A Battle on Two Fronts: Rearming and Tariffs

Defense has become a higher priority for investment in the West.1 Europe is now spending record amounts against the backdrop of growing concerns about the technological dependency that relying on one country for supply of military equipment creates.2 For investors aiming to take advantage of greater defense spending, understanding a company's supply chain is crucial, though not always easy, as the supply chain of the aerospace and defense (A&D) industry is particularly intricate and globalized.

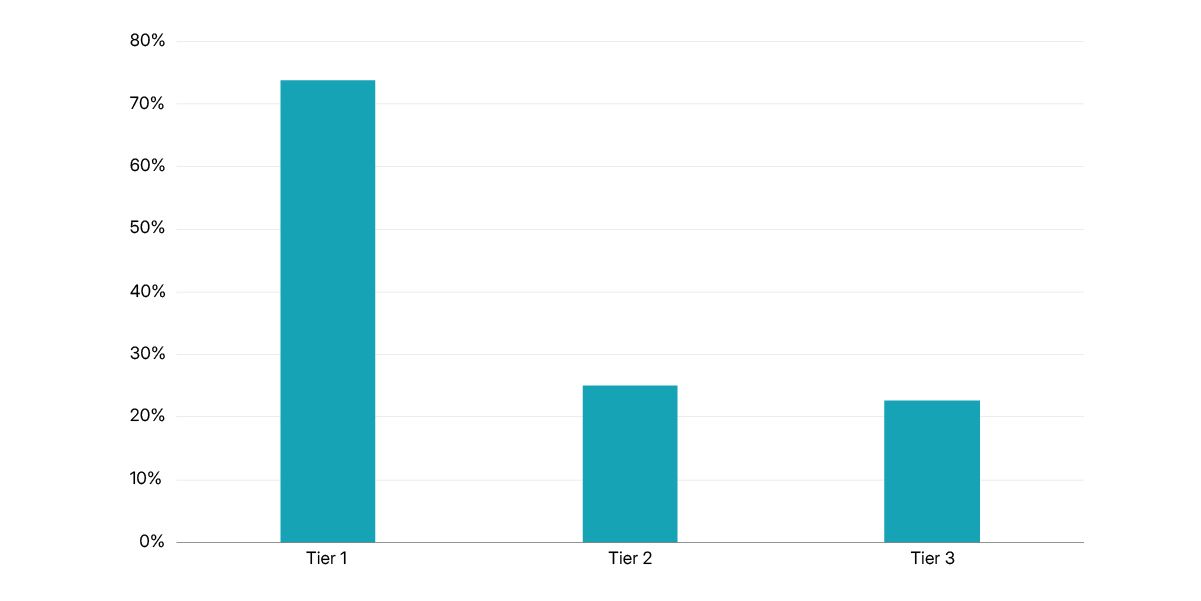

Consider the different direct suppliers (Tier 1) needed to build Lockheed Martin's F-35 aircraft: Rolls-Royce, MBDA, BAE Systems, BKN Aerospace, Leonardo, GKN Aerospace Norway and Terma. They all use parts from their own suppliers (Tier 2) around the world. While some parts are so specialized that they come from a single factory, and therefore are easily tracked, defense companies have less and less oversight over their supply chain as some elements become less specialized, such as those from raw material suppliers (Tier 3).3

Supply chains in the spotlight

New U.S. tariffs have highlighted the intricacies and complications of a global supply chain, and although many tariffs were paused for 90 days as of April 9, the anticipation of looming costs was enough to send industry players scrambling to assess their exposure. One parts supplier, Howmet, declared a force majeure event to avoid having to adhere to contracts affected by the tariffs.4 Ultimately, investors' confidence in whether A&D companies are prepared for further supply-chain disruptions could depend on the oversight that these companies have over their multi-tiered suppliers.

Oversight by A&D companies of their suppliers

Data as of April 24, 2025. The chart shows the percentage of disclosure for A&D on supplier certifications. Tier 1 is a company’s direct suppliers, Tier 2 is its subtier suppliers and Tier 3 is its raw-material suppliers. Source: MSCI ESG Research

Subscribe todayto have insights delivered to your inbox.

Social Risks and Opportunities for Corporates: Long-Term Performance in Global Equity Markets

What goes into an analysis of financially material social risks and opportunities? And what does it mean for a company’s market performance? Our analysis found that scoring on social-risk themes was a key indicator of performance.

Mapped or Missed? Navigating Tariff Uncertainty

Traceable supply chains can offer clarity amid trade-policy volatility, aiding businesses in forecasting costs, navigating tariffs and reducing investor risk.

1 “EU Defense Spending,” New York Times, March 4, 2025.2 “Will Lockheed’s F-35 become a casualty of Donald Trump?” Financial Times, March 27, 2025.3 “Boeing Seeks Plan B After Fire Destroys Key Suppliers’ Plant,” Wall Street Journal, April 9, 2025.4 “Aerospace Firms Scour Contracts Over Tariffs After Supplier Challenge,” Reuters, April 7, 2025.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.