ESG Ratings in Global Equity Markets: A Long-Term Performance Review

In this paper, we review the financial performance of MSCI ESG Ratings in global (MSCI ACWI Index) and developed (MSCI World Index) markets over the course of their history of 11 and 17 years, respectively.

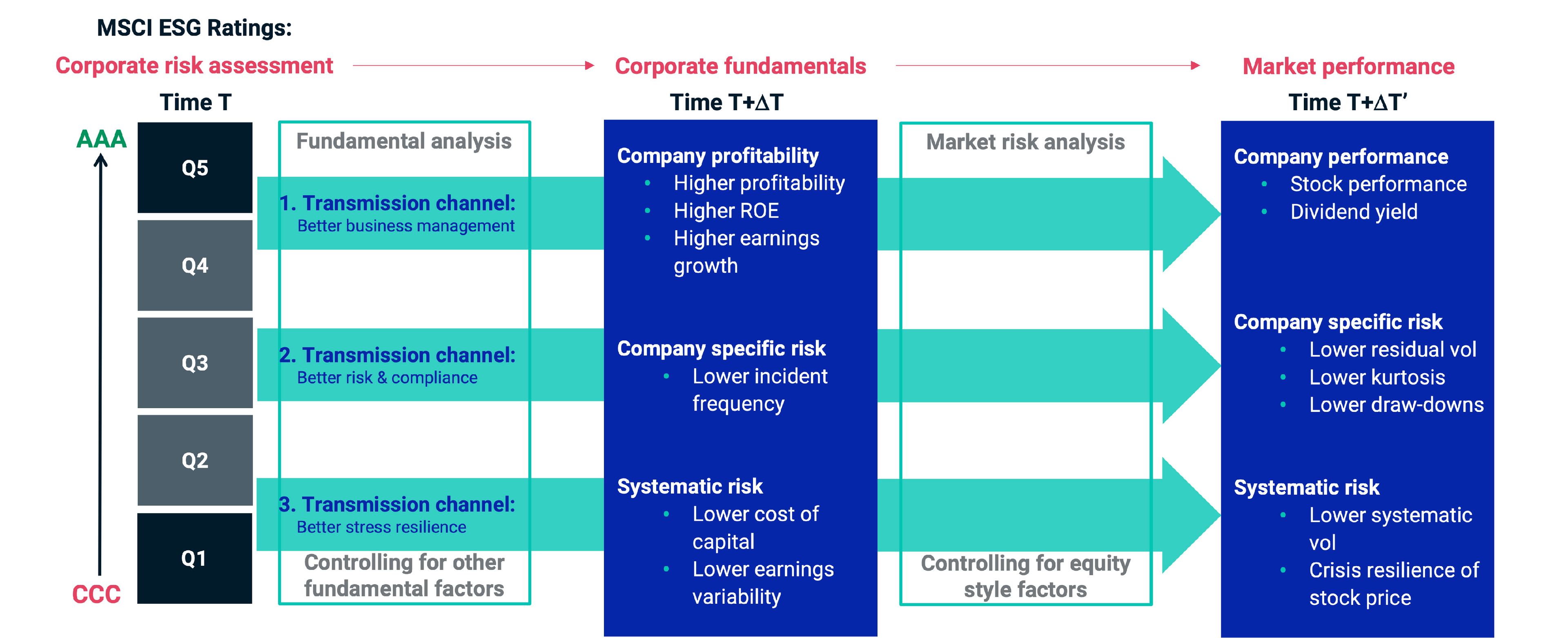

A key difference between MSCI ESG Ratings and traditional market-risk factors such as value or momentum is the fact that MSCI ESG Ratings assess corporate risk rather than market risk. Our study was therefore based on both a fundamental performance assessment (how differences in ESG ratings were associated with differences in earnings and profitability) and a stock-price performance assessment. This is important to understand to what extent (if observed) better corporate-earnings fundamentals were transmitted into better market performance, which we called the "transmission channel."

Using a standard quintile analysis on MSCI ESG scores (controlled for sectors, regions and company size), we found that companies with higher MSCI ESG Ratings outperformed their lower-rated counterparts across both the MSCI ACWI Index and the MSCI World Index over the study periods.

©2025 With Intelligence. Republished with permission from the Journal of Impact & ESG Investing, from: Guido Giese and Drashti Shah. 2025 "ESG Ratings in Global Equity Markets: A Long-Term Performance Review." Journal of Impact & ESG Investing 6, no. 1 (fall).

Read the full paper

Provide your information for instant access to our research papers.

How ESG Risk Management Can Impact Security Risk

Illuminating the Relationship Between ESG and Performance

MSCI ESG Ratings

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.