Sustainability Bond Indexes Were Resilient amid Market Turmoil

We have found in previous studies that stocks and bonds of companies that were more resilient to sustainability-related risks (as measured by MSCI ESG Ratings) exhibited lower market volatility, suggesting they could fare better during periods of market stress, as they did during the COVID-19-driven sell-off in March 2020. Through the initial market turmoil that followed the U.S. tariff announcements on April 2, we tested whether this resilience would hold true for corporate bonds.

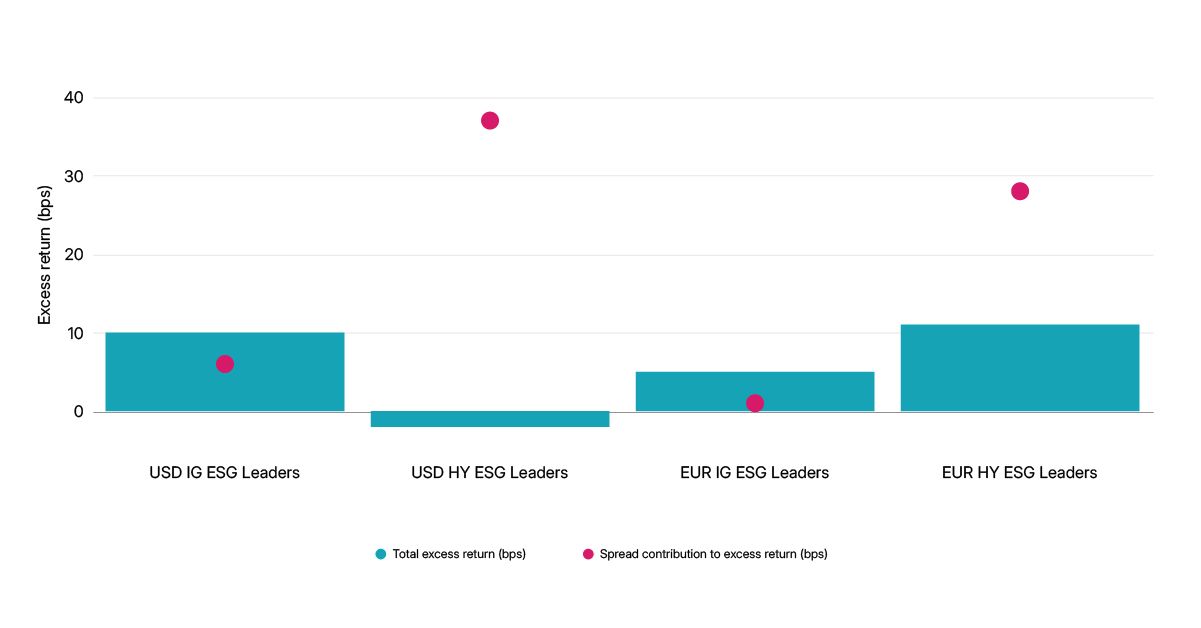

Between March 31 and April 11, 2025, we found that the MSCI Investment Grade (IG) and High Yield (HY) ESG Leaders Corporate Bond Indexes outperformed their parent indexes — in both USD and EUR (except for USD HY). Relative spread movement against the benchmark was the primary positive contributor to the excess return in all indexes, however, underscoring sustainability strategies' potential in managing downside risks during stress.

Why might higher-sustainability-rated bonds behave more defensively?

We previously found that companies with higher ratings showed stronger fundamentals — such as higher profitability and credit quality — and their outstanding bonds displayed lower systematic and idiosyncratic volatility. Their bonds, within their respective credit-quality universe, also less frequently experienced sharp price declines, suggesting they may provide additional information on top of traditional credit-quality assessments and be a useful tool for credit investors, especially during periods of market stress.

How sustainability corporate-bond indexes fared vs. broader indexes in wake of US tariff announcements

Excess returns of the MSCI USD IG ESG Leaders Corporate Bond Index, MSCI USD HY ESG Leaders Corporate Bond Index, MSCI EUR IG ESG Leaders Corporate Bond Index and MSCI HY ESG Leaders Corporate Bond Index versus their respective parent indexes, from March 31, 2025, to April 11, 2025. Return attribution done using the Barra Multi-Asset Class (MAC) Factor Model. Source: MSCI ESG Research

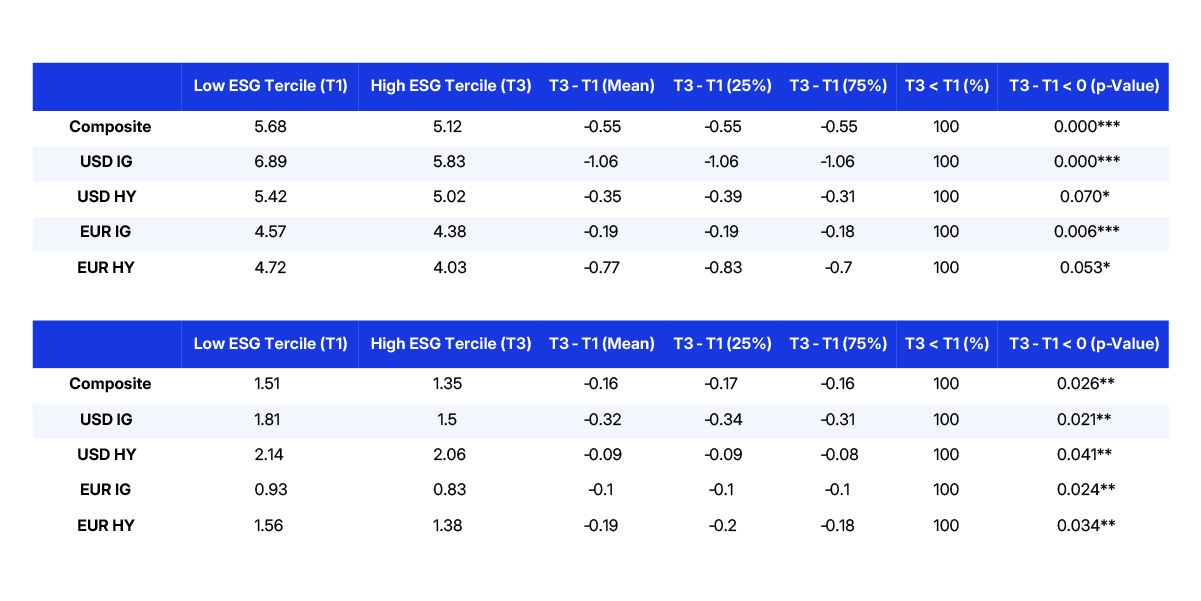

Higher-sustainability-rated companies had lower systematic and idiosyncratic risk

Data for 10-year period between January 2015 and December 2024. The analysis universe is restricted to issuers with available ESG scores in the MSCI USD IG Corporate Bond, MSCI USD HY Corporate Bond, MSCI EUR IG Corporate Bond and MSCI EUR HY Corporate Bond Indexes. Corporate bonds are sorted into terciles by the issuer’s ESG ratings. Systematic risk and idiosyncratic risk are calculated based on MSCI Barra Multi-asset Class (MAC) Factor Model using MSCI’s BarraOne®. *** indicates 99%, ** 95% and * 90% confidence level of rejecting the H0 that there is no difference between the two samples. Source: MSCI ESG Research

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.