Growing Issuer Engagement Means More Transparency for Investors

Quick take

2 min read

May 13, 2025

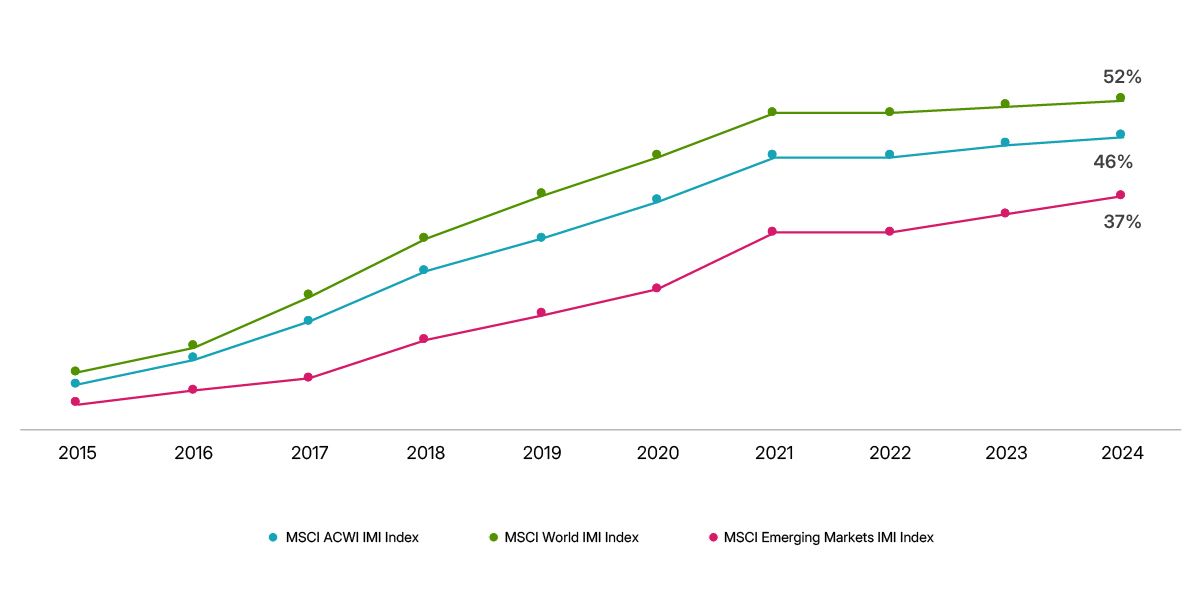

Corporate issuers' engagement with MSCI ESG Research has increased more than sixfold in the past decade. As of December 2024, 46% of all issuers in the MSCI ACWI Investable Market Index (IMI) universe proactively engaged with us, up from just 7% in 2015.

This growth in engagement highlights how companies across all regions have leaned into investor demand for information regarding how they are managing material sustainability-related risks. Based on the evidence linking strong sustainability profiles with a potentially lower cost of capital, proactive issuer engagement can be a strategic differentiator for companies. Providing data feedback can help inform a company's overall sustainability and climate profile across MSCI's product-specific assessments, including MSCI ESG Ratings, to provide greater clarity for investors focused on sustainability.

While the increase in proactive data feedback generally held true for issuers across all industries, regions and market caps, issuers in the financials sector remained the most active across all 11 Global Industry Classification Standard (GICS®) sectors for the third consecutive year.1 Issuers in Europe, the Middle East and Africa continued to have the highest proactive outreach rate by region, ahead of those in Asia-Pacific and the Americas.

Investors are listening

The total value of assets benchmarked against MSCI's sustainability and climate indexes stood at USD 1.1 trillion, as at the end of 2024, highlighting the growing significance investors place on sustainability and climate consideration in portfolio construction and investment decisions, and the value of issuer reporting.2

The authors would like to thank Emma Zhe Wu for her contribution.

A steady growth in proactive issuer outreach

Data as of Dec. 31, 2024. Proactive issuer outreach is the percentage of companies in the relevant MSCI index that have reached out in a given year and is one measure of proactive issuer engagement. Proactive data feedback rate is the percentage of corporate issuers in the MSCI ESG Ratings industry universe that submitted voluntary data feedback through our online issuer portal during that year. Source MSCI ESG Research

Subscribe todayto have insights delivered to your inbox.

Understanding Institutional Investors’ Perspective on ESG Ratings

Understanding ESG risks and opportunities from the perspective of investors could be invaluable for issuers. We examine how investors think about ESG factors and how they incorporate them into their investment processes.

MSCI ESG Ratings and Cost of Capital

We found a strong historical correlation between a company’s MSCI ESG Rating and its cost of capital in both equity and debt markets. Firms assessed as the most resilient to financially material sustainability-related risks financed themselves more cheaply.

1 GICS is the global industry classification standard jointly developed by MSCI and S&P Dow Jones Indices.2 Total assets benchmarked to MSCI indexes comprised of actively managed assets as of Dec. 31, 2024, reported on or before March 31, 2025, using both internal data and data from eVestment, Morningstar, Refinitiv and Bloomberg.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.