The Cornerstones of Benchmarking Private Capital

Key findings

- Benchmarking and indexes are important tools for investors navigating private markets, a significant but relatively opaque investment ecosystem.

- Performance benchmarks that are designed to help assess the returns of a portfolio relative to a broader universe of comparable private capital can be used to determine allocation effects as well as manager selection skill.

- Data is the foundation for creating private-capital indexes, but several other layers such as enrichment and governance are critical and should be considered best practice.

Private capital is a large and rapidly growing, but still relatively opaque asset class.[1] It forms an important part of the portfolios of many institutional investors and is considered increasingly relevant to a broader class of investors.[2] Furthermore, private capital is complex and encompasses a wide range of strategies. Unlike listed equities, where it is possible to follow the market through passive investments, all private investments involve some amount of active exposure. For these reasons, benchmarks and indexes are critical parts of the private-markets ecosystem.

In this blog post, we introduce a number of important considerations related to benchmarking and creating indexes of private capital that investors can use to build or measure investments. We focus on unlisted, closed-end private-asset funds, which we will term "private capital."

An index is a precise calculation of performance numbers (typically periodic returns). It is the result of combining rules on sourcing data with rules for the subsequent computations. Indexes are usually well-defined, finite in number and replicable (in some sense).[3] In contrast, benchmarking is an investor need. Given a portfolio, the goal is to understand its performance relative to some other reference source of returns. Often for benchmarking, the reference will be an index.

Several types of performance benchmarks are in use — especially for private-asset investors. Each type is designed to answer a different investment question. One type can be thought of as a target: for example, a benchmark might be the consumer price index (CPI) plus a spread. A second category comprises those designed to help investors assess the opportunity cost of investing in private assets versus public assets. An example would be an index of listed equities (with returns adjusted for a spread), preferably with the listed equities matching an appropriate size segment, geography and industry mix. A third variety is designed to help assess the returns of a private-capital portfolio relative to a broader universe of comparable private capital. Such a benchmark may be used to determine allocation effects as well as manager selection skill. We will focus on this third type in this blog post.

The data universe

A suite of indexes, and more broadly the underlying dataset suitable for benchmarking, is best constructed in several layers. First, data is foundational when dealing with opaque, unlisted assets. With private capital, the universe of assets and data-sourcing model will determine its precision, accuracy, completeness and avoidance of obvious bias. Admissibility rules for the closed-end funds include a number of key dimensions. For example, funds must be raised via a normal fundraising process and the data source must be expected to provide a complete picture of the fund's life.[4] Private-capital funds often exhibit a so-called J-curve return path, with early returns biased downward by fees. Partial fund histories in the universe can therefore bias universe return calculations.

