Globalization Gets Another Jolt

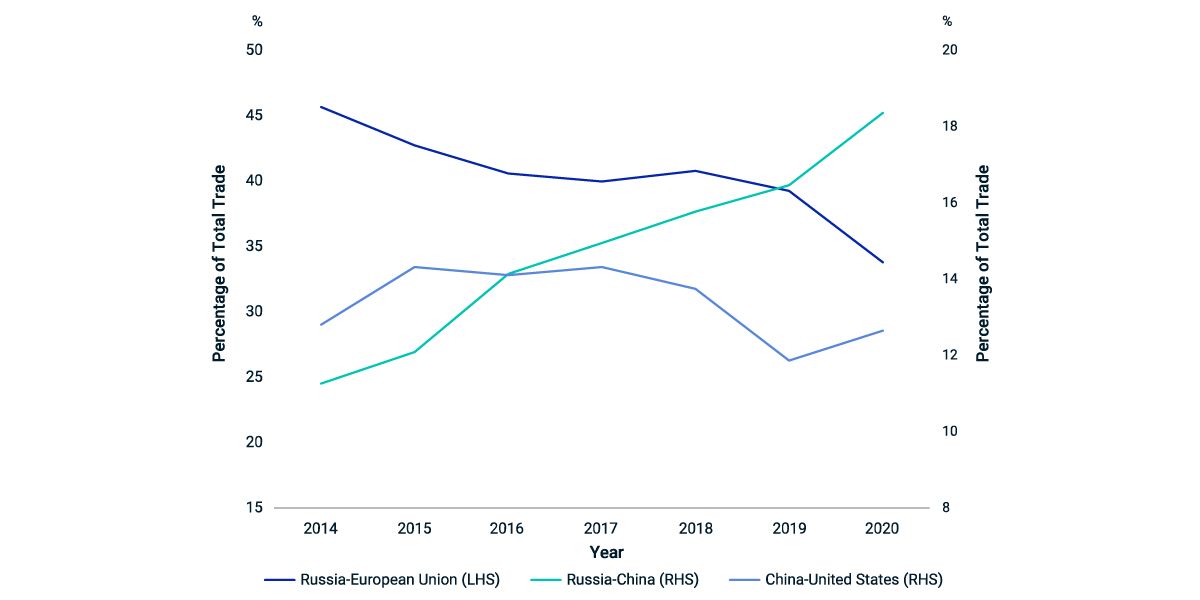

The Russian invasion of Ukraine is another reminder that geopolitics play an outsized role in determining economic relations between countries. The invasion has strengthened political and military alliances, such as NATO, and economic blocs, such as those between the U.S. and EU and between China and Russia, accelerating the long-term shift toward deglobalization, perhaps to a greater extent than the COVID-19 pandemic.1 In this post, we look at equity markets as a lens through which to view and measure deglobalization. It's a trend we've witnessed since 2014, when Russia and China became stronger trading partners, while trade dependencies between Russia and the EU weakened.

