The Erosion of the Real Estate Home Bias

Blog post

May 5, 2015

As an asset class, real estate has historically had a high degree of home bias, especially when compared to equities and fixed income. However, this home bias is starting to erode, with asset owners in many countries already investing internationally or actively exploring options for building off-shore exposures.

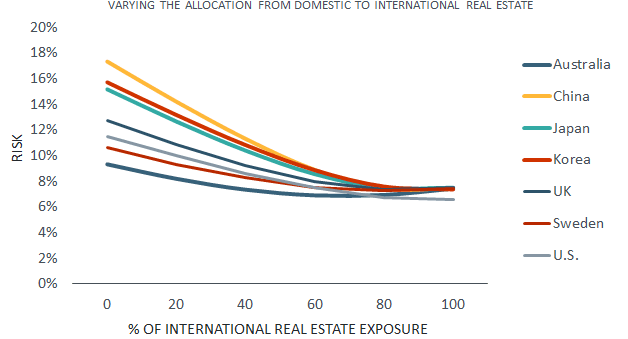

The implications of international diversification vary significantly across countries. Domestic real estate markets differ in their local risks and in their degree of correlation with other real estate markets. The potential impact of these differences can be seen in the chart below, which shows the stand-alone real estate risk for different countries at different levels of international exposure calculated using MSCI's PRE2 model in BarraOne. Under this model, the available diversification benefit is greatest for high volatility markets like China, but is also apparent for lower volatility markets like Sweden and Australia.

While there may be a compelling case for international real estate diversification, it is important to remember that real estate is an illiquid, diverse and cyclical asset class. These characteristics mean that other factors, such as timing and pricing, are important considerations for institutional investors seeking to diversify internationally through real estate. Diversification at the wrong time or into the wrong markets could be detrimental to an investor's portfolio, as Swedish and Japanese investors discovered in the 1980s and North American investors experienced in the 1990s and 2000s.

The implications of international diversification vary significantly across countries. Domestic real estate markets differ in their local risks and in their degree of correlation with other real estate markets. The potential impact of these differences can be seen in the chart below, which shows the stand-alone real estate risk for different countries at different levels of international exposure calculated using MSCI's PRE2 model in BarraOne. Under this model, the available diversification benefit is greatest for high volatility markets like China, but is also apparent for lower volatility markets like Sweden and Australia.

While there may be a compelling case for international real estate diversification, it is important to remember that real estate is an illiquid, diverse and cyclical asset class. These characteristics mean that other factors, such as timing and pricing, are important considerations for institutional investors seeking to diversify internationally through real estate. Diversification at the wrong time or into the wrong markets could be detrimental to an investor's portfolio, as Swedish and Japanese investors discovered in the 1980s and North American investors experienced in the 1990s and 2000s.

Real Estate portfolio risk

Assumes that international and domestic allocations are leveraged at 20%. Risk calculations use MSCI's PRE2 model in BarraOne.

Read the paper, "The Erosion of the Real Estate Home Bias."

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.