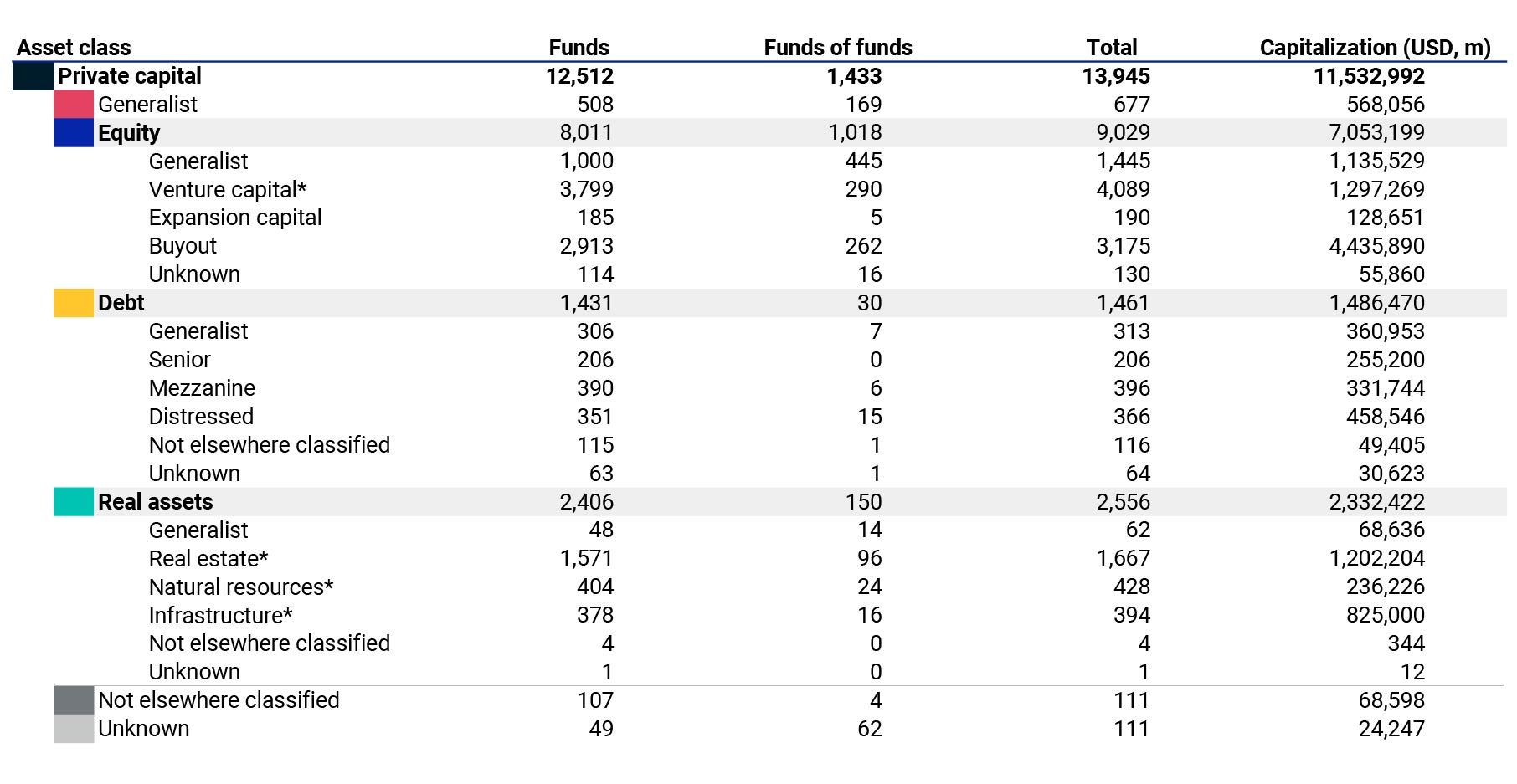

Second, the fund data needs to be enriched with attributes that ease asset owners in their selection of the most relevant benchmark. Arguably the most important is a fund's asset-class category. For example, is it a fund of buyout investments, or is it a venture-capital investment? (And, drilling down, does it target early- or late-stage investments?) An overview of MSCI's classification system for more than 13,000 funds is shown below.

Overview of the MSCI classification system for private capital

* Includes an unshown third tier. Data as of the Q1 2024 update of the MSCI private-capital data universe.

