Stress testing US-China trade wars

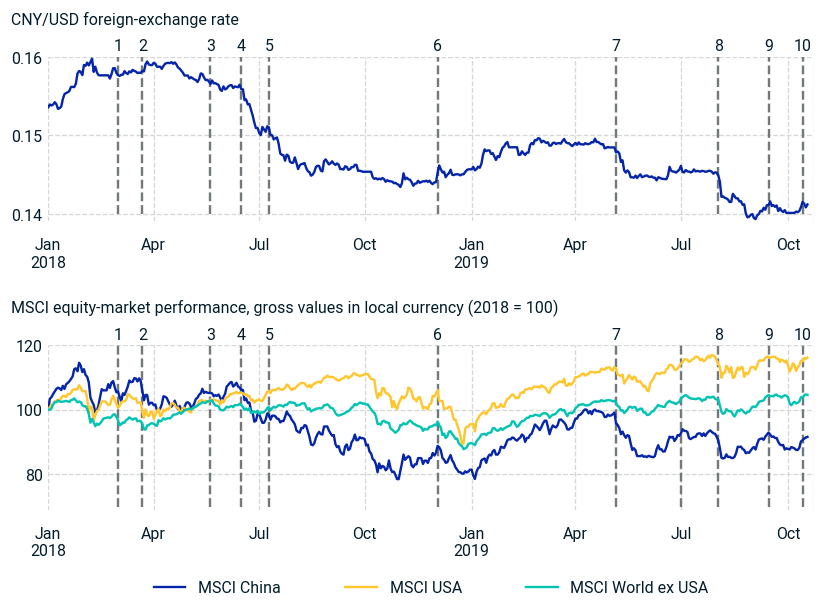

- Considering recent developments in the U.S.-China trade talks, we proposed three stress-test scenarios to assess how this evolving story could impact financial markets.

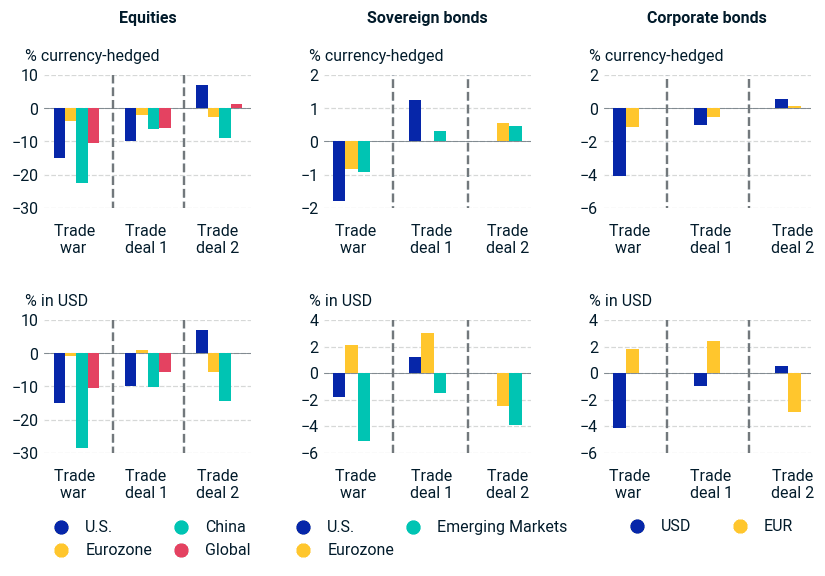

- In one stress-test scenario, an escalation in the trade war could weaken the yuan by another 8% and cause 25% and 15% losses in the Chinese and U.S. equity markets, respectively.

- In both scenarios where China and the U.S. agree on a trade deal and reduce the bilateral trade deficit, sovereign bonds could moderately gain. For other asset classes, it would depend on the details.

Applied shocks | Trade war | Trade deal 1: Reduction on Chinese exports to US | Trade deal 2: Increasing Chinese purchases of US goods |

|---|---|---|---|

Applied shocks Equity predictive stress test Relative shocks | Trade war Equity predictive stress test Relative shocks | Trade deal 1: Reduction on Chinese exports to US Equity predictive stress test Relative shocks | Trade deal 2: Increasing Chinese purchases of US goods Equity predictive stress test Relative shocks |

Applied shocks U.S. equity | Trade war -15% | Trade deal 1: Reduction on Chinese exports to US -10% | Trade deal 2: Increasing Chinese purchases of US goods +7% |

Applied shocks China equity | Trade war -25% | Trade deal 1: Reduction on Chinese exports to US -7% | Trade deal 2: Increasing Chinese purchases of US goods -10% |

Applied shocks DM ex U.S. equity | Trade war -4% | Trade deal 1: Reduction on Chinese exports to US -2% | Trade deal 2: Increasing Chinese purchases of US goods -3% |

Applied shocks Interest-rate predictive stress test Absolute shocks in basis points | Trade war Interest-rate predictive stress test Absolute shocks in basis points | Trade deal 1: Reduction on Chinese exports to US Interest-rate predictive stress test Absolute shocks in basis points | Trade deal 2: Increasing Chinese purchases of US goods Interest-rate predictive stress test Absolute shocks in basis points |

Applied shocks USD 10-year govt. | Trade war +30 bps | Trade deal 1: Reduction on Chinese exports to US -20 bps | Trade deal 2: Increasing Chinese purchases of US goods 0 bps |

Applied shocks CNY 10-year govt. | Trade war +30 bps | Trade deal 1: Reduction on Chinese exports to US -10 bps | Trade deal 2: Increasing Chinese purchases of US goods -15 bps |

Applied shocks EUR 10-year govt. | Trade war +15 bps | Trade deal 1: Reduction on Chinese exports to US 0 bps | Trade deal 2: Increasing Chinese purchases of US goods -10 bps |

Applied shocks Credit stress test Relative shocks | Trade war Credit stress test Relative shocks | Trade deal 1: Reduction on Chinese exports to US Credit stress test Relative shocks | Trade deal 2: Increasing Chinese purchases of US goods Credit stress test Relative shocks |

Applied shocks U.S. credit spreads | Trade war +30% | Trade deal 1: Reduction on Chinese exports to US +30% | Trade deal 2: Increasing Chinese purchases of US goods -7% |

Applied shocks EM credit spreads | Trade war +45% | Trade deal 1: Reduction on Chinese exports to US +20% | Trade deal 2: Increasing Chinese purchases of US goods +15% |

Applied shocks DM ex U.S. credit spreads | Trade war +12% | Trade deal 1: Reduction on Chinese exports to US +12% | Trade deal 2: Increasing Chinese purchases of US goods +7% |

Applied shocks Currency predictive stress test Relative shocks | Trade war Currency predictive stress test Relative shocks | Trade deal 1: Reduction on Chinese exports to US Currency predictive stress test Relative shocks | Trade deal 2: Increasing Chinese purchases of US goods Currency predictive stress test Relative shocks |

Applied shocks CNY/USD | Trade war -8% | Trade deal 1: Reduction on Chinese exports to US -4% | Trade deal 2: Increasing Chinese purchases of US goods -6% |

Applied shocks EUR/USD | Trade war +3% | Trade deal 1: Reduction on Chinese exports to US +3% | Trade deal 2: Increasing Chinese purchases of US goods -3% |

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.