Underperforming Growth Managers Showed Skill

The U.S. equity market's "Magnificent Seven"1 surged to a 27% weight in the MSCI USA Index in July 2023, up from 7% a decade ago. The concentration is even more conspicuous within the MSCI USA Large Cap Growth Index, for which the same seven companies now make up 55%.

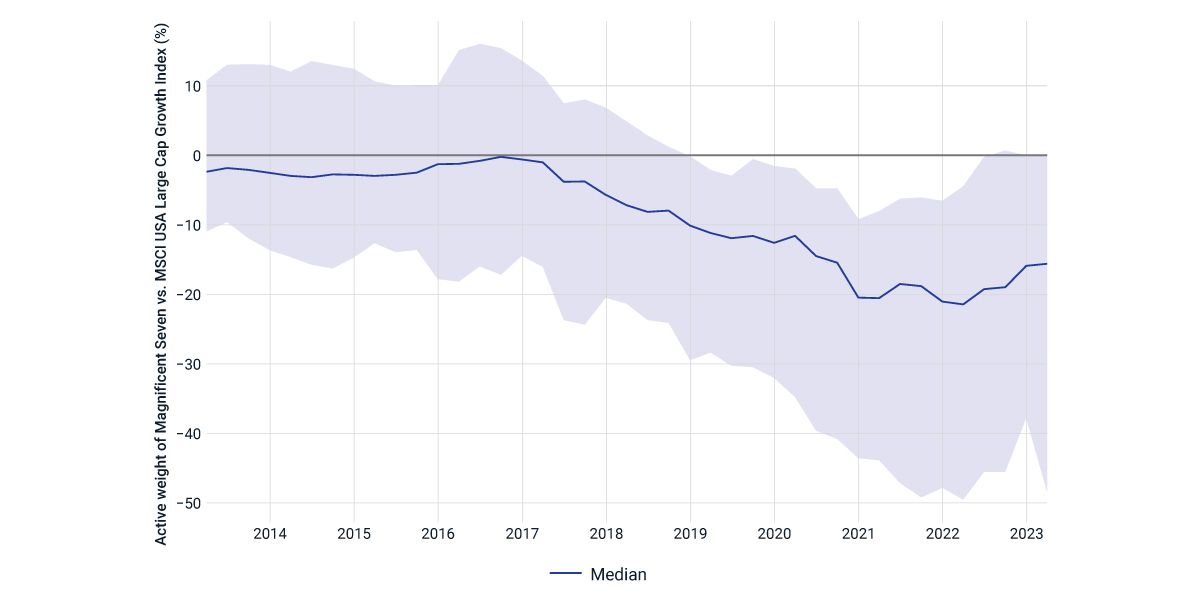

In the middle of the last decade, from 2013 until mid-2017, when the cumulative weight of the Magnificent Seven was modest, their median weight in U.S. large-cap growth managers' portfolios closely mirrored the benchmark, the MSCI USA Large Cap Growth Index. But as the index weight of these stocks climbed, nearly all active growth managers began to underweight them. Managers may have had several motivations, such as low conviction in their performance prospects and the desire, or the regulatory requirement, to mitigate concentration risk.

Active bets often offset underweights in the Magnificent Seven

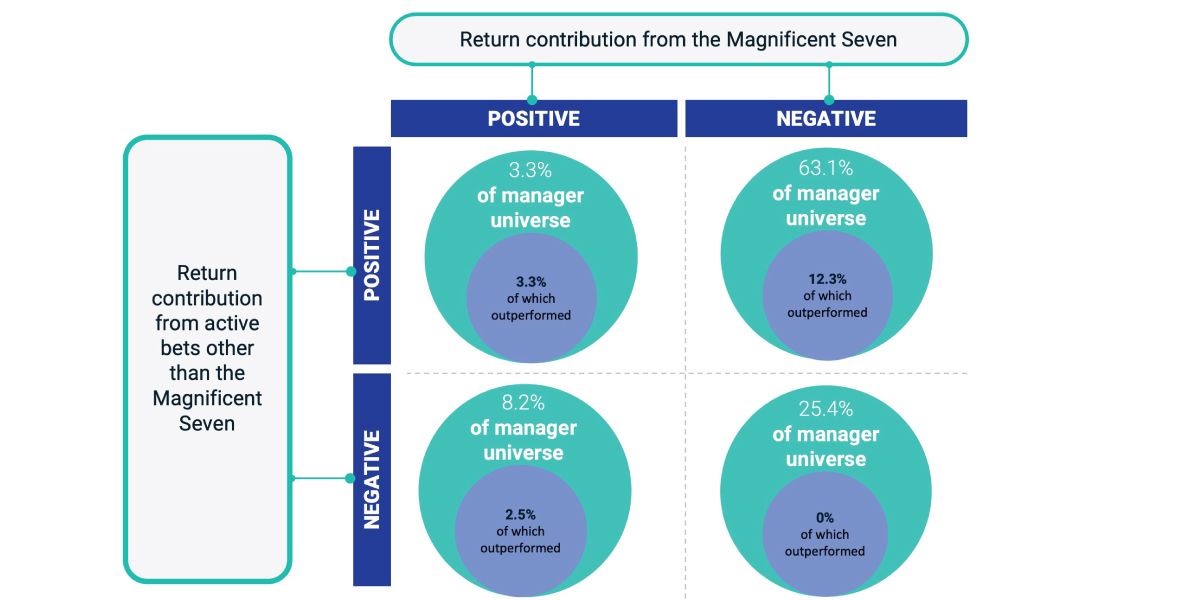

Underweight positions in the Magnificent Seven have been a drag on growth managers' performance relative to their benchmarks over the 10 years ending March 2023. Yet, nearly two-thirds (63%) of growth managers partially or more than offset this negative contribution with active bets on other stocks.

The headline performance of an active manager relative to their benchmark does not tell the whole story. A manager's skill can be revealed by understanding their active bets in the context of high levels of market concentration. Thus, assessing an active manager on their prioritization of concentration risk over tracking risk can be prudent in markets where concentration is elevated.

Large-cap growth managers underweighted the Magnificent Seven as the stocks’ index weight climbed

The range represents the 1st and 99th percentiles of active weights across 122 active large-cap growth managers. Data is from March 2013 through March 2023.

Majority of growth managers showed skill in active bets, offsetting drag from Magnificent Seven underweight

Return contribution from active positions for 122 large-cap growth managers relative to the MSCI USA Large Cap Growth Index for the period March 2013 to March 2023.

Subscribe todayto have insights delivered to your inbox.

'Magnificent Seven' Drove the Equity-Market Rally

Global equities, as measured by the MSCI ACWI Index, roared back through May of 2023. A closer look, however, revealed that just a handful of stocks accounted for more than 70% of the total return. Which stocks punched above their weight?

The Market’s Bad-Breadth Problem

Our panel of experts discusses the issues on investors minds and scenarios for what may come next. From inflation “stickiness” to market concentration to central bank actions, how have conditions varied across the globe?

Factor Performance amid Concentration Shifts

Noting the parallel between today’s technology- and AI-driven concentrated rally and the late 1990s’ technology boom, we examined factor performance and factors’ over- and underweights in the top 10 MSCI USA Index constituents over both periods.

1 The seven companies are Alphabet Inc., Amazon.com Inc., Apple Inc., Meta Platforms Inc., Microsoft Corp., NVIDIA Corp. and Tesla Inc. For the analysis, we consider Alphabet A and Alphabet C as one stock.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.