Price Growth for US Property Ebbed, Deal Volume Fell

The pace of growth in U.S. commercial property prices slowed in September to the weakest annual rate since early 2021. The RCA CPPI National All-Property Index rose 11.1% from a year ago and was unchanged from August.

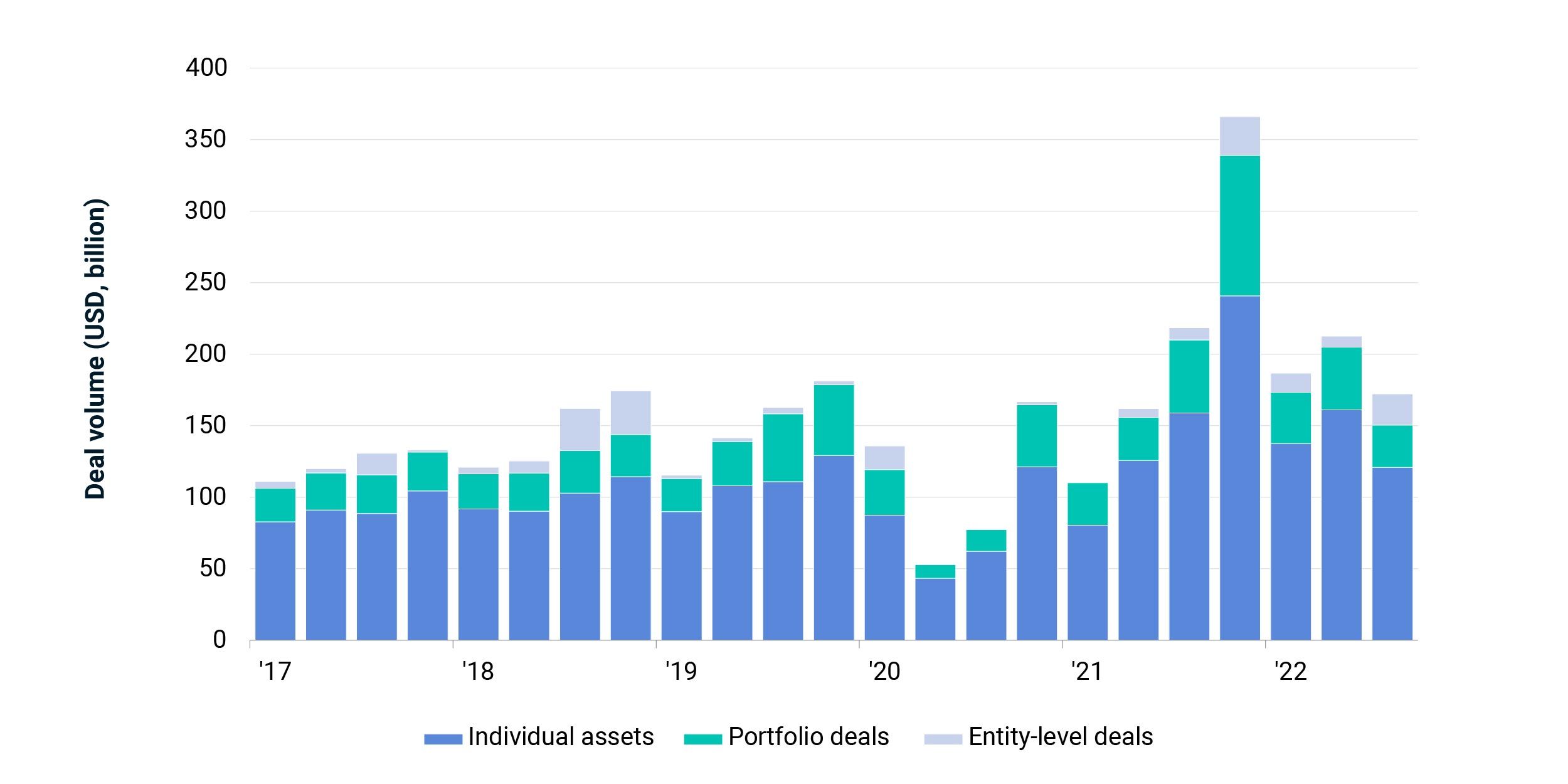

Price growth has eased amid the challenges of rising financing costs and shrinking deal activity. Trading of properties such as offices, apartment buildings and warehouses fell by 21% in the third quarter of 2022 compared to a year earlier. For September, the year-over-year decline in deal volume was 43%.

Annual price growth for offices in central business districts eased to a 4.2% annual rate in September and, compared to August, prices edged down 0.1%. Suburban offices' price growth slipped to an annual rate of 6.6%.

Industrial, apartment and retail decelerated sharply

Price growth for the industrial, apartment and retail sectors also slowed sharply but remained in the double digits. The annual growth rate of the industrial index slowed to 18.1%, the first time this index has registered an increase smaller than 20% since August 2021.

The apartment-sector index posted a 15.9% annual pace of growth and the retail price index an 11.8% rate. Both rates have decelerated throughout most of 2022.

Annual change in the price of US commercial property

Data from RCA CPPI (Commercial Property Price Indexes).

Sales of US commercial property

Subscribe todayto have insights delivered to your inbox.

Getting the Full Picture on Tenant-Default Risk in Real Estate

Tenant-default risk analysis in real estate portfolios is often focused on the largest tenants by rental income due to resource or data constraints, but the underlying data suggests this practice may be inadequate.

Rent-Growth Expectations Shaped Returns for US Industrial Real Estate

Transaction evidence suggests buyers have been pricing in unprecedented income growth for U.S. industrial property.

Dorothy Didn’t Say, ‘There’s no Place like the Office’

Investors in commercial real estate are confronting the lingering effects of COVID-19 on what being an "office worker" means.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.