Breaking Down Private-Debt Concentration

This blog post originally appeared on Burgiss.com. MSCI acquired The Burgiss Group, LLC in October 2023.

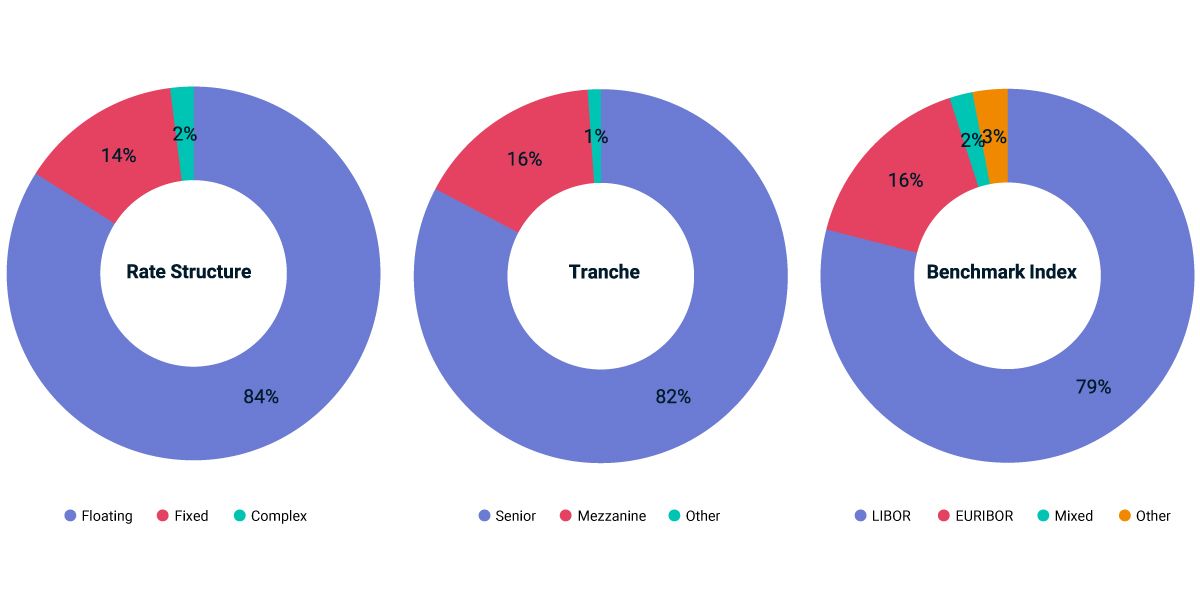

Private debt remained quite concentrated along some important dimensions, based on our analysis of the Burgiss Manager Universe (BMU), which includes almost 23,000 private loans that total USD 2.23 trillion in value. Our data also revealed this debt to be primarily floating-rate — over 80% of private loans by value were benchmarked to a reference index. Just 14% of the BMU was composed of fixed-rate loans and slightly more than 2% complex loans, which can combine fixed- and floating-rate components. While lenders may be worried about duration risk in the current interest rate environment, it does not appear to be a major threat to private debt returns.

Within floating-rate loans, LIBOR remained the dominant reference rate in both 2020 and 2021. EURIBOR indexes a significant share of private debt and will largely supplant LIBOR in the European context. We have yet to see SOFR make such inroads in USD private debt, but expect greater adoption in 2022.

Allocators also may want to diversify in terms of seniority, but this is challenging when it comes to private debt; over 80% of it was senior, while just 16% was mezzanine. Those who are willing to tolerate a lower payment priority are looking at a relatively narrow slice of the private-debt markets. We note, however, that senior loans also encompass their own set of risks.

While private-debt markets were dominated by floating-rate and senior debt, there are other dimensions that limited partners often consider when allocating capital. In future blog posts, we will further explore securities-level data in the BMU and its implications for private debt investors.

Overwhelming concentration in senior-floating-rate debt referenced to LIBOR

Shares of private loans by value. Percentages may not sum to 100 due to rounding.

Subscribe todayto have insights delivered to your inbox.

Surveying the Medley of Sub Lines in Private Funds

Visibility on the use of subscription lines of credit is of key importance to limited partners in private funds. We examined a selection of real-estate, venture-capital and buyout funds to note some key differences between and within private-capital strategies.

A Question of Balance(s) in Subscription Lines of Credit

Amid the growing usage of sub lines across private capital funds, we explore how intensively funds draw on their sub lines — a critical determinant of how sub lines will affect internal rates of return.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.