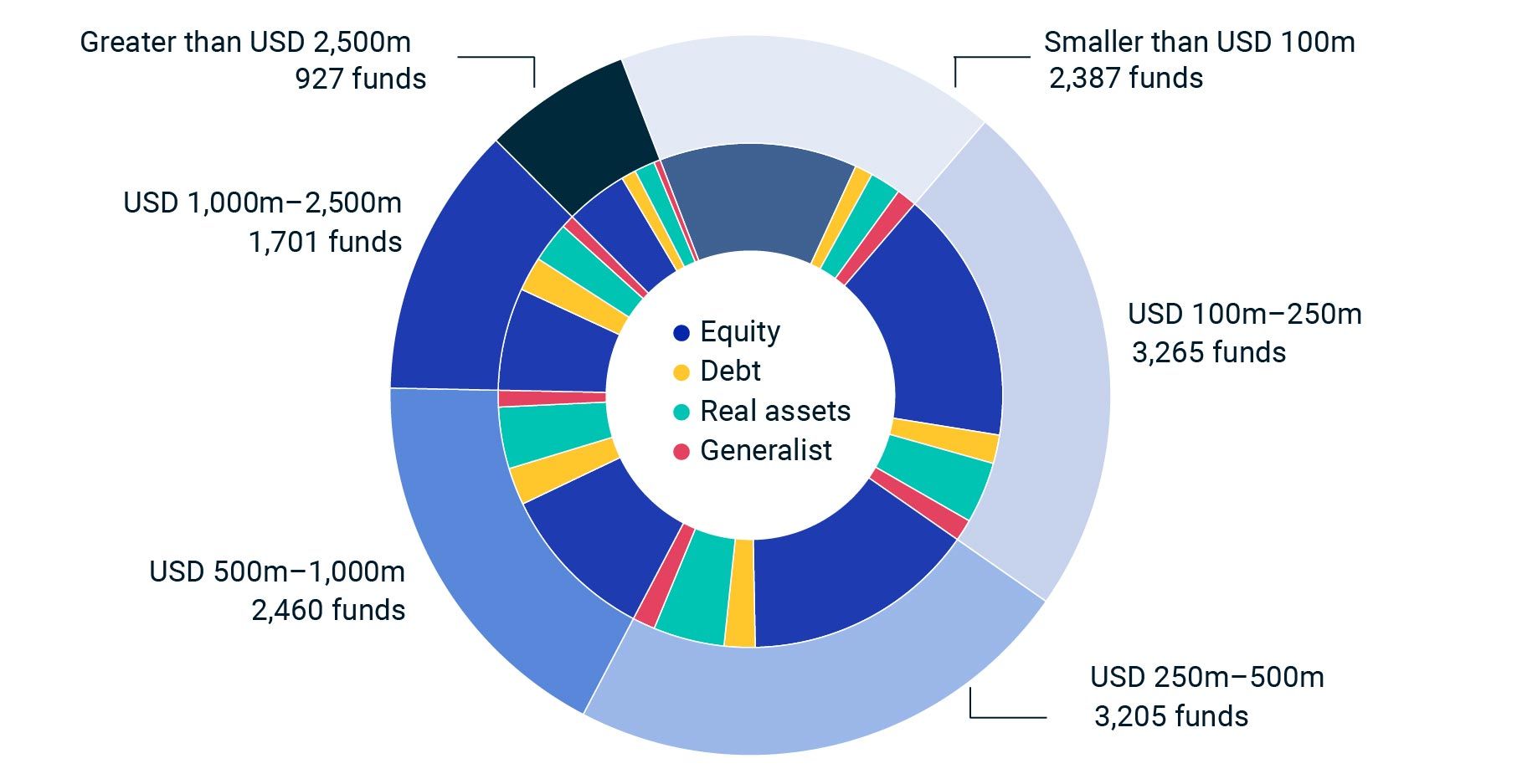

Also critical is fund size. This requires a benchmark provider to monitor a potential constituent fund across multiple fundraising closes while assessing the investable portion of the fund's capital raise. In the exhibit below, we show fund counts by size tier in the MSCI private-capital data universe. Attributes such as industry and geographic classification benefit from holding-level data for a fund. Maintaining such a dataset requires transparent rules for inclusion and for determining attributes, and a strong governance framework.

Fund counts by fund-size range

As of the Q1 2024 update of the MSCI private-capital data universe.

With the universe of funds in place, the third layer consists of defining precisely how index-related computations are performed on the data, including specifying data aggregation and weighting. For MSCI private-capital closed-end fund indexes, we use pooled measures in preference to measures such as medians. These are designed to help maintain the replicability of indexes derived from such a universe. For indexes, other choices are needed including the return methodology (we use Modified Dietz) and how the late submissions of valuations by funds (a perennial issue in private capital markets) is handled.[5]

