Leveraging Governance to Improve Net-Zero Engagement

- Companies' governance practices can have a significant impact on how — and how effectively — investors engage with climate laggards to push for better net-zero alignment.

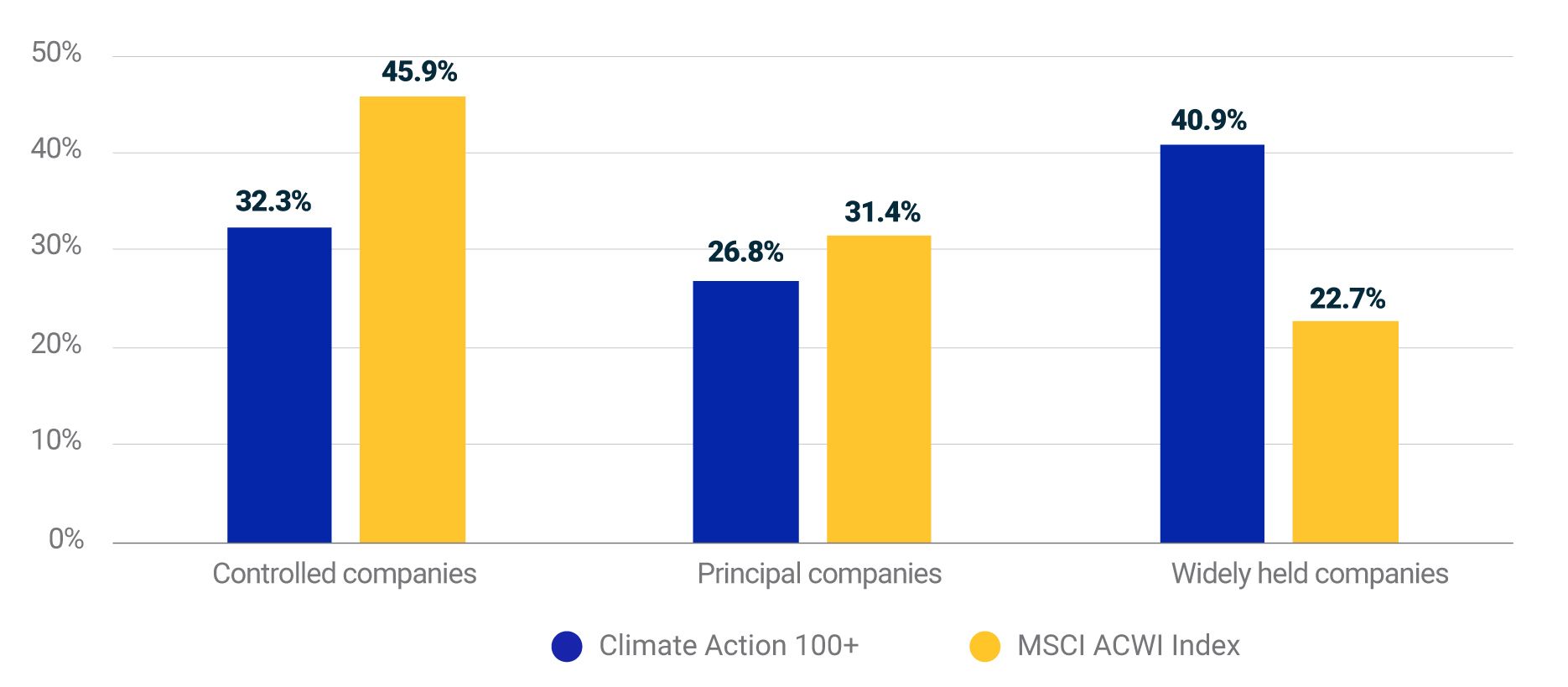

- The Climate Action 100+ engagement focus companies had a higher proportion of widely held companies than the MSCI ACWI Index, but most companies in the focus group nevertheless have a controlling or principal owner that could reduce engagement's effectiveness.

- Only 20% of the Climate Action 100+ focus companies have annual director elections with binding majority voting. For the rest, investors' ability to hold directors accountable for climate performance may be weaker.

