Looking to the futures of emerging markets

Blog post

December 11, 2019

- Emerging markets (EM) have delivered unique risk and return characteristics over the last 30 years but have recently faced a backdrop of changes in monetary policy, increased political uncertainty and concerns around international trade agreements.

- A hypothetical exposure-management strategy for EM using a handful of local, country-by-country futures contracts had a high level of tracking risk stemming from country and currency risk.

- EM futures' liquidity has grown significantly and may be a consideration in managing EM exposure during normal and stressed times.

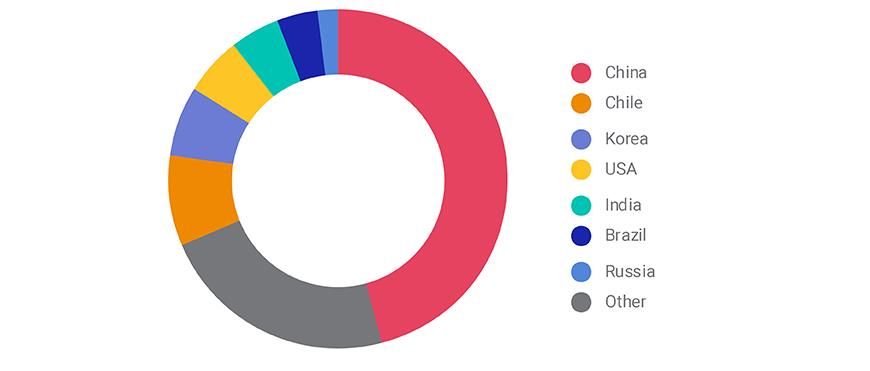

Economic exposure to EM

Revenue exposure of the MSCI Emerging Markets Index as of Oct. 31, 2019.

These eggs don't fit in one basket

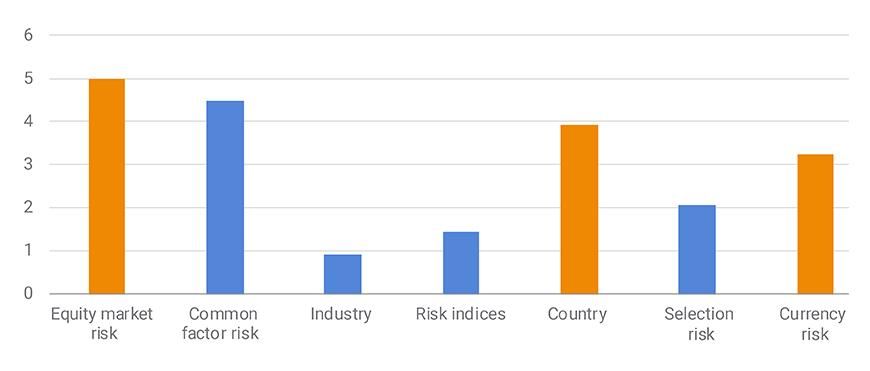

Due to the lack of liquidity in fully replicating indexes linked to EM, one common approach for investors looking to access emerging markets as a whole or hedge out EM risk was through a basket of liquid local futures contracts. For illustration purposes, we used the MSCI Emerging Markets Long-term Risk Model to create a hypothetical optimized basket of the largest EM country markets (represented by indexes here, with no embedded currency exposure) to track the MSCI Emerging Markets Index (100% currency-unhedged index).

EM benchmark replication using a proxy basket of market exposures

Data as of Oct. 31, 2019. Residual risk of an optimized basket represented by the MSCI China A 50 Index, MSCI India Index, MSCI Russia Index, MSCI Brazil Index, MSCI Korea Index and MSCI Thailand Index.

As shown in the exhibit above, this approach introduced significant residual risk to currencies as well as countries, particularly during times of market stress. We found the ex-ante equity-market risk was almost 5.0%, while the currency risk was 3.3% and country risk nearly 4%. It may have been possible to reduce the equity risk further through exposure to various other countries, but investors may have faced liquidity issues sourcing futures to smaller markets. And institutional investors may not always consider other instruments — such as ETFs or swaps — as suitable, due to (borrowing) cost, funding requirements, regulations, time horizon or other considerations.

Liquidity and volatility in EM

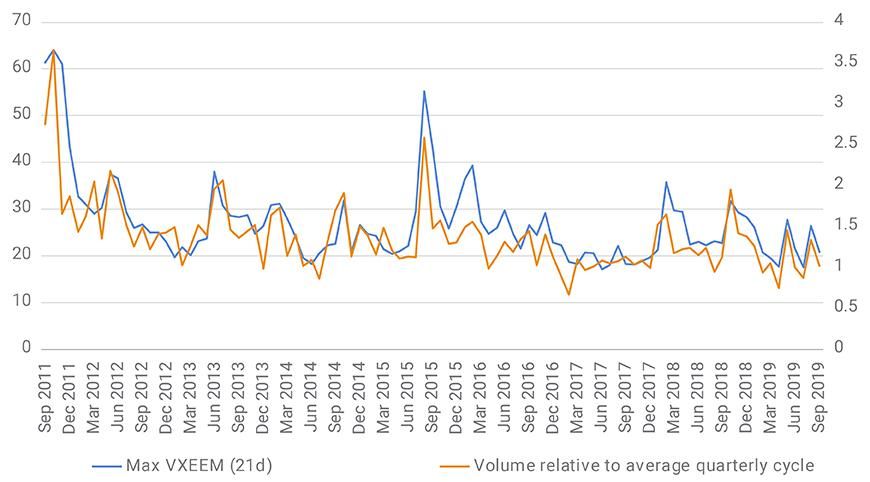

As we've seen, there is a balance between sourcing liquidity and working to meet portfolio objectives. This may be especially true during times of market volatility. We examined whether using futures contracts linked to the MSCI Emerging Markets Index,2 may have taken unintended risk bets out of the equation and provided access to greater liquidity.

Liquidity of futures linked to the MSCI Emerging Markets Index has risen

Source: CQG.

To further examine the link between EM volatility and liquidity, we ran a short study (with data from June 11, 2011, to June 11, 2019) looking at the empirical relationship between EM futures trading volume relative to recent history and EM implied volatility, as measured by the Cboe Emerging Markets ETF Volatility Index (VXEEM).3 In the exhibit below, we plot:

- The maximum level of the VXEEM, to capture intra-month market events

- The monthly aggregate EM futures volume less the previous three-month average futures volume, to remove growth trend and seasonality of futures activity

Liquidity rose with volatility

Source: Cboe Global Markets, CQG

Futures liquidity is a critical component of the global financial market's ecosystem, and a lack of liquidity in EM futures led some investors to use a basket of liquid local contracts — which introduced a high level of tracking risk stemming from country and currency risk. More recently, EM futures' liquidity has grown and may be a consideration in managing EM exposure during both normal and stressed times.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1Melas, D. 2019. “The future of emerging markets: 30 years on from the launch of the MSCI Emerging Markets Index.” MSCI Research Insight.2As of the end of November 2019, the futures linked to the undhedged MSCI Emerging Markets Index had exposure to 26 countries and currencies. The open interest in EM futures rose to 1.5 million contracts, from 1.3 million contracts in November 2018, representing around USD 79 billion of notional amount outstanding.3From an exchange-traded perspective, funded instruments such as ETFs have been a natural choice for investors to manage EM exposure, given their higher levels of liquidity.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.