Index building

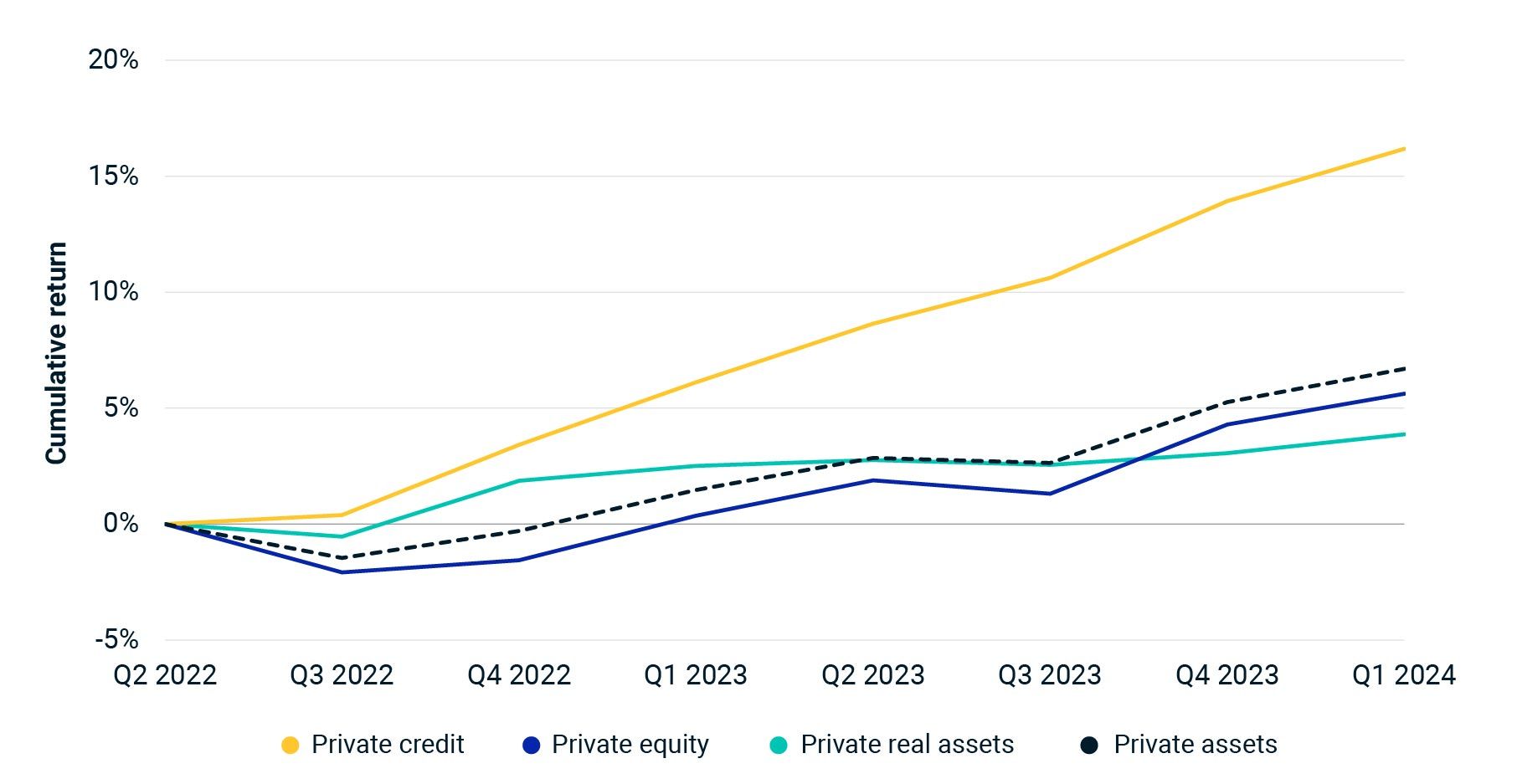

The fourth layer is the creation of the indexes. MSCI has more than 130 closed-end-fund indexes for private capital and in the exhibit below, we show the recent returns of four category-level indexes. Given the previous stages, the creation is relatively straightforward, involving the definition of clear inclusion criteria for each index. However, this is an oversimplification as the creation of indexes is not merely the choice of these criteria. In addition, further layers of governance are needed to maintain the indexes, including, critically, a restatement policy.[6]

Returns of category-level MSCI private-capital indexes

MSCI Global Private Asset Closed-End Fund Index, MSCI Global Private Real Asset Closed-End Fund Index, MSCI Global Private Credit Closed-End Fund Index, MSCI Global Private Equity Closed-End Fund Index as of the Q1 2024 update of the MSCI private-capital data universe.

In summary, creating a universe of private-capital funds suitable for constructing indexes is a non-trivial undertaking. It depends critically on the sourcing model for the underlying data. Furthermore, strict criteria for what funds are allowed into the universe are important for a universe which is representative and free of obvious biases. Enriching the dataset with various fund attributes is necessary to create indexes which are representative of differing investment strategies. Finally, a governance framework is required in order to create reliable and robust indexes.

Subscribe todayto have insights delivered to your inbox.

1 The cumulative capitalization of funds is more than USD 10 trillion. From vintages 2004-2013 to 2014-2023, fund counts have increased by 97% while capitalization has increased by 144% (as of the Q1 2024 update of the private universe; capitalizations exclude funds of funds).2 Arleen Jacobius, “How private market asset classes are changing the game in investment portfolios,” Pensions & Investments, Oct. 23, 2023.3 Throughout this blog post, a time series of returns will be termed replicable if there exist some set of investments (i.e., commitment amounts) which would result in a portfolio with those returns.4 A normal process would make a fund available to a broad set of investors and not just one (or a small set) of limited partners.5 The Modified Dietz method of calculating periodic returns takes into account the timing of cash flows during the period.6 A restatement policy dictates under what circumstances a previously published index return would be restated. See MSCI Private Capital Closed-End Fund Index Policies (client access only).

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.