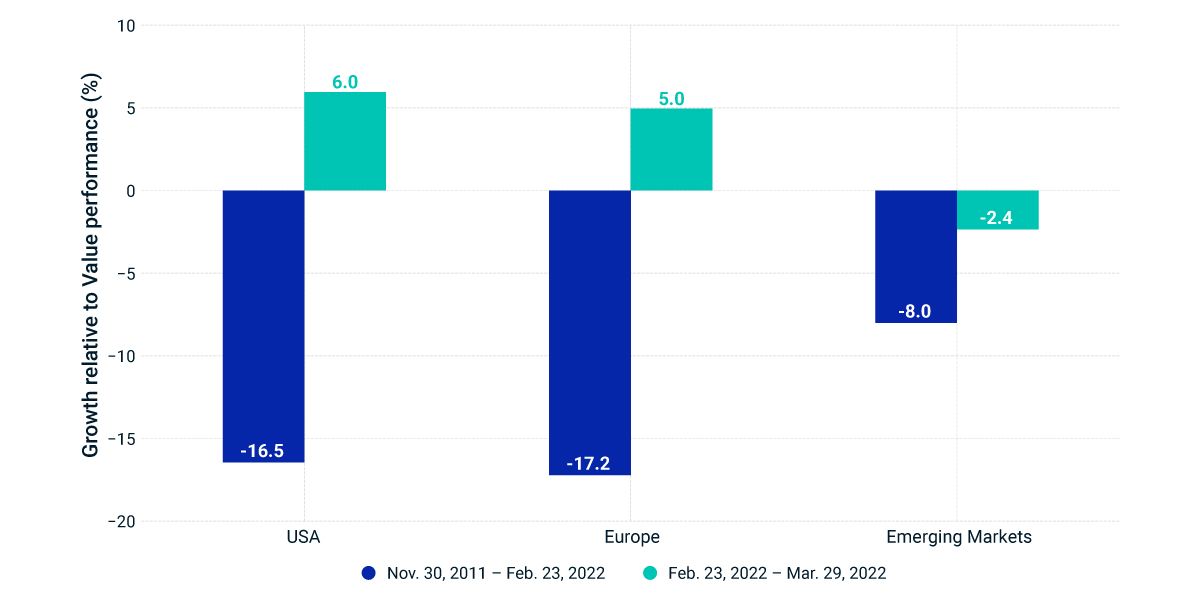

Growth-Value Leadership Diverged Regionally After Russian Invasion

For markets, Russia's build-up of military forces along its border with Ukraine last November reinforced the growth-to-value style-factor rotation across global and regional equity markets that began in late 2020. Following Russia's invasion on Feb. 24, 2022, growth started to outperform value in the U.S. and Europe, but the growth-to-value rotation continued in emerging markets (EM).

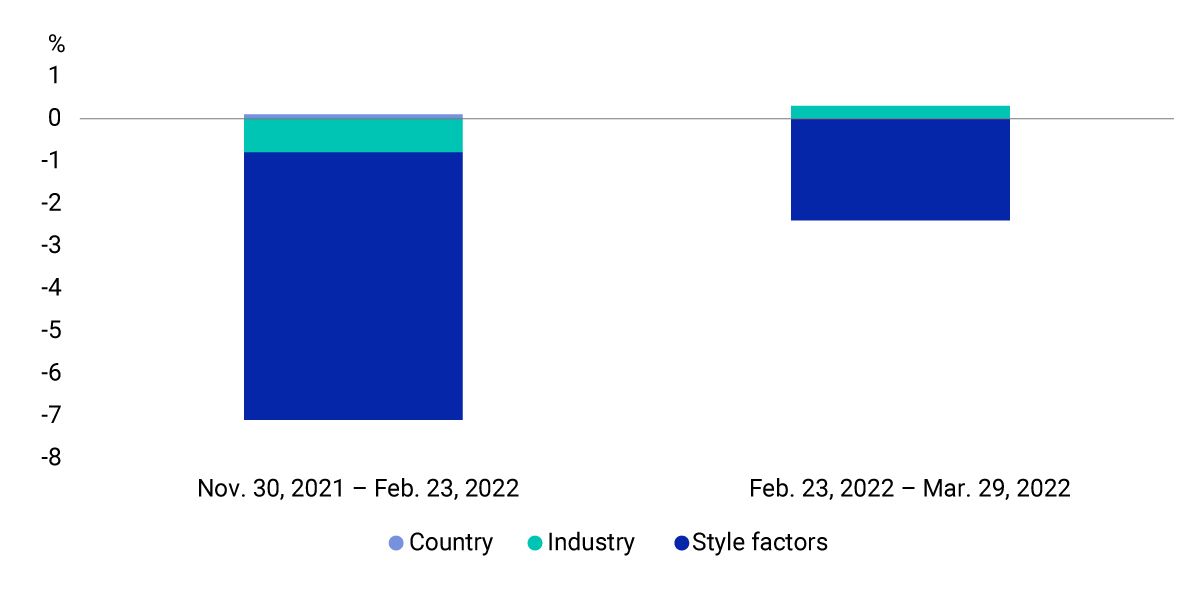

What drove this persistent underperformance of growth relative to value in EM?

Performance attribution, based on MSCI's Barra Emerging Markets Equity Model (EMM1), shows that style factors, compared with country and industry factors, were the predominant drivers of the relative performance of value and growth, prior to and after Russia's invasion.

More specifically, from Nov. 30, 2021, to Feb. 23, 2022, country, industry and style factors explained 0.1%, -0.8% and -6.3% of the -8% growth-value relative performance in the EM (based on the MSCI EM Growth and MSCI EM Value Indexes). Post-invasion through March 29, 2022, country, industry and style factors explained 0%, 0.3% and -1.8% of the -2.4% growth-value relative performance.

Post-invasion, growth stocks rebounded vs. value in US and Europe, but continued to underperform value in EM

Style factors mattered more for MSCI EM Growth vs. MSCI EM Value Indexes’ relative performance

Subscribe todayto have insights delivered to your inbox.

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.