Understanding Private Real Estate

Blog post

September 15, 2015

Private real estate and other real assets have become a major component of many institutional investors' portfolios in recent years, but risk management has lagged. A wide range of proxies and assumptions have stood in place of a solid risk management framework, with perhaps the most common risk model being … nothing.

What may have been acceptable for small allocations is unacceptable when real assets constitute 10%-20% of the portfolio. The emergence of the risk allocation paradigm – asset allocation along multi-asset class risk factors, rather than single asset-class buckets – makes it all the more important to understand real estate's systematic drivers, and to understand how real estate is different from the traditional asset classes.

The Barra Private Real Estate Model (PRE2) introduced a suite of new models, based on new data and methodology. The model covers real estate in 31 countries across five continents, plus farmland and timberland in the U.S. and U.K. Income return factors distinguish the risk of rental income from that of capital appreciation, and property sub-type and metro area factors provide added granularity in the U.S.

The model looks at the three sources of real estate risk and return:

Debt + Income Return + Capital Appreciation

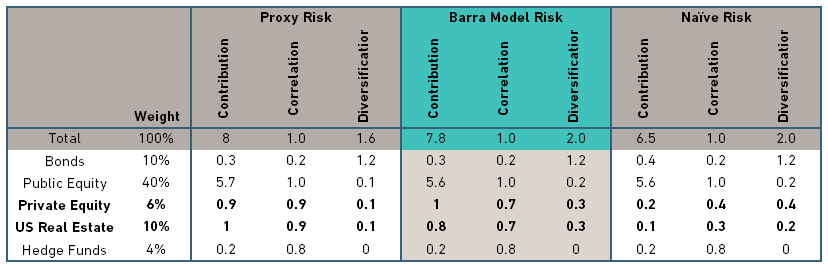

Modeling the first component, debt, is relatively straightforward, either as simple leverage or as funding instruments exposed to the risk factors of the MSCI's fixed income risk models. The other two are far more challenging. Accurately modeling these components requires private real estate data and a statistical methodology that can see past the smoothness of the valuations. These features are incorporated into the Barra Integrated Model, which spans global stocks, bonds, commodities, currencies, volatility futures, hedge funds and private equity. The model's Bayesian desmoothing methodology reveals a significantly higher level of commonality between private real estate and other asset classes. Despite this commonality, however, the utility of other asset classes as proxies for private real estate is limited. The use of tenancy and lease information to map real estate to equity and bond market factors is tenuous. These factors can be important ingredients in forming a view on a property's expected return, but they fail to capture real estate risk. Although there is commonality with both stocks and bonds, the majority of real estate risk is driven by endogenous factors. Ultimately, real estate is its own asset class. As can be seen in the below exhibit, proxies for private assets suggest they provide little diversification, while the smooth valuations (based on lagged appraisals of direct holdings) naively suggest private assets contribute very little risk. The reality is in the middle. Private assets have offered diversification benefits, but they have also been cyclical and exposed to some of the same systematic risks driving other assets' performance. What is the True Degree of Private Asset Risk?

The Barra Private Real Estate Model represents a major advance in understanding the drivers of investments in global private real estate. It reveals a higher degree of commonality between public and private real estate, but also shows other relationships to be far weaker than others have assumed. Incorporated in the Barra Integrated Model, PRE2 brings private real estate investments up to the same standards of risk management as the other 90% of the market.

Read the paper, "The Barra Private Real Estate Model (PRE2) Research Notes"

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.