The World Comes to China

Blog post

May 23, 2018

Emerging markets may never be the same. On May 31, MSCI will include 226 China large-cap A shares to the MSCI Emerging Markets Index. Inclusion at a 5% initial weight could lead to approximately USD 22 billion of capital inflows into these stocks.1 What might investors need to consider as we approach this milestone?

First, let's look at the composition of the MSCI Emerging Markets Index. The China A shares that will be partially included to the index — large-cap mainland Chinese stocks that are traded domestically — will be added in two phases: half of their 5% initial weight will occur May 31, while the balance will be added in August. Historically, it has been difficult for many international investors to trade these shares, market accessibility has improved in recent years.

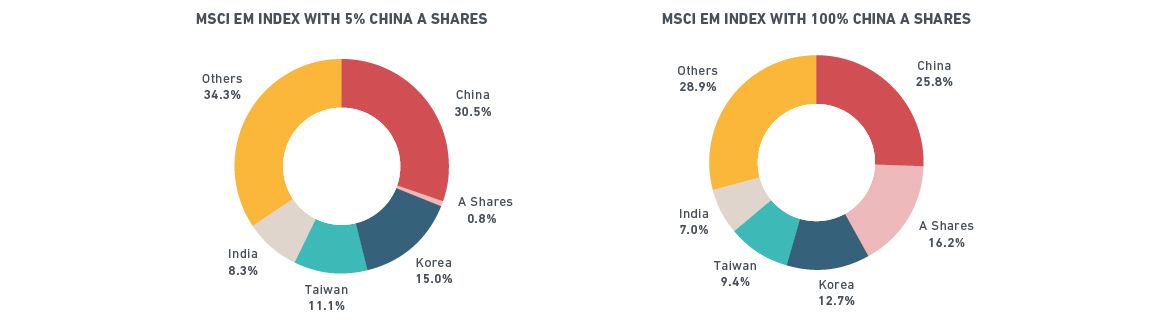

The initial inclusion will boost China's proportion of the index by only 0.8%, to 31.3%, based on current values. But what if the Chinese market continues to liberalize enough to warrant full inclusion down the road? The A shares market is one of the biggest in the world, with more than 3,000 stocks traded. If full inclusion were to happen, China equities could comprise 42% of the MSCI Emerging Markets Index, with A shares alone accounting for about 16% of index weight.2

China would comprise 31.4% of the MSCI Emerging Markets Index at 5% inclusion as of August 2018 (left panel), based on data used for MSCI's May 2018 Semi-Annual Index Review. At a hypothetical 100% inclusion (which may or may not occur in the future), China would comprise 42% of the index, based on the current market capitalization. All figures are approximate.

THE INCLUSION JOURNEY

Five years ago, when MSCI floated the idea of adding China A shares to its mainstream indexes, global investors were unenthusiastic. This was because few were familiar with the Chinese domestic equity market even though the MSCI China Index (covering other share classes and Chinese stocks listed overseas) already represented the largest country by market cap in the MSCI Emerging Markets Index. Global investors were unfamiliar with this market because they were unable to access it.

China had cautiously opened its domestic A shares market to the world through efforts targeting institutional investors: the Qualified Foreign Institutional Investors (QFII) and Renminbi Qualified Foreign Institutional Investor (RQFII) programs. While these programs attracted some early capital, they failed to provide the minimum level of market accessibility needed by institutional investors.

Thus, the journey to inclusion was far from smooth and took years of effort. In addition to capital mobility restrictions and unequal market access under the qualified investor schemes, investors were uneasy about issues such as uncertainty of capital gains tax (2014), questionable beneficial ownership under the early phase of the Stock Connect program3 (2015), widespread voluntary stock suspensions (2016) and pre-approval restrictions on launching financial products (2016). Despite numerous setbacks, Chinese policy makers and regulators made significant progress, addressing investor concerns one by one. Finally, when the Stock Connect program was expanded to include Shenzhen-traded shares in December 2016, it provided the breakthrough that global investors were seeking – a market that afforded open accessibility to all investors.

MSCI China A Shares Inclusion Journey

INVESTORS ARE PREPARING

Since MSCI announced in June 2017 that it would partially include China A shares in several of its key indexes, we have seen increased interest in investing in Chinese stocks by global investors as market accessibility has improved:

- The opening of Special Segregated Accounts, a proxy of international investors' readiness and appetite to trade A shares, has surpassed 4,000 accounts, up from less than 1,700 since Stock Connect started three years ago.

- The total portfolio value settled through the Northbound Stock Connect reached RMB 520 billion (USD 84 billion) last December.

- More than 1,800 China A shares including those being added to the MSCI Emerging Markets Index are held by Stock Connect investors. Stock Connect is rapidly establishing itself as the primary channel to access A-shares.

Further reading:

Subscribe todayto have insights delivered to your inbox.

1Based on USD 13.9 trillion of assets benchmarked to MSCI indexes as of December 2017.2This is a hypothetical scenario for illustrative purposes only. MSCI has not made any decisions regarding whether or not to further include China A shares into the MSCI Emerging Markets Index.3The Stock Connect program allows international and mainland Chinese investors to trade securities in each other’s markets through their home exchanges.4Specific measures include: a 38 billion RMB repo facility with nine Primary Liquidity Providers (PLPs) banks and a RMB 400 billion swap facility; banks with onshore RMB liquidity commit to increase offshore RMB liquidity around inclusion dates; China A shares inclusion trades would enjoy prioritized RMB liquidity around the time of index inclusion; and effective information dissemination among intermediaries and efficient recycling of RMB would be ensured. In addition, the Hong Kong Stock Exchange will also accept U.S. dollars and Hong Kong dollars as pre-payment currencies to ease CNH funding pressures.5Based on data as of May 15, 2018. If China mid-cap A shares were added to the pro forma MSCI Emerging Markets Index, the total number of China securities would be 631 while the number of emerging-market constituents would be 1,320.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.