Incorporating Sector Investing in Portfolio Management

Research Paper

June 20, 2024

Preview

Sector investing offers investors a strategic approach to gaining exposure to distinctive segments of the economy. Using the sector indexes constructed from the MSCI US Investable Market 2500 Index, which represents the investment opportunity set accessible to U.S. domestic investors, we studied sector investing in the U.S. over the last two decades.

Because sectors vary in their economic, thematic and factor exposures, as well as their sustainability and climate profile, degree of concentration and fundamental characteristics, their performance behavior has differed as macroeconomic conditions have changed.

We found that, over the last two decades ending May 2024, most U.S. sectors had low performance correlations, suggesting that investors could have built portfolios using sector rotation strategies to potentially improve performance or combined less-correlated sectors to reduce portfolio risk.

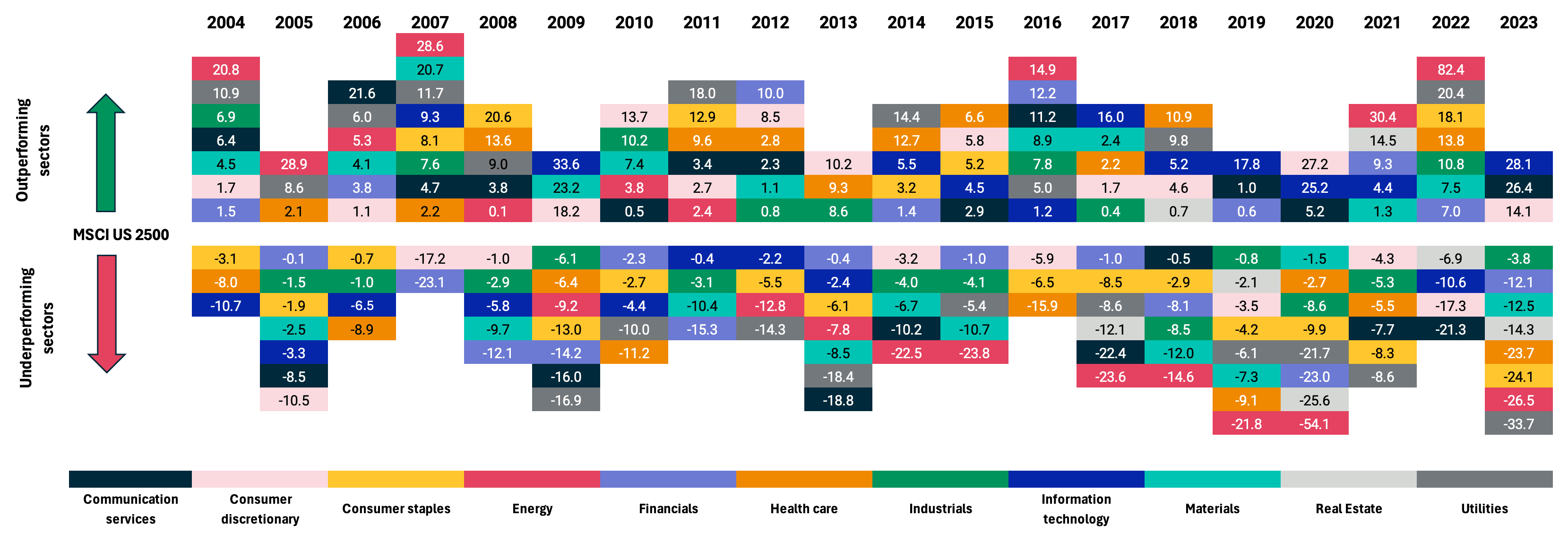

Calendar-year active returns of US sectors

Data period from Dec. 31, 2003, to Dec. 29, 2023. The plot shows the calendar-year active returns of the U.S. sector indexes compared to those of the MSCI US Investable Market 2500 Index. Returns are gross in USD.

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

Reimagining Country Investing

We introduce an integrated framework to investing in individual country and regional markets, analyzing macroeconomic risks and new growth opportunities as well as the role of sustainable investments in a globally diversified portfolio.

Finding Value: Understanding Factor Investing

We examine how value investing could be implemented in a passive portfolio, using three generations of value indexes as a starting point for creating investment vehicles: traditional value, value- or fundamentally weighted and high-exposure value.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.