The Tipping Point: Women on Boards and Financial Performance

Blog post

December 13, 2016

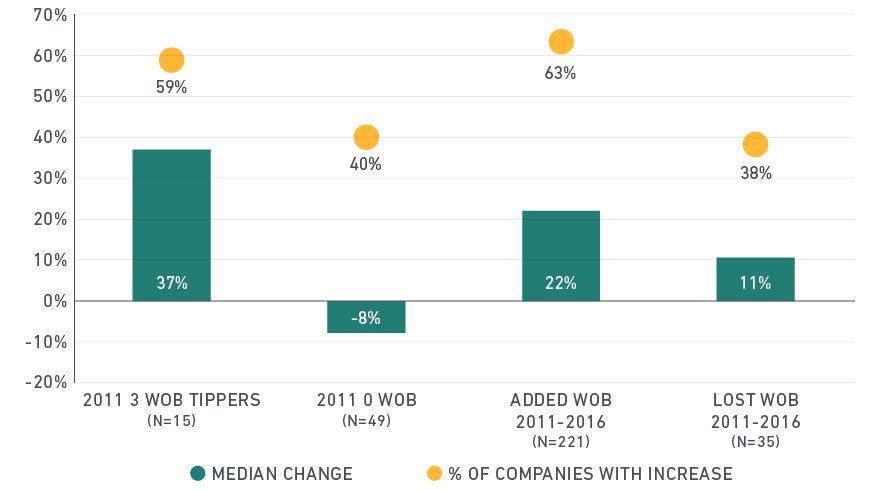

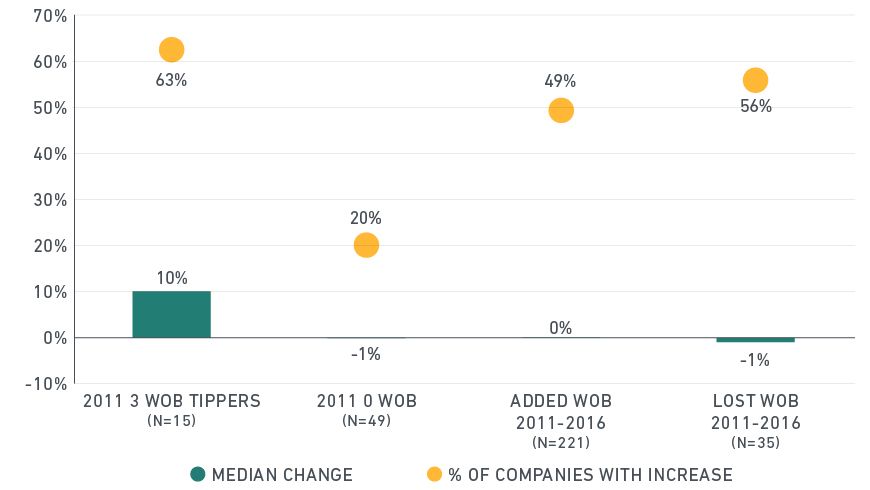

A growing body of research shows that having three women on a corporate board represents a "tipping point" in terms of influence, which is reflected in financial performance. Our analysis from last year looked at a snapshot of global companies in 2015 with strong female leadership, finding that they enjoyed a Return on Equity of 10.1% per year versus 7.4% for those without such leadership. This year, we analyzed U.S. companies over a five-year period (2011-2016). U.S. companies that began the period with at least three women on the board experienced median gains in Return on Equity (ROE) of 10 percentage points and Earnings Per Share (EPS) of 37%. In contrast, companies that began the period with no female directors experienced median changes of -1 percentage point in ROE and -8% in EPS over the study period (see below exhibits).

Source: MSCI ESG Research

The chart compares the five-year EPS performance of four groups of companies: 1) those that reached the "tipping point" of three women on the board (WOB) in 2011; 2) those that had zero women on the board in 2011; 3) those that added any number of women between 2011-2016; and 4) those that lost any number of women between 2011-2016.

Source: MSCI ESG Research

The chart compares the median five-year ROE change (in percentage points) of four groups of companies: 1) those that reached the "tipping point" of three women on the board (WOB) in 2011; 2) those that had zero women on the board in 2011; 3) those that added any number of women between 2011-2016; and 4) those that lost any number of women between 2011-2016.

Such superior performance from companies with at least three female board members may derive from better decision-making by a more diverse group of directors, as some studies hypothesize. But outperformance may also be tied to greater gender diversity among senior leadership and the rest of the workforce, which has been correlated with reduced turnover and higher employee engagement. Globally, we found that large multinational companies that had a critical mass of female directors tended to have more gender-diverse leadership teams and were more likely to have a female CEO. We also found that such companies were more effectively tapping available female talent supplies throughout the organization. Thus, the presence of at least three women directors may be seen as a doubly positive indicator: of a better-performing company and of a more functional organization overall. In short, having more women directors may lead to a virtuous cycle.

The author thanks Meggin Thwing Eastman, Damion Rallis and Gaia Mazzuchelli for their contributions to this post.

Such superior performance from companies with at least three female board members may derive from better decision-making by a more diverse group of directors, as some studies hypothesize. But outperformance may also be tied to greater gender diversity among senior leadership and the rest of the workforce, which has been correlated with reduced turnover and higher employee engagement. Globally, we found that large multinational companies that had a critical mass of female directors tended to have more gender-diverse leadership teams and were more likely to have a female CEO. We also found that such companies were more effectively tapping available female talent supplies throughout the organization. Thus, the presence of at least three women directors may be seen as a doubly positive indicator: of a better-performing company and of a more functional organization overall. In short, having more women directors may lead to a virtuous cycle.

The author thanks Meggin Thwing Eastman, Damion Rallis and Gaia Mazzuchelli for their contributions to this post.

Further reading:

Women on Boards at MSCI:

In the photo accompanying this blog, the women shown are (from left to right):

Wendy E. Lane, Chairman, Lane Holdings, Inc. and Board of Directors, MSCI

Alice W. Handy, Founder and CEO, Investure and Board of Directors, MSCI

Kathleen Winters, Managing Director, Chief Financial Officer and Executive Committee member, MSCI

Diana Tidd, Managing Director, Head of Index and Executive Committee member, MSCI

Linda H. Riefler, Former Chairman of Global Research and Chief Talent Officer, Morgan Stanley and Board of Directors, MSCI

Catherine R. Kinney, Former President, New York Stock Exchange and Board of Directors, MSCI

Linda-Eling Lee, Managing Director and Global Head of Research for ESG, MSCI (also the writer of this blog)

Alice W. Handy, Founder and CEO, Investure and Board of Directors, MSCI

Kathleen Winters, Managing Director, Chief Financial Officer and Executive Committee member, MSCI

Diana Tidd, Managing Director, Head of Index and Executive Committee member, MSCI

Linda H. Riefler, Former Chairman of Global Research and Chief Talent Officer, Morgan Stanley and Board of Directors, MSCI

Catherine R. Kinney, Former President, New York Stock Exchange and Board of Directors, MSCI

Linda-Eling Lee, Managing Director and Global Head of Research for ESG, MSCI (also the writer of this blog)

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.