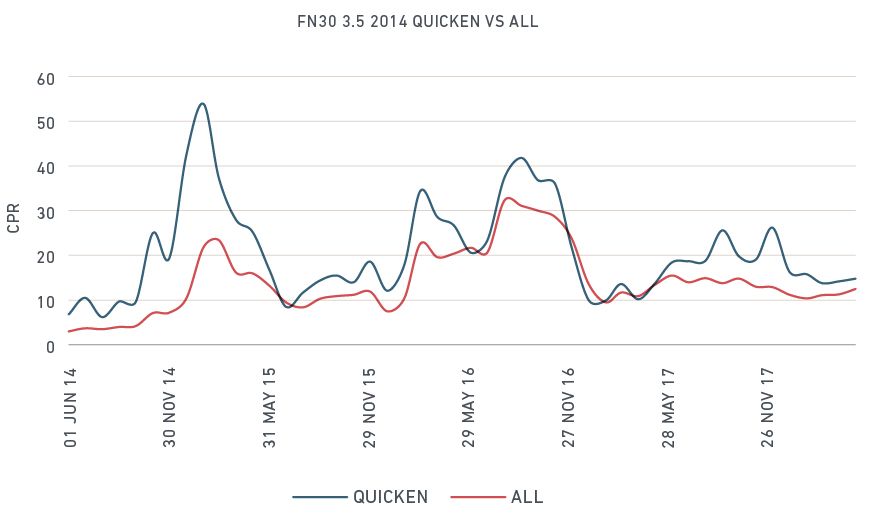

Quicken's refinance rates appear to have been reined in

Source: Fannie Mae, MSCI

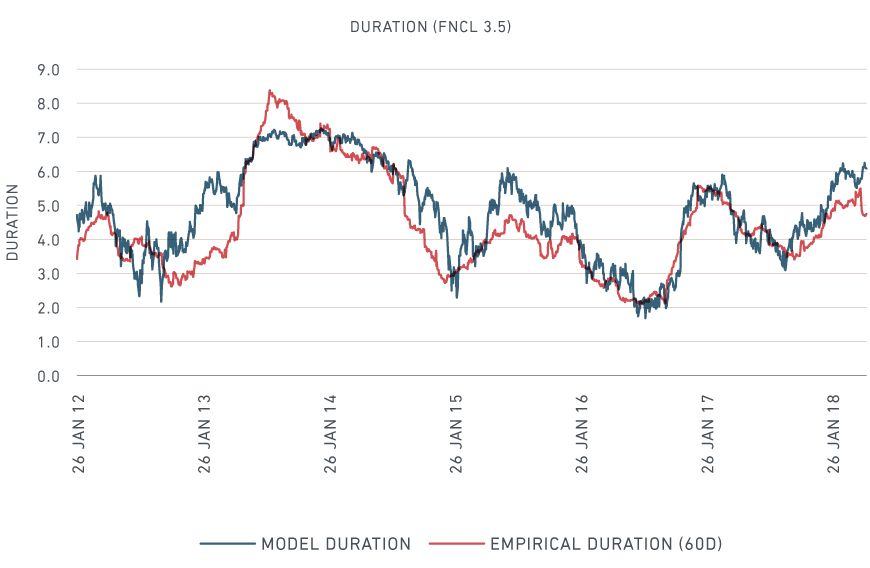

MSCI MODEL ASSUMPTIONS HISTORICALLY HAVE BEEN IN LINE WITH MARKET EXPECTATIONS

Given the uncertainties around future refinance regimes, we back tested our MSCI prepayment models by comparing the model durations with empirical durations that reflect the actual price dynamics of the MBS market historically.

While not indicative of future performance, looking at the exhibit below, we see that the MSCI models have been generally consistent with actual market pricing dynamics, with two exceptions:7

- Positive OAS directionality during the "taper tantrum" in 2013, when empirical durations were generally longer than model durations due to Fed's QE program

- Negative OAS directionality during the "refinance scare" episodes of 2012 and 2014, when empirical durations were generally shorter than model durations

MSCI Agency Prepayment Model duration vs. market expectations

Our models indicate mild credit loosening going forward and future refinance intensity generally in line with recent performance, as opposed to the high-cresting refinance wave of 2003. The FHFA's UMBS program could exert further constraints on large refinance surprises. However, MBS investors may want to watch the trend toward looser mortgage credit which could potentially lead to a refinance regime with greater intensity.

1 The prevailing rate needs to be roughly 40 basis points (bps) lower than existing mortgage's rate for the homeowner to gain a tangible economic benefit. As of Oct. 11, 2018, the Freddie Mac survey showed the prevailing 30-year-fixed mortgage rate for new mortgages was 4.9%. The average 30-year-fixed mortgage rate for outstanding mortgages was 4.3%.

2 Yu, Y. (2018). "MSCI agency fixed rate refinance prepayment model." MSCI Model Insight. (client access only)

3 Federal Housing Finance Agency. "FHFA Announces Decision to Stop Credit Score Initiative." July 23, 2018

4 Consumer Financial Protection Bureau. (2017). "Supervisory Highlights Consumer Reporting Special Edition."

5 Federal Housing Finance Agency. "FHFA Issues New Prepayment Monitoring Report" March 28, 2018

6 Reindl, JC. "How Quicken Loans passed up Wells Fargo to become nation's top mortgage lender." USA Today, June 1, 2018.

7 Zhang, D. and P. Zangari. (2017). "Getting Ahead of the Curve." MSCI Research Insight.

Further Reading

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.