Value’s Lost Decade: Learning from Value Strategies’ Behavior over Two Contrasting Decades

Research Paper

February 1, 2023

Preview

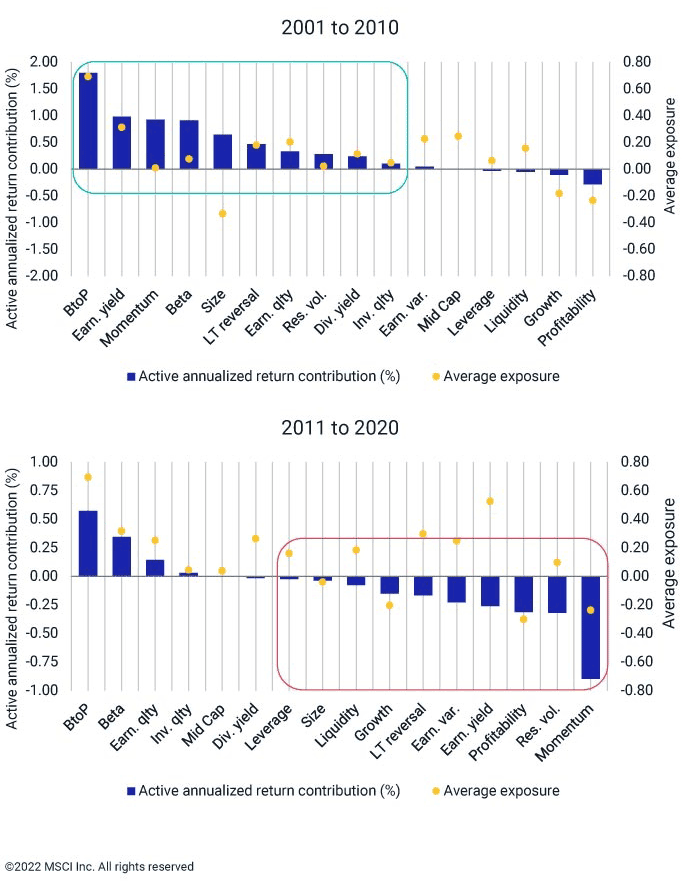

After more than a decade of unattractive performance and "neglect," value strategies became a favorite in 2021 and remained so in early 2022. We saw a rotation from growth to value, and value investments posted some long-awaited outperformance.

In "Value's Lost Decade," we dig into the performance of value strategies over the past two contrasting decades to understand what affected performance and what caused the prolonged period of value's underperformance, especially in the latest 10 years.

©2023 With Intelligence. Republished with permission from the Journal of Beta Investment Strategies, from: Mehdi Alighanbari, Arihant Jain, Saurabh Katiyar, and Waman Virgaonkar. 2023. "Value's Lost Decade: Learning from Value Strategies' Behavior over Two Contrasting Decades." Journal of Beta Investment Strategies 13, no. 4 (winter).

A tale of two decades of value performance

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

Did Value-Factor Exposure Deliver for Value Funds?

Building on previous MSCI research into the nuanced performance of the value factor, including the impact of sectors and other style factors, we look at how exposure to value drove the performance of actively managed value funds.

How Diversified Are US Equity Investors?

The universe of stocks represented by the MSCI USA Index comprises over 600 securities. U.S. investors might assume there are ample opportunities for diversification and potential risk reduction in the domestic market. Is this assumption correct?

Bringing Value to the 21st Century

In the second post in our series, we further probe value's underperformance over the past decade and ask if the historic definition of value remains relevant. We specifically look at whether a company's valuation can be enhanced by reflecting R&D investments.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.