Rethinking EM Equity Investing as EM ex-China and China Diverge

Key findings

- Global economic divergence and rising geopolitical risks are re-shaping how asset owners and asset managers are assessing opportunities in emerging markets (EM).

- The low factor-return correlations between China and EM excluding China (ex-China) highlights why many investors are considering a split-market framework for allocating capital to EM.

- A factor-risk model with this split embedded in its design has provided clearer insights into the risk-return drivers over the last 30 years, which in turn could lead to more resilient EM portfolios.

Sizing and allocating to EM equities requires a careful balance between capturing the long-term growth potential and navigating the often complex landscape of political, economic and currency risk. As global economic divergence persists, more asset owners and asset managers are addressing the increasing heterogeneity within EM directly by carving out China from broad EM benchmark allocations. This split is actionable because of China's economic scale and its particular policy- and retail-driven market dynamics. In this blog post, we explore the empirical rationale for such a framework and its implications for portfolio analysis and construction and compare it to the traditional holistic EM approach.

Performance and risk divergence: China vs. EM ex-China

Although China and EM ex-China generated similar cumulative returns between 2011 and 2024, their trajectories over the last decade have been quite different. China's equity markets benefitted in the 2010s from tech-sector growth and market liberalization reforms, but its performance since 2021 has lagged amid regulatory crackdowns, property-sector stress and geopolitical frictions. In contrast, key EM ex-China markets — India, Brazil and some Southeast Asian countries — have exhibited positive momentum since 2021, driven by global supply-chain reshuffling and commodity tailwinds. The MSCI China Index has declined 10% annualized while the MSCI EM ex-China Index rose 3% annualized from 2021 to the end of 2024, in USD.

Trends in the correlation of returns underscore this divergence and are indicative of a potential structural shift in China's market drivers compared to those of EM ex-China. Before 2021, China and EM ex-China exhibited moderately high positive correlation of returns. After the COVID-19 pandemic, however, the correlation dropped to 26% in October 2024 and has recently been hovering around 35%.

Rolling 12-month correlation between MSCI China index and MSCI EM ex-China index

Based on weekly gross total returns in USD.

Growth in the style-factor opportunity set

A closer look at factor behavior reveals even greater differences between China and EM ex-China. Using the latest MSCI Emerging Markets Equity Factor Model (EMEFMLT), which segments style and industry factors separately for China and EM ex-China, we observed that key style factors also exhibited very low cross-region return correlations. Beta and momentum factors, the strongest style factors by return volatility in the EM model, exhibited less than half the correlation compared to the USA and European market models.

Style-factor correlation

Period: September 2004 to January 2025, using daily factor returns, except carbon efficiency and ESG which started from July 2020 and June 2018, respectively. Europe and USA factor correlation were calculated based on daily factor returns from the MSCI USA Equity Factor Model (EFMUSALT) and the MSCI Europe Equity Factor Model (EUREFMLT).

Understanding EM value performance with a split-market lens

We conducted a risk exposure and factor-performance attribution exercise on a simulated EM value index made up of 70% MSCI EM ex-China Value index and 30% MSCI China Enhanced Value index, using both the single-market Barra Emerging Markets Equity Factor Model (EMM1) and the new split-market MSCI EMEFMLT.

Both models confirmed the strategy's core and intuitive exposures: strong active loadings to value, elevated investment quality and negative tilts to profitability relative to the MSCI Emerging Markets Index. Additionally, the new split-market EM model identified a positive active exposure to the China SOE (state-owned enterprise) factor, reflecting a tilt toward China's likely most policy-sensitive sectors.

Active style-factor exposures of a blended EM value strategy

As of January 2025. Exposures shown as standard deviation terms.

The new EM model also provided more insight into performance attribution. For example, the granularity and regional split of the contributions of value and quality. In addition, the unexplained (specific) contribution was significantly reduced in the decomposition of active returns with the new split-market model.

Active performance attribution of a blended EM strategy

Period: August 2019 to January 2025.

Portfolio construction for a minimum-volatility strategy

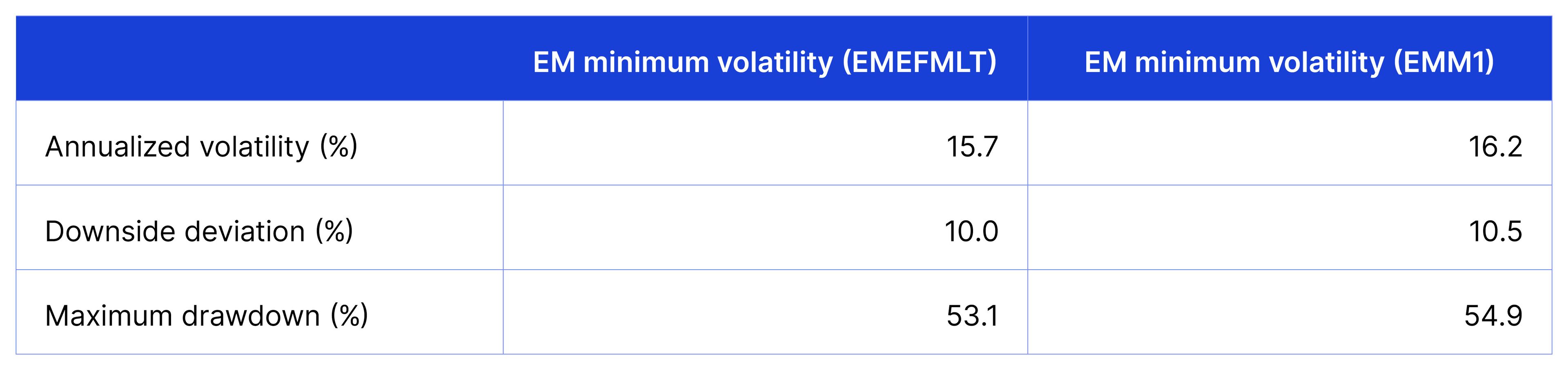

To help assess the impact of the split-market risk-model estimation framework, we simulated minimum-volatility strategies based on the old (EMM1) and new (EMEFMLT) models.[1] Over the 20-year simulation period, the EMEFMLT-based portfolio consistently exhibited lower realized total risk and a smaller maximum drawdown than the EMM1-based portfolio. The three-year rolling volatility was also consistently lower than that in the EMM1-based strategy, especially during periods of region-specific stress, such as China's stock market crash in 2015, the concurrent currency crises in Turkey, South Africa, Indonesia and Argentina in 2018 and the 2018-2020 U.S.-China trade war.

Risk-return profile of simulated minimum-volatility strategies

Period: May 2003 to August 2024.

The split-market structure EMEFMLT model incorporates multiple enhancements and, in particular, is able to isolate China's idiosyncratic risk. This exercise does not dismiss more traditional models but does highlight a trend: as China and EM ex-China diverge, portfolios that seek to account for their distinct risk characteristics may achieve more robust outcomes with the new split-market model.

Adapting to a bifurcated emerging-market environment

The question remains whether the level of divergence we have illustrated between China and EM ex-China is cyclical or structural. For now, however, the Chinese domestic equity market, shaped by centralized policy and geopolitical tensions, continues to operate in a different risk regime than EM ex-China markets, as it has for the last five years. Whether the investor focus is portfolio analysis, performance attribution or portfolio construction, we have illustrated the potential benefits of a split-market factor framework and what it can bring to support investor decision-making in EM.

Subscribe todayto have insights delivered to your inbox.

1 All constraints and objectives were taken from the MSCI Minimum Volatility Index methodology but with the indicated change in the risk model used in the optimization.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.