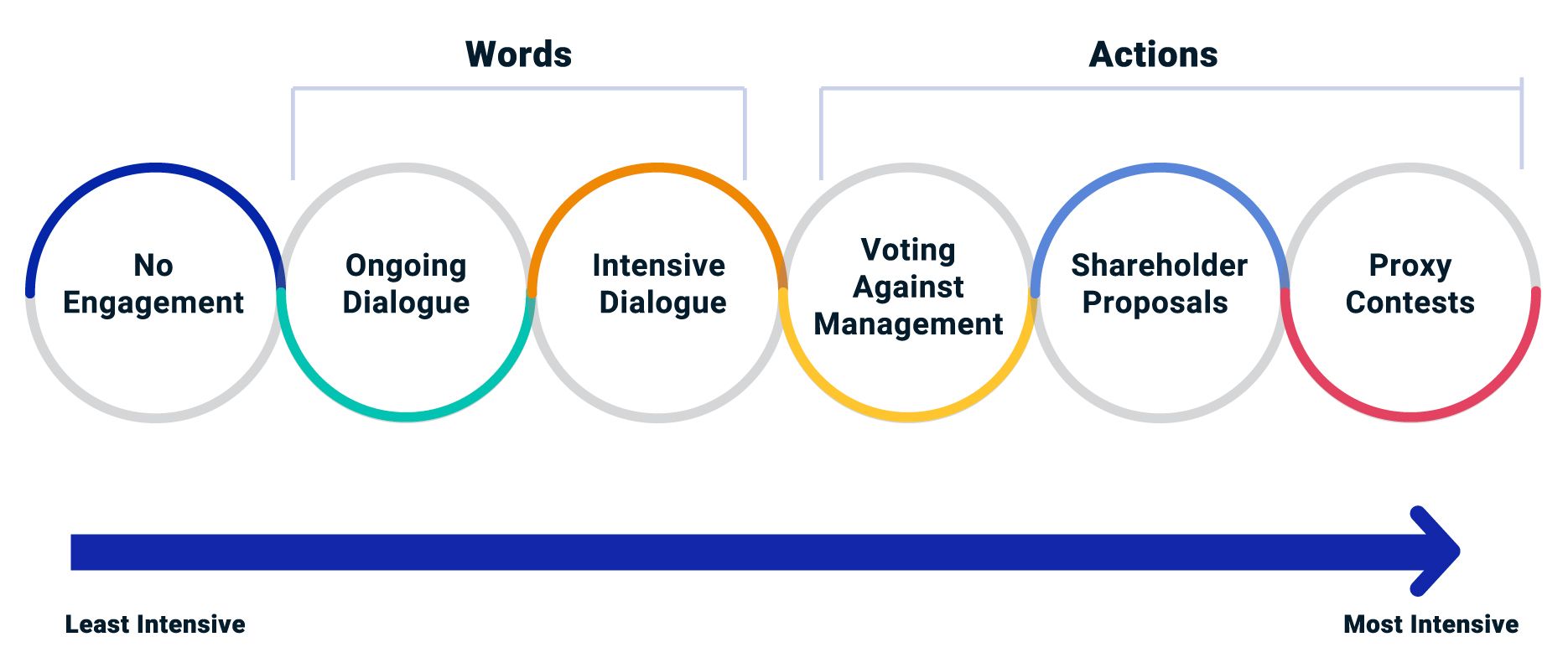

Mechanisms for investor engagement

Source: MSCI ESG Research LLC.

The investor-led initiative Climate Action 100+ has targeted 166 companies for engagement due to their globally significant GHG emissions and strategic importance to the global carbon transition.1 We analyzed the governance practices of these focus-group companies to understand the engagement challenges and opportunities investors may face when pushing for decarbonization pathways aligned with portfolio targets.2

The exhibit below looks at the frequency among the Climate Action 100+ companies of five governance factors that can have an impact on the effectiveness of investor engagement.

Corporate governance at Climate Action 100+ focus companies

Loading chart...

Please wait.

Source: Climate Action 100+, MSCI ESG Research.

In the remainder of this post, we discuss how governance factors can influence engagement.

Ownership, control and engagement

Understanding a company's ownership structure is key to understanding its broader governance framework. One important dimension is the company's level of control. We classify companies as being:

- Widely held: No shareholder controls more than 10% of votes.

- Principal: The largest shareholder or bloc controls 10% to 30% of votes.

- Controlled: The largest shareholder or bloc controls 30% or more of votes.

Ownership classification of Climate Action 100+ companies by region

As of Sept. 8, 2022. Source: Climate Action 100+, MSCI ESG Research.

Widespread ownership may benefit investors. Formal engagement mechanisms — for example, voting against a management proposal or submitting a shareholder proposal — are more likely to succeed when there is no large, insider-aligned voting bloc ready to quash a challenge from other investors. If ownership is highly dispersed among many investors, however, shareholders may struggle to overcome inertia and marshal enough votes to challenge the status quo.

For controlled companies — and principal companies, where the largest owner is insider-aligned — formal engagement mechanisms are less likely to succeed. For the nearly 60% of Climate Action 100+ companies that are controlled or principal-owned, investors may need to focus on dialogue to effect change on climate. This is especially true for companies that deviate from a "one-share, one-vote" capital structure, as minority investors may find their influence reduced at the expense of a major shareholder.

Dialogue can be escalated by bringing private conversations into the public forum — for example, by publishing an open letter or speaking at the company's annual general meeting. And, even when they fail, formal engagement mechanisms that win significant support from minority investors can send a powerful message and potentially lead to reputational costs for companies.3

Holding boards accountable

Opposing a director's reelection is a powerful way to express concern about a company's net-zero ambitions, but investors may wish to consider their vote's potential impact — or lack thereof.

We put director-election regimes into three categories:

- Plurality voting: The directors who receive the most votes will be elected. This means all nominees are guaranteed to be elected in an uncontested election.

- Plurality voting with resignation policy: A plurality election, but directors must resign if they don't get majority support (the board can usually choose to reject the resignation and keep the director).

- Majority voting: Directors are elected only if they get majority support. Directors who do not receive majority support will automatically leave the board.

Strengthening net-zero strategies

Ownership structures and election regimes for board members are just two of the governance factors we discuss in our paper on net-zero engagement. Other factors that can influence engagement success include how potential engagement targets are identified and prioritized, how climate performance is evaluated, the identities of key owners and the voting options available to shareholders. Bigger picture, the question for investors is whether they are willing to engage with high-carbon-emitting companies and, if so, what tools they're prepared to use.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1“Companies.” Climate Action 100+.2All analysis in this blog post used our latest available data and research as of Sept. 8, 2022. Our analysis included 164 of the 166 total Climate Action 100+ focus-group companies, excluding one company that had been acquired and one that was not in MSCI ESG Ratings coverage.3Kastiel, Kobi. 2016. “Against All Odds: Hedge Fund Activism in Controlled Companies.” Columbia Business Law Review 2016(1): 60-153.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.