Looking inside ESG indexes

Blog post

August 30, 2019

- ESG investments often intertwine values-based and financial considerations.

- Values-based ESG screens are a portfolio constraint that have historically led to more concentrated portfolios with slightly higher levels of risk.

- Integrating ESG screens with ESG considerations showed risk reduction during our study period.

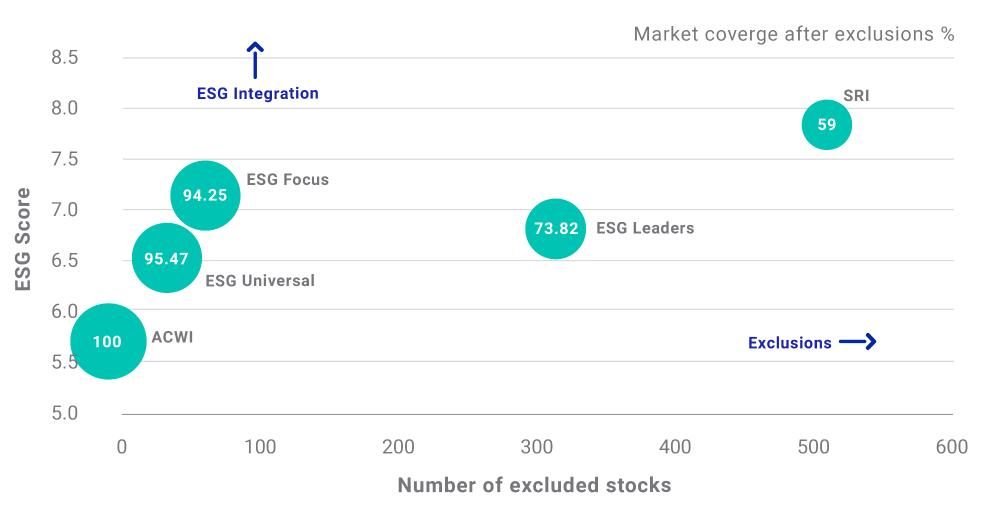

- Limited exclusions plus ESG weight tilt. The MSCI ACWI ESG Universal Index applies limited exclusions (red-flag controversies and controversial weapons) and tilts weights toward companies with higher and improving ESG quality. It uses a straightforward mechanism to determine stock weights.

- Limited exclusions plus maximized ESG quality. The MSCI ACWI ESG Focus Index applies basic exclusions6 and then uses an optimizer to maximize the ESG quality under strict tracking error and sector deviation constraints.

- Greater exclusions plus best-in-class stock selection. The MSCI ACWI ESG Leaders Index and MSCI ACWI SRI Indexes apply more extensive exclusions and then perform a best-in-class selection of the highest MSCI ESG-rated companies (the best 50% and 25%, respectively). These indexes are narrower than the others with a broad set of exclusions and high criteria for ESG quality.

ESG quality of constituents vs. number of exclusions (MSCI ACWI Index)

As of Dec. 31, 2018, MSCI ACWI Index re-balancing. Bubble sizes represent market coverage after exclusions but before MSCI ESG Ratings were applied.

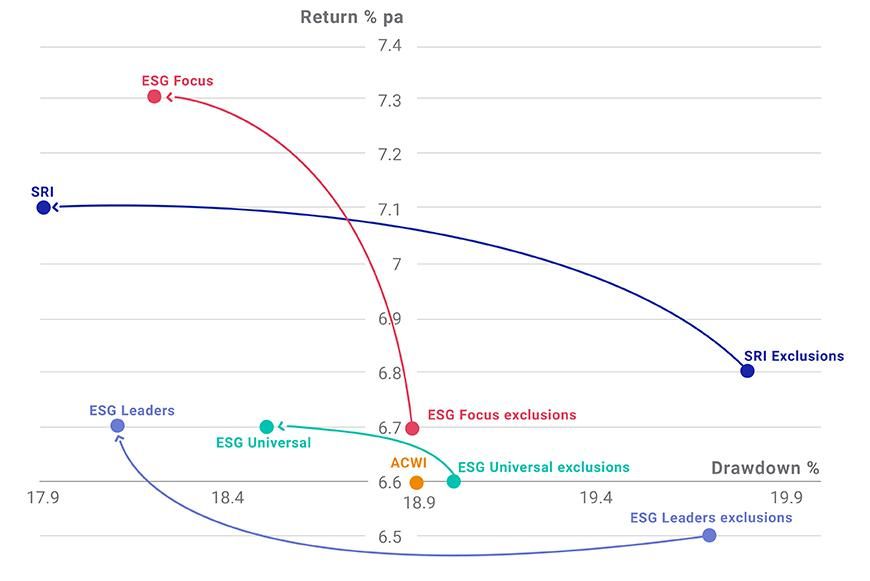

Each of these ESG indexes follows a two-step methodology: The first step applies exclusions to the underlying index ("values"), while the second step integrates MSCI ESG Ratings into the index. Thus, we can break out the separate investment impacts of the two. We analyzed the risk and return implications of applying the index-specific exclusionary screens only (step 1) and then the risk-return characteristics of the combined methodology (step 1 + step 2) from May 31, 2013 through Dec. 31, 2018.

How integrating ESG with exclusions affected risk and return

Looking at exclusions alone for these four indexes (before ESG considerations are applied), the risk of each approach exceeded that of the MSCI ACWI Index during the study period, generally in line with the extent of exclusions except for ESG Focus exclusions, which showed the same level of risk as the benchmark after step 1.

In contrast, integrating financially focused ESG considerations (in the form of the MSCI ESG Ratings) had a positive impact on both risk-and-return characteristics of all four indexes. Integration led to improved risk-adjusted returns, with slightly higher returns and lower levels of risk than the MSCI ACWI Index during our study period.

Overall, we found that integrating ESG considerations outweighed the effects of the exclusions on our four indexes.

1 Giese, G., Lee, L..-E., Melas, D., Nagy, Z., and Nishikawa, L. 2019. "Foundations of ESG Investing: How ESG Affects Equity Valuation, Risk and Performance." Journal of Portfolio Management, July 2019.

2 Asness, C. "Virtue Is Its Own Reward: Or, One Man's Ceiling Is Another Man's Floor." AQR, May 18, 2017.

3 Values-based exclusion may have resulted in outperformance in some situations. For example, alternative energy companies have outperformed coal-based utilities in recent years (from Dec. 31, 2008, to Dec. 31, 2018], so the exclusion of the latter has helped investors during that period. However, these typically have been unsystematic one-off effects.

4 Giese, G., Lee, L..-E., Melas, D., Nagy, Z., and Nishikawa, L. 2019. "Foundations of ESG Investing: How ESG Affects Equity Valuation, Risk and Performance." Journal of Portfolio Management, July 2019.

5 This the longest period for which live track records are available for MSCI ACWI ESG Leaders and MSCI ACWI SRI. MSCI ACWI ESG Focus and MSCI ACWI ESG Universal were launched on Aug. 11, 2016 and Feb. 8, 2017, respectively. For the time period before the launch, backtested index data was used for the purpose of this study. This report contains analysis of historical data, which includes hypothetical, backtested or simulated performance results. There are frequently material differences between backtested or simulated performance results and actual results subsequently achieved by any investment strategy. Past performance — whether actual, backtested or simulated — is no indication or guarantee of future performance. None of the information or analysis herein is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision or asset allocation and should not be relied on as such.

6 The MSCI ACWI ESG Focus Index excludes red flag controversies, controversial weapons and tobacco producers.

Further Reading

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.