Distress in US Commercial Property Increased Further

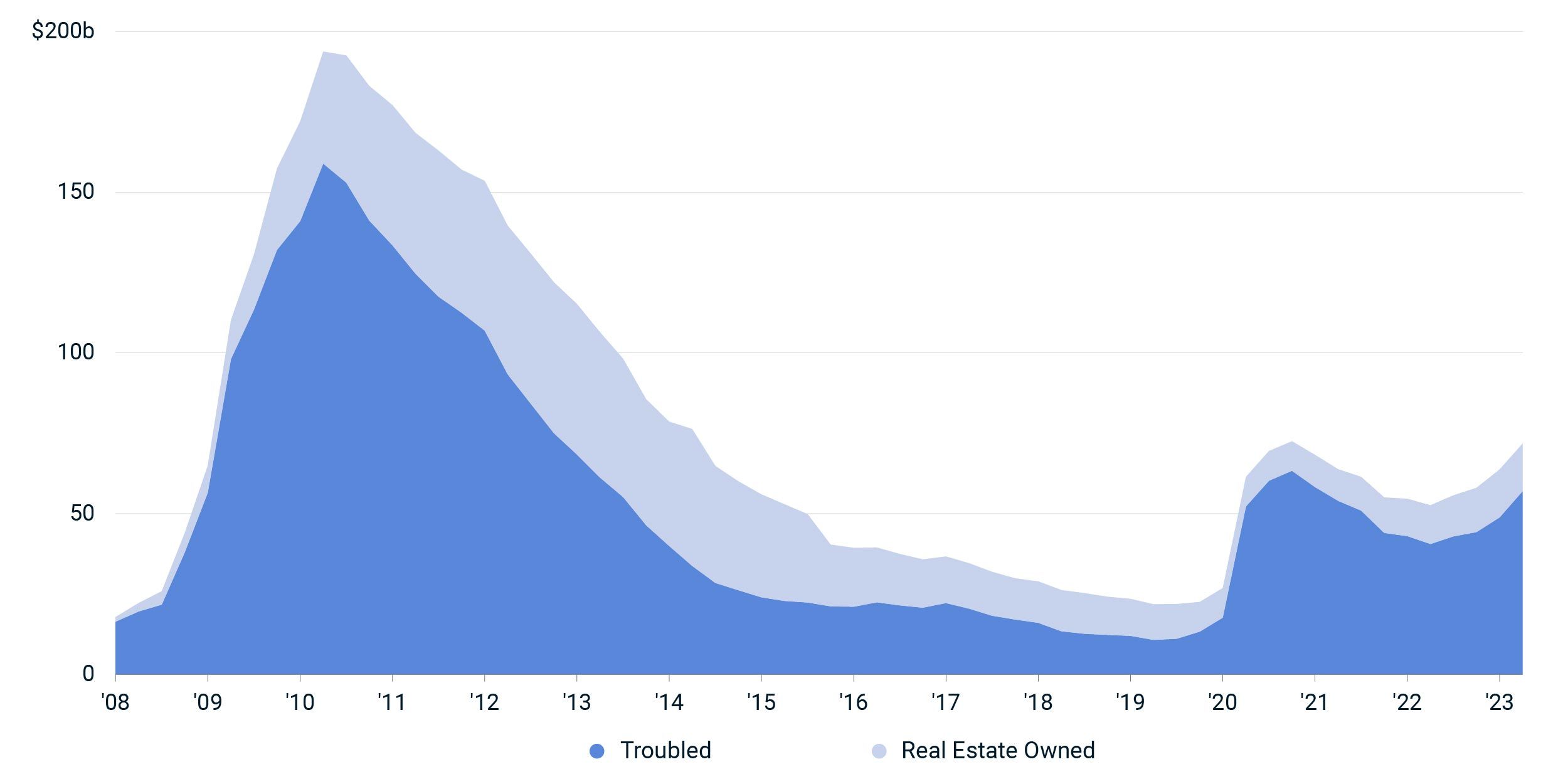

The balance of distress in the U.S. commercial-property market rose to USD 71.8 billion at midyear, marking the fourth consecutive quarter of increase. Distress, which encompasses both financially troubled assets and assets taken back by lenders, outpaced workouts between property owners and lenders by about USD 8 billion during the quarter. Not since Q2 2020 at the onset of the pandemic has distress grown by as much in a single quarter.

Offices constituted more than 80% of the distress added during Q2 2023, with USD 6.7 billion of net inflows. By the end of June, the office sector was responsible for the largest share of marketwide distress, making it the first time since 2018 that neither the retail nor hotel sector was the biggest contributor.

Potentially distressed assets totaled USD 162.3 billion at the end of the second quarter. Not all potential distress leads to full-blown financial trouble: Of those assets classified as distressed at midyear, 35% had previously been deemed potentially distressed. In late June, federal regulatory agencies issued a policy statement on commercial-property loans and workouts, urging lenders to work with creditworthy borrowers who may be facing financial strain.

Distress in commercial property mounted

Cumulative distress. Assets classified as “real estate owned” have been taken back by lenders through foreclosure.

Subscribe todayto have insights delivered to your inbox.

The Price Is Right? Real Estate Merits More Measures

There is no one correct measure of property-market pricing because the assets that constitute a market are heterogenous.

The Struggles of Sweden's Property Market

Investment activity in Swedish commercial property has collapsed in the last 12 months as the market has struggled to adapt to higher interest rates.

CMBS Dominates First Wave of Commercial Property Debt

According to our analysis, commercial mortgage-backed security (CMBS), collateralized loan obligation (CLO) and investor-driven lenders are behind more than half of the approximately $400 billion in loans coming due in 2023.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.