Standing at the Crossroads of Trade and Climate Risks

Preview

Amid rising trade and climate policy uncertainties, Southeast Asia is emerging as a focal point for risk and opportunity. This report unpacks the “double jeopardy” facing manufacturers operating in the region: escalating physical-climate threats — like floods and extreme heat — and a shifting trade-policy landscape. With nearly a quarter of MSCI ACWI Index (IMI) market cap tied to Southeast Asian manufacturing operations, investors worldwide have a stake in understanding these evolving dynamics.

Drawing on our suite of climate tools, including MSCI GeoSpatial Asset Intelligence and MSCI Climate Value-at-Risk model, our analysis offers a granular, scenario-based view of potential exposures and losses. With trade and climate risks increasingly shaped by jurisdiction- and location-specific factors, asset-level intelligence adds a critical layer of insight for risk-informed decision-making. Additionally, climate-scenario analysis offers a structured framework to explore possible futures and strengthen preparedness.

Discover how local risk hotspots across a global investment footprint could evolve — and what that means for long-term investment decisions.

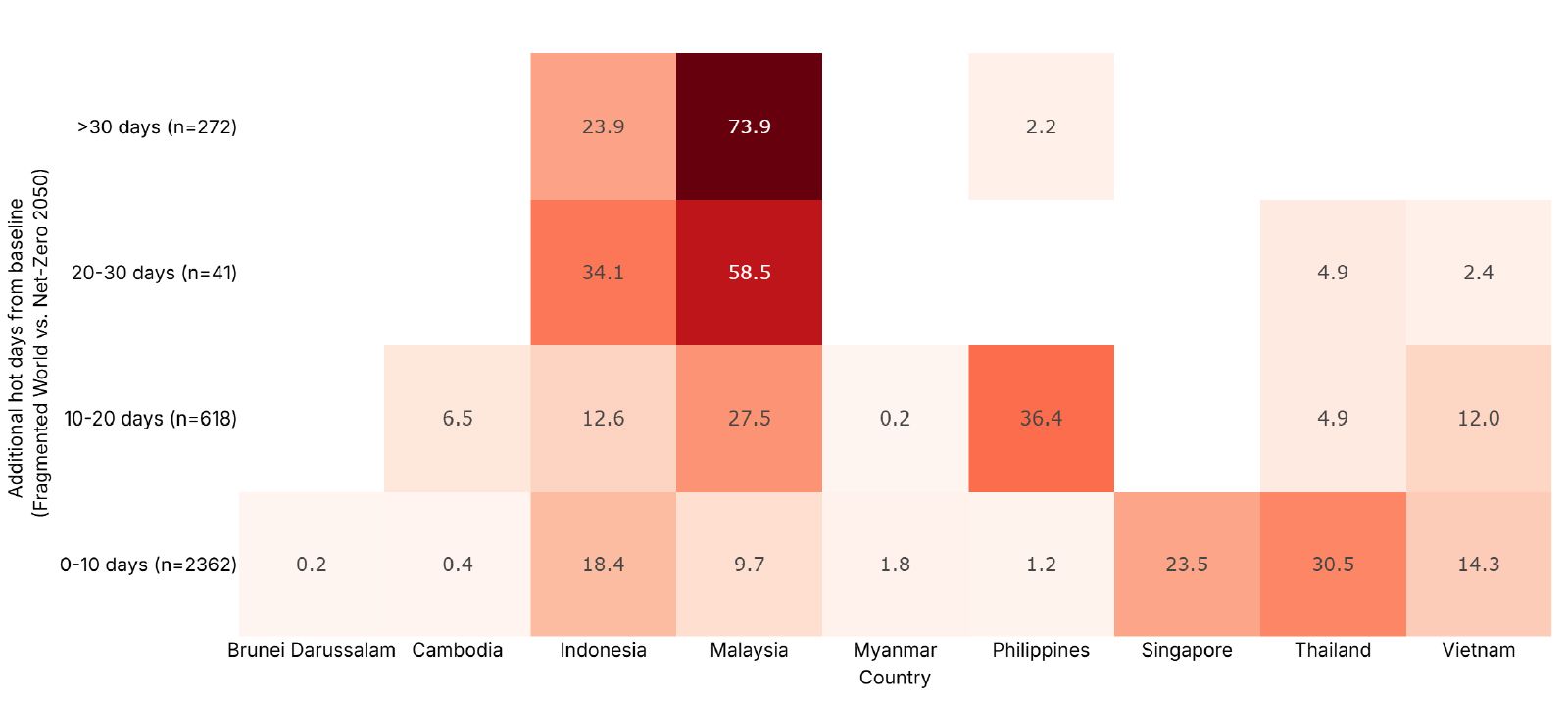

Data as of March 31, 2025. Includes 3,293 production facilities in Southeast Asia owned or operated by constituents of the MSCI ACWI IMI as of Dec. 31, 2024. Additional hot days refers to the difference in number of days with wet-bulb globe temperature (WBGT) above 25°C between the NGFS Fragmented World and Net-Zero 2050 scenario in 2050. Values show the % of assets in each heat category by count. This analysis is based on hypothetical scenarios and modeled data. There may be material differences between model results and actual outcomes. Source: MSCI ESG Research, using MSCI GeoSpatial Asset Intelligence

Read the full paper

Provide your information for instant access to our research papers.

Uncovering Nature Risks Through Geospatial Analysis

Nature loss is a rising risk to the global economy, disrupting supply chains, raising costs and slowing growth. Investors — such as asset managers, insurers and banks — who use geospatial analysis are better positioned to manage these location-specific risks.

GeoSpatial Asset Intelligence

GeoSpatial Asset Intelligence delivers asset-level nature and physical risk data to help investors, banks and insurers identify and manage risk.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.