Has the Bond Market Gone Crazy?

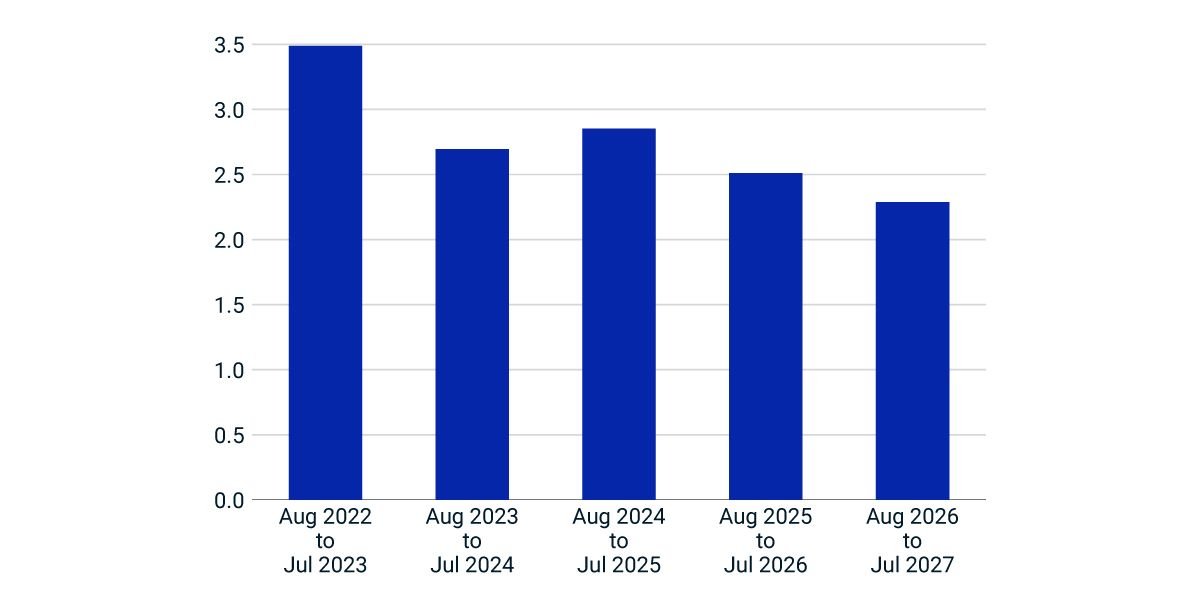

Signals from the bond market show what some investors consider a remarkably optimistic inflation outlook. As shown in the chart below, next year's Treasury-market-implied inflation rate was 3.5%, as of the market close on Aug. 10. In the following year, this rate fell to 2.7%, and by year five to 2.3%, close to the Federal Reserve's long-standing 2% inflation target.

Bond-market skeptics may find this interpretation hard to swallow. Even though July's consumer price index showed a decline in year-over-year headline inflation, the core CPI (excluding food and energy) was unchanged and, at 5.9%, is still exceptionally high by historical measures. Skeptics will point to highly expansionary monetary and fiscal policy, combined with increases in commodity prices induced by the Ukraine war and supply-chain bottlenecks, as causes of this inflation and may argue it is likely to persist, as consumers and businesses revise their inflation expectations and demand higher wages and prices.

Revisiting our macroeconomic scenarios

The skeptics may yet be shown to be right, but market-implied inflation signals are still important as investors consider future economic scenarios. In April, we looked at three scenarios for U.S. inflation and Fed policy based on assumptions of macroeconomic shocks and Fed-policy strength and credibility. We called these scenarios "Soft landing," "Slamming the brakes" and "Stagflation."

If current market-implied inflation expectations turn out to be approximately accurate, the inflation part of the soft landing will in fact have been realized. Talk of stagflation will have been shown to be premature and erroneous. But lower inflation expectations could also be aligned with the "Slamming the brakes" scenario, where Fed rate hikes prove to be overaggressive and trigger a hard landing and prolonged economic downturn.

Investors may want to scrutinize more carefully the implications to their portfolios resulting from either the "Soft landing" or "Slamming the brakes" scenarios.

Plummeting market-implied inflation

Market-implied forward U.S. inflation rate, annualized in percent.

Subscribe todayto have insights delivered to your inbox.

What Can We Learn from the July CPI?

The U.S. consumer price index (CPI) climbed 8.5% from a year earlier in July 2022, down from the 9.1% pace set in June.

Fed Chair Powell: See You in September

At last week’s Federal Open Market Committee (FOMC) meeting, Federal Reserve Chair Jerome Powell continued to talk tough on inflation.

Fed Policy and the Threat of Stagflation

Over the past few months, investors have increasingly focused on inflation and central banks’ potential tightening of monetary policy.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.