European Equities: A Door to China’s Reopening?

Quick take

June 14, 2023

China's Manufacturing Purchasing Managers Index, which provides an early indication of economic activity in the Chinese manufacturing sector, improved to 51.9 in March 2023 (the latest available reading), up from a recent low of 47.0 in December 2022 after nearly three years of China's zero-COVID-19 policy. But China's equities continue to play catch-up with other regional equity markets. The MSCI China Index, which has struggled since the onset of the COVID-19 pandemic in early 2020, returned 7.4% (gross USD return) between Dec. 30, 2022, and May 29, 2023. By comparison, the MSCI Emerging Markets Index returned 2.5% over the same period.

Could investors participate in China's reopening other than by directly investing in China shares?

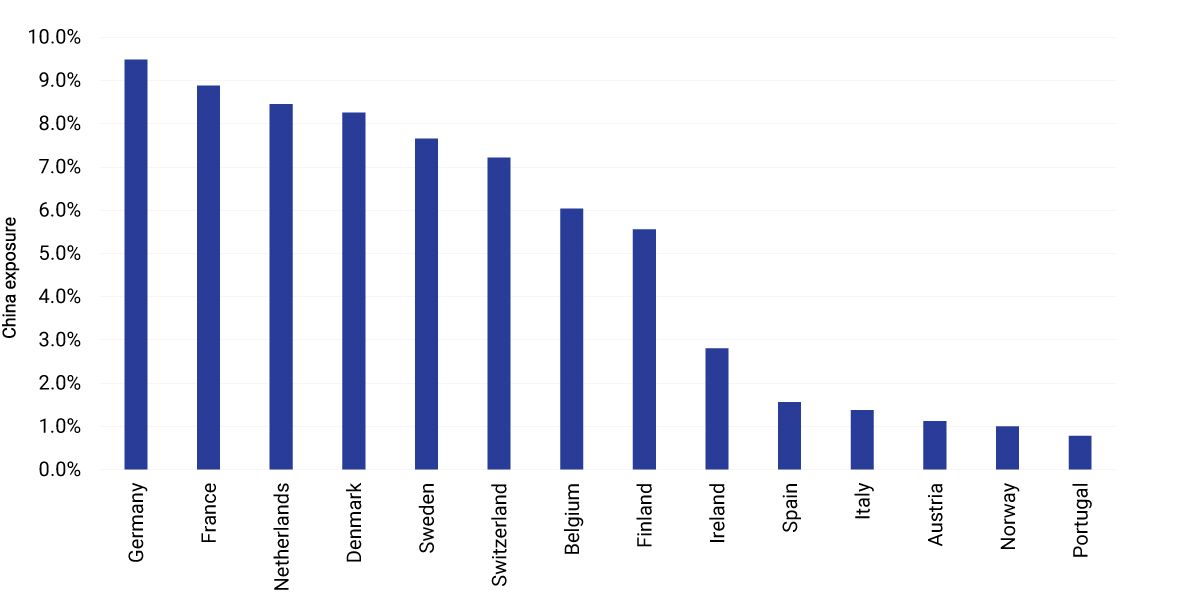

Using the MSCI Economic Exposure Data, we looked at European equity markets' exposures to the Chinese economy. Historically, European companies have derived a meaningful share of revenues from emerging markets, and in particular, China. Within continental Europe, as of April 28, 2023, France and Germany had the highest economic exposure to China.

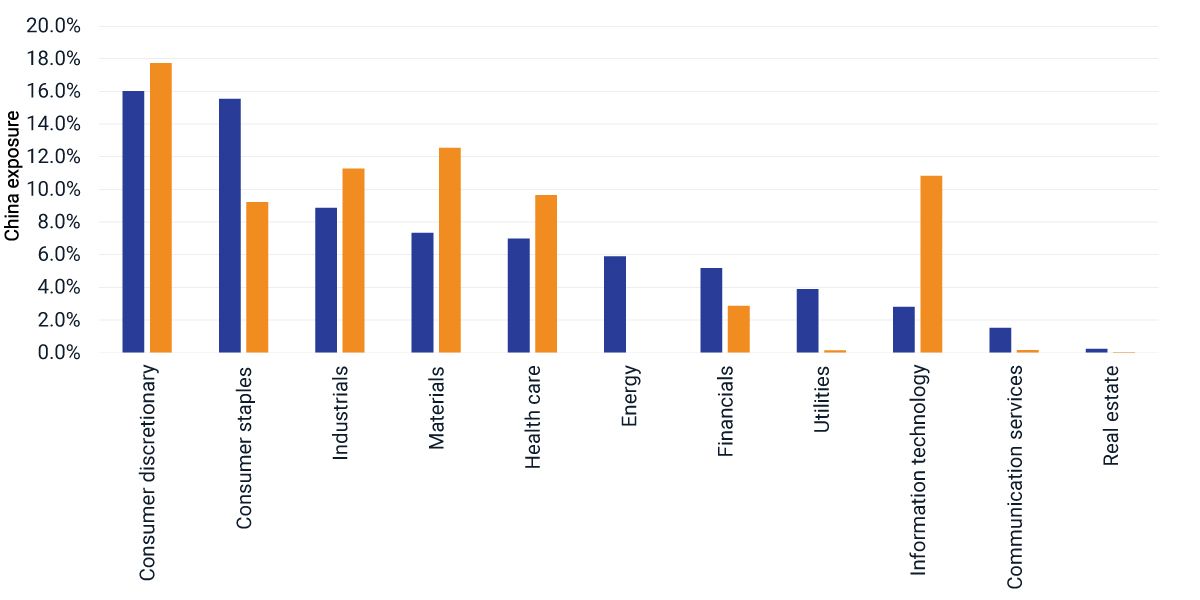

As of April 28, 2023, in France and Germany, the consumer discretionary sector — specifically, luxury goods — offered the highest exposure to China, but the industries making up the exposure differed. In France, the lead industry was consumer durables and apparel, for example, LVMH Moet Hennessy Louis Vuitton and Hermes International S.A. In Germany, the leader was the automobile and components industry, for example, BMW AG, Mercedes-Benz and Porsche AG.

German and French equity markets had just under 10% economic exposure to China

The blue bar combines the economic exposure to China of the MSCI France Index and the MSCI Germany Index. As of April 28, 2023.

Industries’ exposure to China differed in France and Germany

The blue bars represent the economic exposure to China in the MSCI France Index. The yellow bars represent the economic exposure to China in the MSCI Germany Index. As of April 28, 2023.

Subscribe todayto have insights delivered to your inbox.

The Impact of China’s Reopening

China reopened its borders and eliminated COVID-19 quarantine requirements on Jan. 8, which appears to be the end of its three-year-long, “zero-COVID” policy.

How Could China’s Reopening Impact Global Stocks?

Chinese stocks sold off sharply last year but have since rebounded off their October 2022 lows. Performance has been driven in large part by China’s COVID-19 lockdowns and subsequent reopening.

Global Markets One Year After Russia’s Invasion of Ukraine

European equity markets were among the worst-hit by the Russia-Ukraine war, given Europe’s proximity, but were also the quickest to recover. The war accelerated the divide between countries, sectors and factors.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.