Quantifying ESG fund performance

Blog post

April 6, 2020

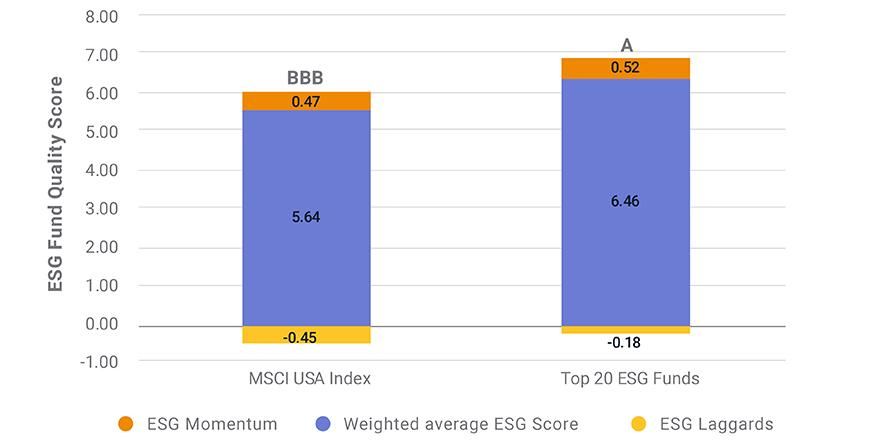

- We find that a group of 20 ESG funds had higher MSCI ESG Fund Ratings than the MSCI USA Index as these funds included fewer stocks classified as ESG laggards.

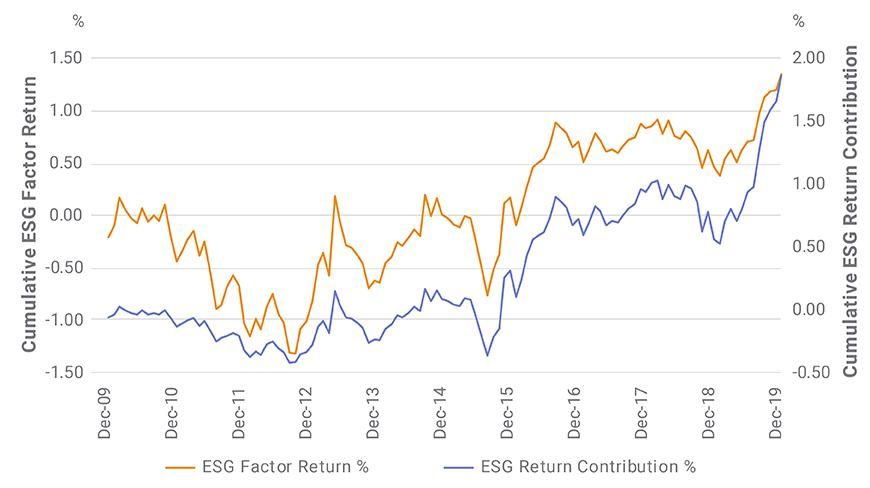

- From December 2009 to December 2019, the ESG factor cumulatively contributed 1.88% to the top 20 ESG funds' returns, with more than 80% of that return occurring in the last four years of the study period.

- Investors who want to evaluate ESG's impact on risk and return can use a risk model that integrates ESG.

Top 20 ESG funds held fewer laggards

From the exhibit above, we see that the top 20 ESG funds had a higher weighted average ESG score of 6.46 than the MSCI USA Index score of 5.64. The ESG fund score can help investors understand the make-up of their ESG funds.2 This is an additional tool investors can use to look beneath the hood of these funds. ESG momentum — which measures net increase or decrease in stock-level ratings — is an important element of the score. While both the MSCI USA Index and top 20 ESG funds benefitted from ESG momentum due to including companies whose ESG ratings have increased year-over-year, the MSCI USA Index included relatively more ESG Laggards3 than the top 20 ESG funds, resulting in a lower ESG score. Overall, the MSCI USA Index received a BBB rating while the top 20 ESG funds which received an A rating.

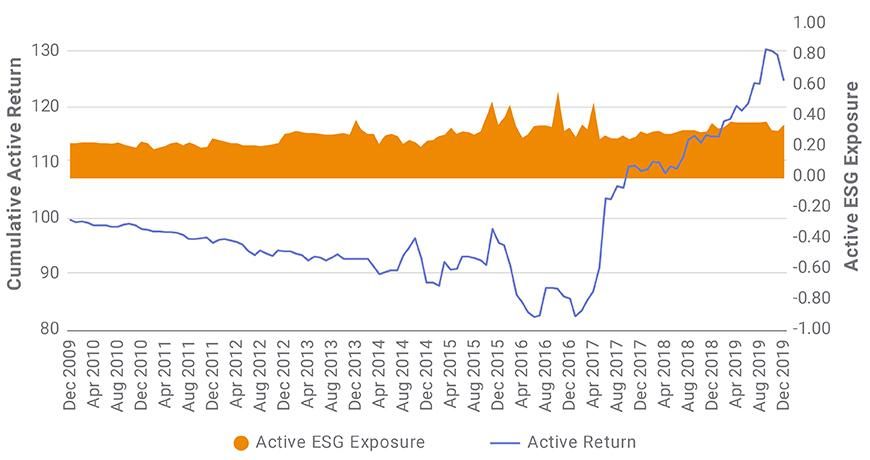

We then evaluated if the top 20 ESG funds provided additional return over time. As the exhibit below shows, the top 20 ESG funds had an average active ESG exposure of 0.30 which can be considered a meaningful exposure to ESG.4 Over the 10-year period ended December 2019, these funds outperformed the MSCI USA Index by 0.78% on an annualized basis. This return premium was especially pronounced since 2017.

Top 20 ESG funds' active return and exposure to ESG

This leads us to our original question: How much has ESG contributed to the return of these ESG funds? To quantify the contribution from ESG, we used a global equity factor model that includes ESG as a factor.

ESG contributed to top 20 ESG fund returns over the last four years

Over the entire analysis period from December 2009 to December 2019, ESG had a cumulative return contribution of 1.88%. Most of this return came during the last four years. From 2015 to 2019, ESG returned 1.55% which corresponds to the improved performance of ESG in the risk model as seen in the exhibit above. This may have been due to greater awareness and/or adoption of ESG investing.5

Examining the top 20 ESG funds gives us insight into recent contribution of ESG to fund performance and helps us measure ESG's impact. Quantifying risk and return directly attributable to ESG will help investors measure the impact of ESG considerations as part of the investment process.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1The MSCI ESG Fund Rating is equal to the weighted average ESG score of a fund’s holdings plus ESG momentum (the fund’s net exposure to holdings with improving versus worsening ESG ratings) less ESG tail risk (the fund’s exposure to holdings with CCC and B ESG ratings).2Please see the executive summary of the MSCI ESG Fund Ratings Methodology for further details.3ESG Laggards are stocks rated as B or CCC or with ESG score or 0.0 to 2.9. Please see the MSCI ESG Ratings Methodology for further details.4Bonne, G., Roisenberg, L., Subramanian, R., and Melas, D. 2018. “Introducing MSCI FaCS: A New Factor Classification Standard for Equity Portfolios” MSCI Research Insight.5Kotsantonis, S., Pinney C., and Serafeim, G. 2016. ”ESG Integration in Investment Management: Myths and Realities.” 28.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.