Why global small-cap stocks are becoming an important part of institutional portfolios

Blog post

March 16, 2017

Institutional investors worldwide traditionally have tended to focus on the stocks of larger companies, finding them less risky, more liquid and offering greater investment capacity than small-cap stocks. But asset owners and managers increasingly are allocating strategically to the small-cap equity segment as part of their global equity portfolios i.e., via an "all-cap" approach.

There are four main reasons for this trend:

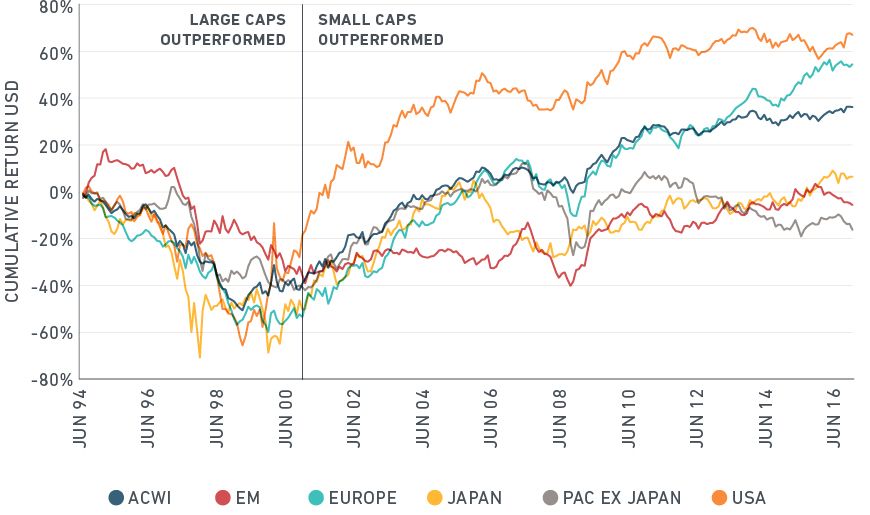

First, small caps have historically earned a premium compared to their large-cap counterparts. As seen in the chart below, this premium has existed globally since the early 2000s. Contrary to the claims of small-cap critics, our research shows the size premium has historically existed outside the U.S. as well, which has made small-cap investing a global phenomenon.

Small caps have outperformed large caps over the last 15 years

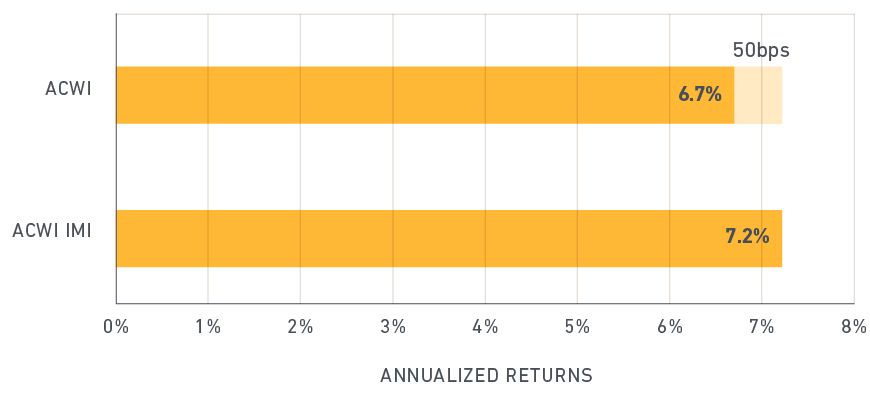

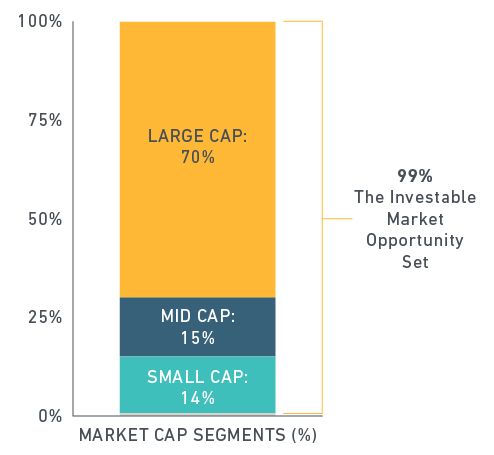

Consider the return of a global equity portfolio with small caps to one lacking small caps. Using the MSCI ACWI IMI, which has constituents across the all-cap spectrum, as a proxy for a global equity portfolio, we find that it had annualized returns of 7.2% for the 15 years that ended Dec. 31, 2016. That return compares with 6.7% for the MSCI ACWI Index, which tracks large- and mid-cap stocks only. As the chart implies, investors who choose to forego 14% of the opportunity set are inherently making an active bet against the investable market. For the past 15 years, they would have given up 50 basis points annually in additional returns.

The 50 basis point gap: Global equity returns with and without small caps

MSCI Investable Market Indexes. Data from 2002-2016

Complete coverage of the investment opportunity

Finally, finding active global small-cap managers who have provided excess returns on a consistent basis has frequently been cited as a key challenge. However, indexed options also exist; these approaches have been aided by the declining cost of trading small caps globally and improved investability of small-cap indexes.

The natural starting universe for equity investors should be the global investable opportunity set, which includes large-, mid- and small-cap stocks. Any deviation from this asset allocation would be deemed an active decision. The question for institutional investors then is: Is there an overlooked premium in your current equity allocation?

Further reading:

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.