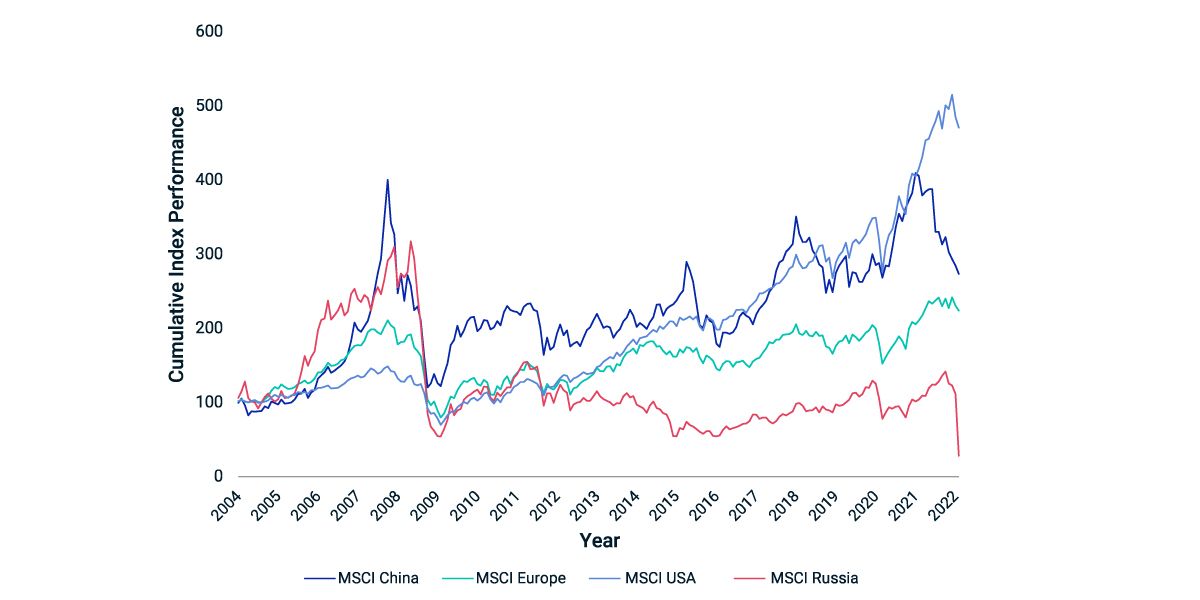

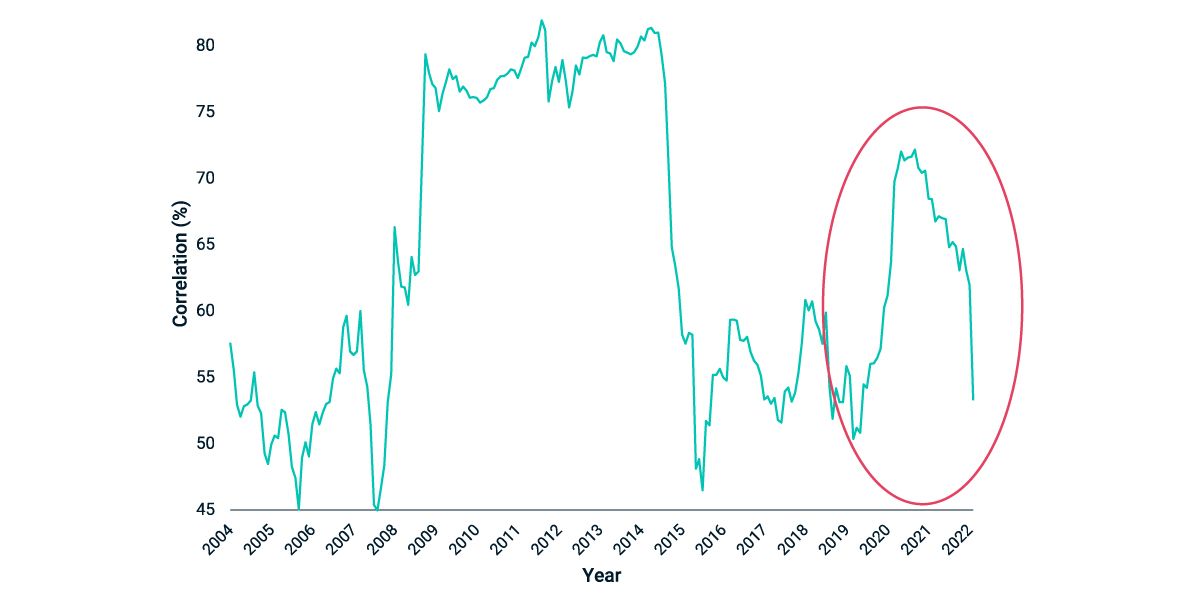

In an earlier blog post, we observed a notable trend toward deglobalization that began in 2015 as correlations across markets started to decline. Keeping the economic blocs mentioned above in focus, we can see that performance — which had been more in sync across these blocs — has deviated since 2015, and correlations have dropped even more since the onset of the pandemic, in 2020. The stark drop in correlations as of the end of February 2022 suggests a further decoupling among these economic blocs, along with local effects, as certain regions were more affected than others by the invasion.

Today, the implications of deglobalization, and the Russia-Ukraine conflict more widely, may make it even more important for investors to rethink asset allocation and find creative ways to diversify investments, both globally and across asset classes.

Deglobalization Indicators

Percentage of Total Trade

Regional Performance Over Time

Correlation Across Regions

Subscribe todayto have insights delivered to your inbox.

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.