Risk Control with Maximum Exposure

Research Paper

March 7, 2022

Preview

In this paper, we introduce alternative approaches to risk control that aim to maximize exposure to non-cash assets, and compare them against classic risk-control approaches. We began by applying various risk-control approaches to the MSCI ACWI Index, and evaluated each in terms of performance, exposure and sensitivity to varying leverage and volatility-target levels.

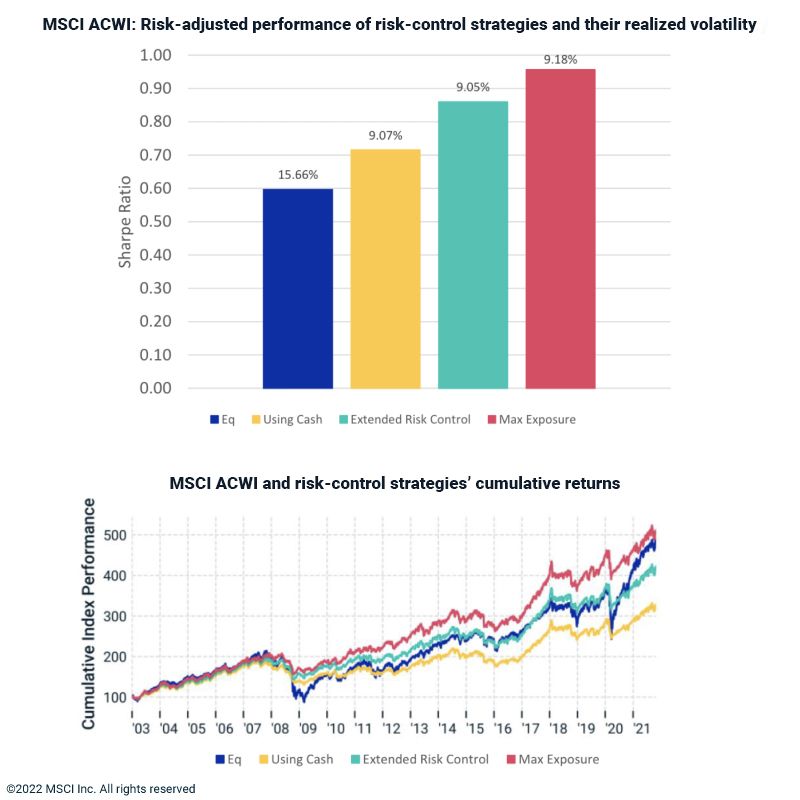

In the exhibits below, we compare the risk-adjusted and absolute performance of simulated risk-control approaches, highlighting three key takeaways:

- Risk-control solutions delivered higher risk-adjusted returns than the parent index.

- The Treasury security solution outperformed the cash solutions.

- The max-exposure solution provided the highest Sharpe ratio improvement.

Sample period: Jan 1, 2002 – Oct 31,2021. VT=10%, Leverage Cap =150%. For illustrative purposes only. Past performance is not a guarantee of future results. There can be no assurance of any investment outcome. Simulation and model results may differ materially from actual results, and related assumptions. Simulations and models may show better or improved investment performance versus actual investment returns.

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

Using Derivatives to Manage Volatile Markets

Exchange-traded derivative contracts linked to indexes such as the MSCI Emerging Markets, MSCI World and MSCI EAFE Indexes experienced substantial growth during extreme market volatility in March 2020.

ESG and Climate Derivatives in Equity Exposure Management

Most efforts to manage climate and ESG portfolio risks have involved reducing holdings of stocks negatively exposed to these risks, and increasing those that are positively exposed.

Trends in Futures and Options Linked to MSCI Indexes

Over the past two decades, as equity-derivative markets have grown, some investors have looked to exchange-traded futures and options as they seek to efficiently manage market risks and exposures in portfolios.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.