Are Subscription Lines of Credit Still Worth the Cost?

Subscription lines of credit (sub lines) have become widespread across buyout, private-debt and real-estate funds, but elevated interest rates are prompting limited partners (LPs) to reassess sub lines' value. We estimate that an LP would have lost at least 1% of paid-in capital to service sub-line debt in a quarter of recent buyout and real-estate funds.

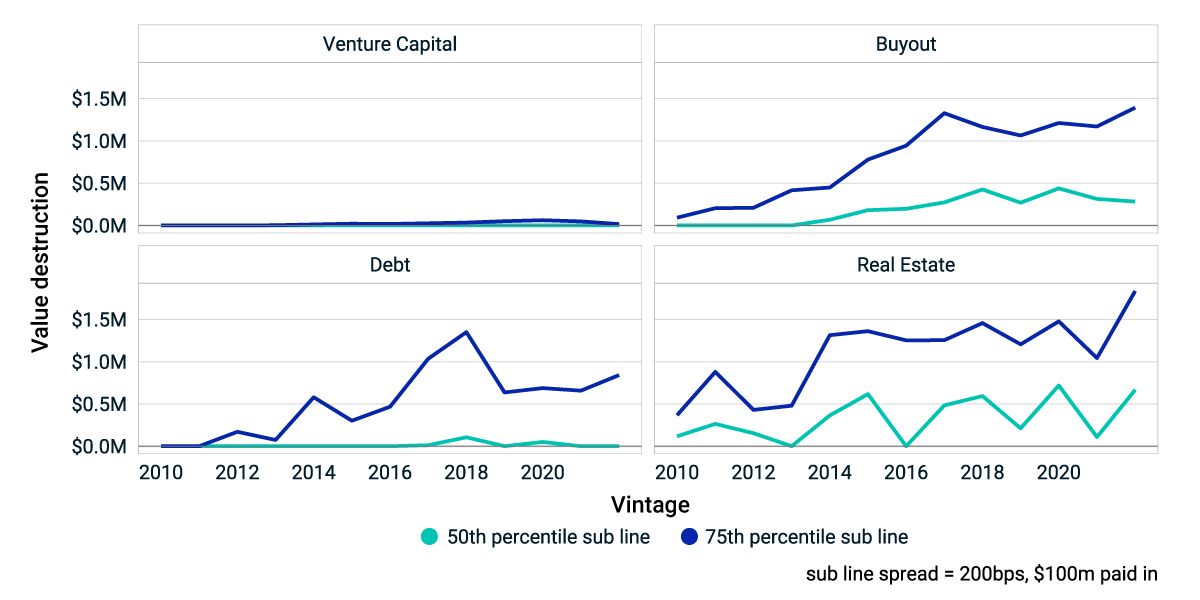

While sub lines nominally enable general partners (GPs) to manage liquidity, GPs are increasingly using them to delay capital calls for months, inflating internal rates of return by hundreds of basis points. Delaying sub-line repayment was mostly a nonissue when debt-servicing costs were low, but with risk-free rates now close to 5.5%, LPs are growing more skeptical of aggressive sub-line deployment. We combine our earlier estimates of effective sub-line term — the average length of time a GP delays capital calls via sub lines — with observed risk-free rates and a realistic 200-basis-point spread to estimate the cost of sub lines. We find that for an LP committing USD 100 million to recent buyout and real-estate funds, in a quarter of cases, upward of USD 1 million of paid-in capital would have gone to service sub-line debt.

VC is the exception

For venture capital, where sub lines are rare, costs are predictably low. A meaningful fraction of private-debt sub lines costs LPs 1% of paid-in capital by relying on these facilities. In buyout and private real estate, value destruction rising above 1% of paid-in reflects both the growth in sub-line deployment and higher interest rates.

Relatively large LPs may have access to their own credit facilities at terms comparable to those of GP sub lines. These LPs can better align cash flows with liquidity needs, while facing less incentive to extend repayment timelines. LPs paying millions of dollars to service sub-line debt may prefer this approach.

How servicing sub lines erodes capital in various segments

The amount of paid-in capital spent to service sub-line debt by an LP making a USD 100 million commitment. This does not include any noninterest fees on the credit facility.

Subscribe todayto have insights delivered to your inbox.

Inflating Returns with Subscription Lines of Credit

The increased use of subscription lines of credit by general partners in some private-capital funds has lifted returns by squeezing the timeframe over which returns are calculated. We examine buyout, private-credit and real-estate funds to see where the greatest inflation lay.

Surveying the Medley of Sub Lines in Private Funds

Visibility on the use of subscription lines of credit is of key importance to limited partners in private funds. We examined a selection of real-estate, venture-capital and buyout funds to note some key differences between and within private-capital strategies.

The Rise (and Rise) of Sub Lines in Private Capital

Private capital funds have grown increasingly comfortable utilizing subscription lines of credit, though usage varies. We examine their deployment across venture capital, buyout, real estate and debt funds.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.