Real Estate Asset Selection Mattered — Especially in a Crisis

Blog post

May 14, 2020

- Analyzing 94 actual portfolios from 2008 and 2019, we find asset selection accounted for anywhere between 60% and 78% of tracking error between portfolios and benchmarks over any given year.

- During past market disruptions, such as the 2008 global financial crisis, variation in both allocation and selection increased, but the increase for selection was more pronounced.

- With the COVID-19 pandemic causing unprecedented disruption, attribution analysis may be a useful tool for helping investors understand and explain what drove returns in their real estate portfolios.

Attributing Relative Portfolio Performance

Asset-level attribution analysis can help investors understand the reasons for a portfolio's outperformance or underperformance versus an index. It breaks down the relative return into structure- and property-specific scores, allowing the influences of submarket allocations and asset selection to be distinguished.

Specifically, attribution analysis distinguishes that part of the relative return derived from the portfolio's weightings in strong or weak sectors of the market (allocation), from that part derived from the performance of the assets in the portfolio within each segment of the market (selection).

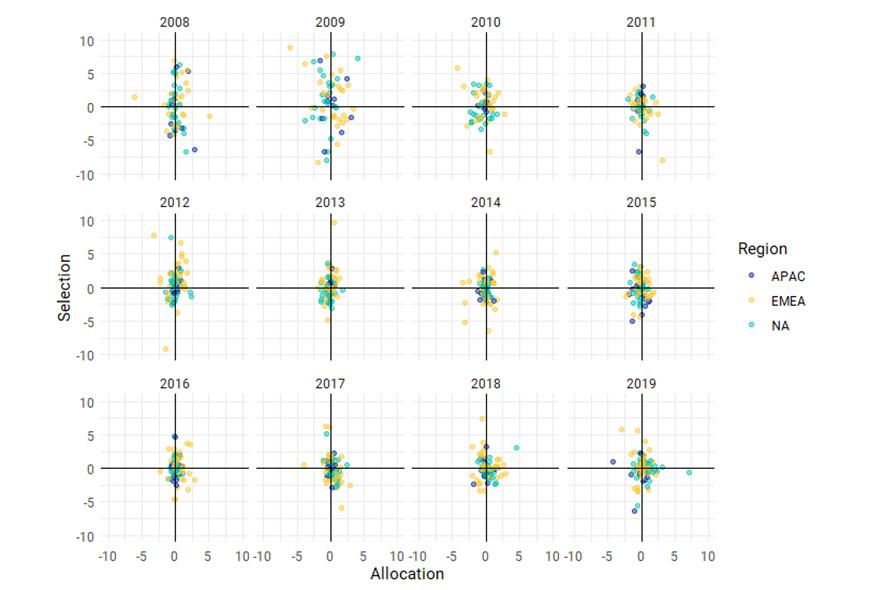

Using data from 94 real portfolios we explored how allocation and selection scores contributed to relative returns between 2008 and 2019. Over the entire analysis period, selection accounted for 70% of the annual tracking error between portfolios and benchmarks, with its contribution ranging from a low of 60% in 2018 to a high of 78% in 2016.

Selection Accounted for 60% to 78% of Observed Tracking Error in Any Given Year

During periods of market stress like the 2008 global financial crisis, as the spread in relative returns between portfolios increased, we observed more variation in both allocation and selection scores. However, the increase tended to be greater for selection, meaning that it tended to account for more tracking error in these years.

Why the Lower Contribution from Allocation?

One potential explanation for the lower contribution we observed from allocation could be that real portfolios are built and managed while referencing benchmark weightings that may constrain the allocation scores. Another explanation may lie in the construction of benchmark segmentations themselves. Traditionally, segmentations have been built along property type and geography lines, but underlying these groupings may be additional systematic drivers of return that could be used to construct alternative segmentations, which, if implemented, could potentially increase how much tracking error is explained by allocation.

Putting Portfolios into a Broader Market Context

As strategies become more sophisticated and investors demand more insight into the drivers of risk and return in their portfolios, attribution analysis may provide valuable insights. Our analysis showed that asset selection played an important role in driving the relative returns of real estate portfolios from 2008 to 2019, particularly during periods of disruption. With the COVID-19 pandemic causing unprecedented disruption, attribution analysis may be a useful tool for understanding and communicating the idiosyncratic aspects of portfolios.

Further Reading

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.