US Property Deals Slumped, Price Growth Withered in Q4

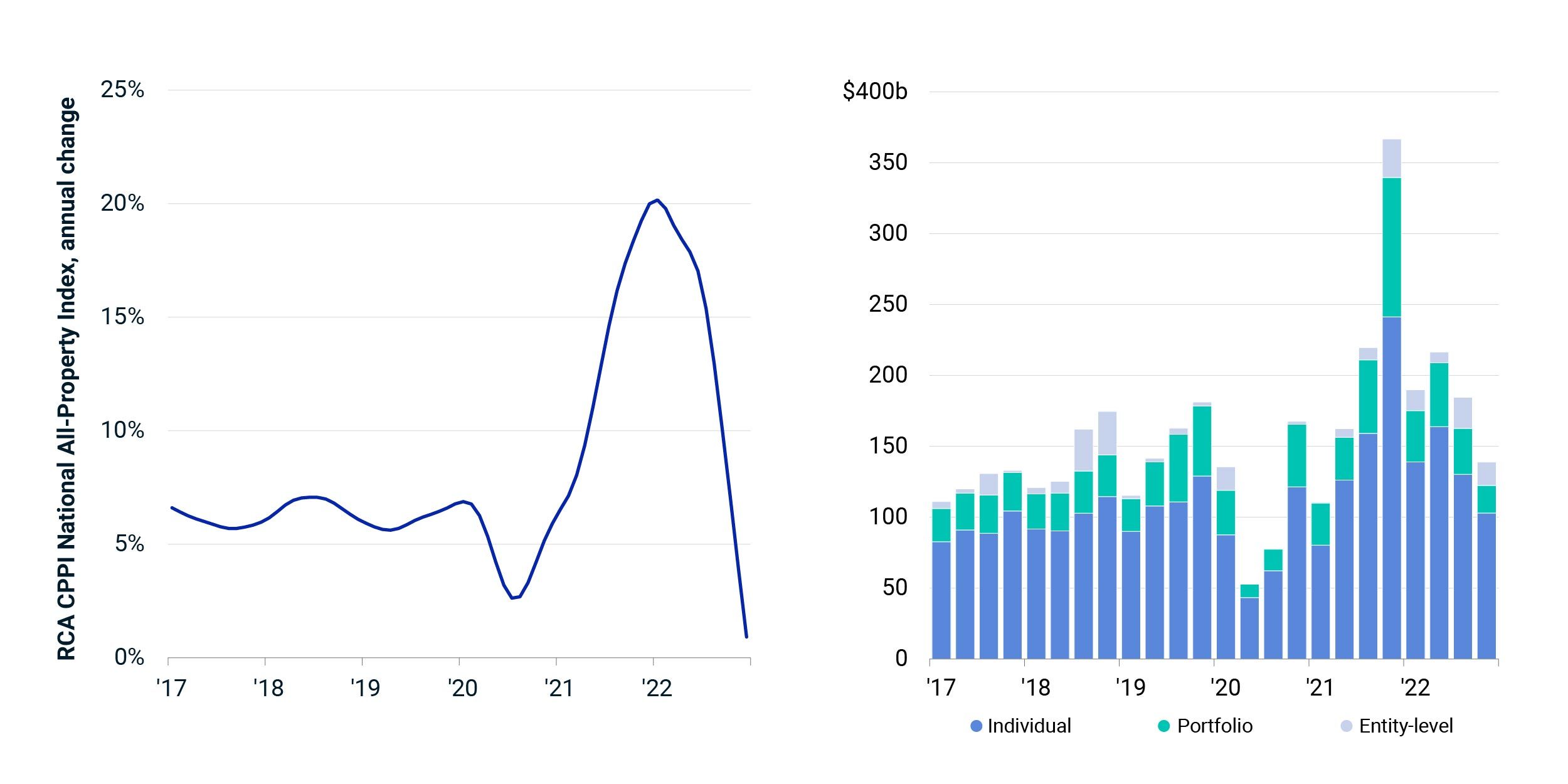

Sales of U.S. commercial property fell 62% from a year prior in the fourth quarter of 2022, and annual price growth decelerated to the slowest rate of gain since 2011. Still, for the year in total, 2022 was the second-strongest year for sales on record, behind 2021.

Trading of properties such as offices, apartment buildings and warehouses slowed over 2022 as investment conditions became more uncertain. The surprising leader in investment sales for the year was the retail sector, showing a 4% year-over-year increase. Deal volume in the office sector fell the most across the major property types, dropping 25%.

Prices under pressure

Annual growth in property pricing slowed further in December. The RCA CPPI National All-Property Index rose just 0.9% from a year ago, and compared to November, prices fell 1.2%. Prices began to decline on a monthly basis in September.

The apartment sector showed the greatest deceleration in price growth in 2022. The annual growth rate slowed to 1.8% in December, down from annual rates greater than 20% seen through the first half of the year. Prices for apartment assets dropped 1.9% in December from November, the largest monthly price decline across the property sectors.

Sales of US commercial property and annual price change

Subscribe todayto have insights delivered to your inbox.

2023 Trends to Watch in Real Assets

Real estate investors enter 2023 facing a very different investment landscape to the one they encountered at the beginning of 2022.

Global Real Estate Returns Turned Negative

After the declines in many country and regional indexes in the third quarter of 2022, it is clear that commercial-property markets globally have entered a period of adjustment.

Challenges for Non-Traded Private REITs Are not Unique

As 10-year Treasury yields hit a low of 0.52% in August of 2020, yield-hungry investors had to look beyond the bond market.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.